Story Highlights

- Boosting customers' financial well-being increases confidence

- First step: listen for customers' financial goals

- Individualized interactions show customers that the bank cares

Banks can be effective partners to customers who want to improve their financial well-being. And caring for customers' well-being offers significant opportunities to banks.

When customers strongly agree that their bank looks out for their financial well-being, 84% are fully engaged, while none are actively disengaged. And when banks take time to address customers' financial well-being, they strongly increase customers' confidence in their primary bank.

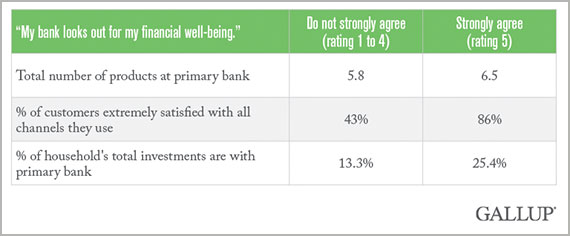

The problem is, only one in four customers strongly agree that their bank looks out for their financial well-being, according to Gallup's Retail and Banking Industry study. But on average, those 25% of customers have more products -- such as checking and savings accounts, debit or credit cards, mortgages, or brokerage and investment accounts -- with their bank than customers who do not think their bank looks out for their financial well-being.

In addition, customers who strongly agree their bank cares about their financial well-being are more likely to be extremely satisfied with more of the channels they use than those who don't agree their bank cares about their financial well-being. Most importantly, when customers strongly agree their bank cares about their financial well-being, they have a far higher percentage of their household's total investments with their primary bank than customers who don't strongly agree.

Though banks may know that caring for the financial well-being of their customers is important, they may not be sure how to implement the right customer service strategy to promote that well-being. It can appear to be a daunting task, but small changes in how bank employees interact with customers can make a big difference when starting the process. Here are some suggestions.

Listen for Customers' Goals

A first step toward improving customers' financial well-being is listening for what a customer's financial goals are, or noticing where his or her financial well-being may be suffering. Coaching bank employees to listen for opportunities to take everyday interactions a step further -- while solving long-term financial well-being issues -- can go a long way toward making customers feel as if the bank cares about their financial success. For example, when a customer who visits a branch mentions she is working toward buying a home, bank employees could offer services that can help her meet that goal, such as setting up automatic withdrawals into a savings account to save for a down payment or meeting with to discuss loan options.

Bank employees -- particularly call center employees -- should seize every opportunity to have a conversation with customers about their needs and goals. Though efficiency is important in employee-customer interactions, it shouldn't come from sacrificing customer service. Employees should learn to sense when a customer is in a hurry -- or when a customer may have more time and be open to discussing her financial goals. Employees should be given the freedom to allow either interaction to happen.

Make Every Interaction Count

As more customers interact with banks online rather than in person, banks should make every person-to-person interaction count. If a customer frequently overdraws on his checking account and repeatedly asks about getting an overdraft charge reversed, for example, it's a red flag that something is amiss in his financial well-being.

When this happens, employees shouldn't just waive the fee and send the customer on his way; they should show concern for his financial well-being. Employees could offer to set up a savings account, which the customer could draw from rather than overdrawing his checking account, or they could inform the customer of different balance alerts he could receive if his account balance is getting low. Conversations like these go beyond just completing the task the customer requested -- they integrate concern for a customer's financial well-being with customer service.

Present a Consistent Message

A key step in showing customers that the bank cares about their financial well-being is making sure what's learned in a person-to-person interaction isn't lost. Banks already have a lot of information about their customers, and knowing what the customer hopes to achieve financially is crucial to keeping those conversations consistent. A customer's financial goals should be recorded in a customer database so employees can be aware of those goals and ask about them.

Customers are increasingly interacting with their bank online and through mobile applications, so banks should make sure they are using these media effectively to help customers meet their financial goals. Though many banks offer tools and information about managing debt, saving for major purchases and the importance of financial well-being on their websites, many customers do not take advantage of them. Employees can use their conversations with customers to help connect them to these resources.

As banks continue to increase the sophistication of their mobile offerings, this channel can also become a vital vehicle for supporting customers' financial well-being. Providing resources such as real-time alerts and location-based messages and applying "gamification" to many of the more mundane aspects of financial planning could increase customers' financial well-being and make the customer experience "stickier."

Employees' Financial Well-Being Matters Too

Making sure that bank employees have high financial well-being is also important in ensuring that customers' financial goals are met. Bank employees who are struggling with debt or are unaware of the products and services the bank has to offer are unlikely to provide effective support to customers.

Bank employees should receive ongoing education on banking services and on financial well-being best practices. Employees who want to reduce their debt or save for retirement should receive access to coaches and materials to empower them to achieve their financial goals; this will give them a first-hand experience to pass on to customers. Banks should take time to make sure that employees are thriving in financial well-being, feel well-supported and have resources available to help them achieve their financial goals.

Bottom Line

Whether interactions occur in person or online, banks should tailor their messages to help customers achieve their goals. Tailoring messages also can reinforce that the bank and can be an adviser and advocate about their financial well-being. Individualized interactions show customers that the bank cares, and actively helping customers to improve their financial well-being can increase customer engagement -- and lead to higher profitability.

Survey Methods

Results are based on Web surveys conducted in November 2013 and completed by 11,809 national adults, aged 18 and older, who had an active checking account with any bank or financial institution. Data were weighted to match the national population of banked adults on gender, age and education; data were also weighted so each of the top 20 banks and the remaining banks and credit unions were represented in proportion to their share of national deposits. For results based on this sample, one can say that the maximum margin of sampling error is ±0.9 percentage points at the 95% confidence level. Margins of error are higher for subsamples. In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.