Story Highlights

- Growing digital banking trend is amplified by a relatively young population

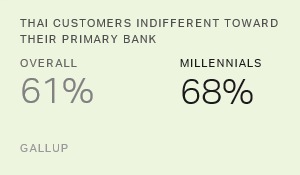

- Millennial customers are particularly indifferent toward Thai banks

- Banks need to understand what it takes to build customer engagement

Banks in Thailand are struggling to keep up amid rapid economic and technological changes.

Thai banks are still recovering from the 1997 financial crisis. And with mobile and internet channels becoming increasingly popular among Asian banking customers, banks are forced to rethink their business strategies.

Thailand's relatively young population further amplifies the country's growing digital banking trend. The median age in Thailand in 2015 was 36.7 years, and the country's young consumers are poised to reshape the economy.

The problem is, ���۴�ýfinds that 61% of Thai banking customers overall -- and 68% of millennial banking customers, those born between 1980 and 1996 -- are indifferent toward their primary bank. "Indifferent" means they are neutral; they don't really care about the company, and they neither love nor hate the brand.

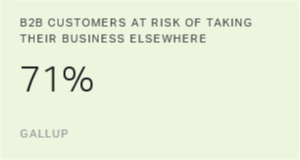

These indifferent customers have no particular allegiance to their primary bank. They might switch to a different company if the opportunity presents itself or if the potential benefits outweigh the costs of switching. Indifferent customers cost banks money: On average, indifferent banking customers in Thailand have a net return rate of 0%.

By contrast, fully engaged customers are more committed and have strong positive feelings toward their primary bank. They spend more and stay longer with the bank, and they act as its brand ambassadors. This unparalleled customer loyalty translates to higher business performance and profitability -- from increased wallet share and number of products used to greater brand advocacy. For Thai banks, fully engaged banking customers provide an average net return rate of +23%.

However, winning over customers amid economic and technological changes is easier said than done. First, banks need to understand what it takes to build -- and then objectively evaluate how well they're hitting the mark.

In its 2016 Thailand banking industry study -- one of the largest of its kind to date -- ���۴�ýhas unearthed insights to help leaders enhance customers' emotional engagement and foster more loyal and lucrative customer relationships. The discoveries from this study offer an in-depth look at Thai banking customers' behaviors, attitudes, wants and needs in a changing marketplace.

Four Key Findings That Banks Should Address

-

A majority of Thai banking customers (61%) are indifferent toward their primary bank. Thai banking customers have not experienced enough differentiated service from their main bank to sway their preference, loyalty or repurchase behavior.

-

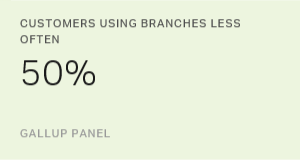

When it comes to banking channels, customers care about quality more than quantity. Banks need to focus on consistently delivering solutions as opposed to simply completing transactions. Thai customers want more quality and consistency across physical and digital channels.

-

Thai customers want banks to build meaningful relationships with them -- looking out for customers' financial well-being and becoming . While Thai banking customers seem to generally be happy with the overall service their primary bank provides, their expectations for building a positive relationship with the bank are unmet. Thai banking customers want their primary bank to look out for their financial well-being, provide them with advice on how to fulfill their financial goals and demonstrate a commitment to their financial future. They want a relationship, not a product.

-

Disengaged millennials -- not competitors -- pose the greatest threat to Thai banks today and in the near future. Sixty-eight percent of Thai millennials are indifferent toward their main bank. On average, they consistently use just two banking channels, giving banks only a small window of opportunity to and win more of their business.

���۴�ýhas also found that customer engagement matters more than both satisfaction and advocacy in driving positive outcomes. Though satisfaction and advocacy show some links to improved customer behavior, only customer engagement is predictive of high performance across four critical measures for the majority of a bank's customer base. For example, an overwhelming majority (90%) of fully engaged Thai banking customers say they will continue to use their primary bank for the rest of their life.

How Financial Leaders Can Enhance Customer Engagement

Urgently combat customer indifference. Thai banks need to focus on building customer engagement. Leaders should aim to differentiate their brand and employ a variety of strategies for engaging customers, including emphasizing customers' financial well-being and focusing on building meaningful relationships with customers.

Evolve from an "omnichannel" (many channels) to an "optichannel" (customers' preferred channels) strategy. Customers expect perfect service in each interaction more than they desire the convenience of a variety of channel options. Banks should offer both omnichannel and optichannel experiences, providing customers with the convenience of multiple channels while ensuring they can use their preferred channels for streamlined, coordinated experiences.

Combine digitalization with human interactions as a way of attracting and engaging customers across a range of demographics. Banks need to provide five-star experiences across multiple channels as part of a seamless customer experience to engage all types of customers. Though digital interactions are increasing, branch experiences are still critical, especially because younger customers tend to seek advice and support in person.

Reinvent sales and service processes in transforming branch and call center customer experiences. Many Thai banks have embarked on large-scale transformations that include radical changes to technology, processes and systems. However, to improve engagement, banks should implement structured routines and processes -- such as ongoing coaching and short-cycle management systems -- across branches and call centers.

Place customer engagement -- and customer centricity -- at the heart of the bank's infrastructure and operating strategy. Any organization seeking to drive customer engagement needs to make its customer engagement initiative central to its strategy. Leaders should regularly remind employees of the bank's overarching goal -- a customer-centric culture -- and equip them to build and maintain a culture of engagement.

Bailey Nelson contributed to this article.