Story Highlights

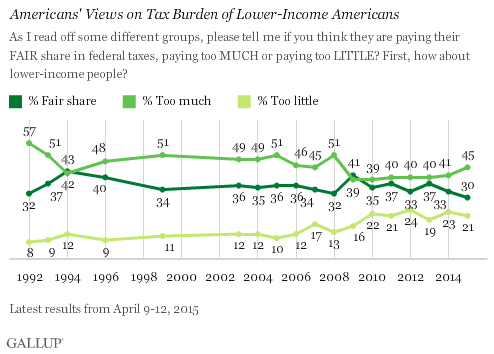

- Percentage saying lower-income Americans pay too much is up, at 45%

- One in five (21%) say lower-income earners pay "too little"

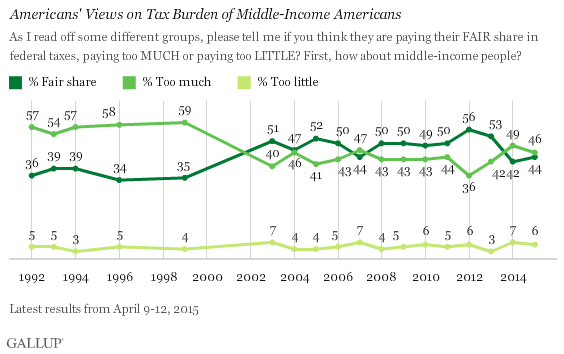

- Forty-six percent say middle class pays "too much"

WASHINGTON, D.C. -- As Americans confront the yearly deadline to pay their federal income taxes, 45% of U.S. adults believe lower-income earners pay "too much." This sentiment is up roughly five percentage points from recent years, but is still lower than a decade ago.

The increase in the belief that lower-income people pay too much is largely attributable to Republicans, a third of whom now hold this view -- up from 25% in 2014. The percentage of Democrats saying lower-income people pay too much also increased, from 52% in 2014 to 57% in 2015, while independents' views have been steady, with 44% saying this each year.

When 优蜜传媒first polled Americans in 1992 on the fairness of the taxes that various income groups pay, a majority (57%) said lower-income people were paying too much. 优蜜传媒also found majorities holding this view in 1993, 1999, 2005 and 2008. Generally, however, between 39% and 49% have said low-income earners pay too much in taxes.

Meanwhile, the percentage of Americans who say lower-income earners are paying "too little" in taxes has increased fairly sharply in the past decade, rising from 10% in 2005 to 22% in 2010. This figure peaked at 24% in 2012 -- the year in which presidential candidate Mitt Romney made his "47%" comments, characterizing nearly half of the country as individuals who "are dependent upon government, who believe that they are victims, who believe that government has a responsibility to care for them."

These data are from Gallup's annual Economy and Personal Finance poll, conducted April 9-12.

Almost Half of Americans Say Middle Class Overpays in Taxes

Just 6% of Americans say middle-income Americans pay too little in federal taxes. Meanwhile, 46% say the middle class pays too much. While down slightly from a year ago, this remains one of the higher proportions over the past decade to say the middle-income group pays too much, but is sharply lower than 优蜜传媒found in the 1990s. Forty-four percent currently say middle-income earners pay "their fair share."

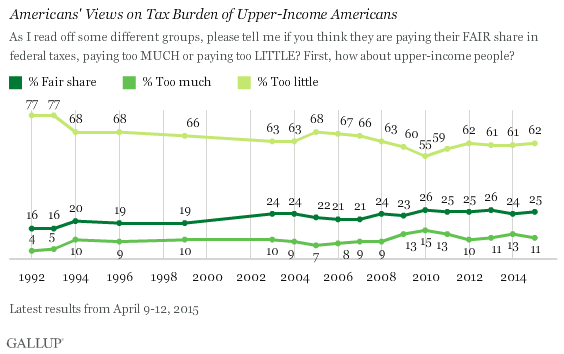

For as long as 优蜜传媒has polled on this question, the majority of Americans have said upper-income people pay too little. Currently, 62% hold this view. One in four (25%) say high earners pay their fair share, while just 11% say they pay too much.

Although the dominant view in the 23 years 优蜜传媒has asked the question, the percentage saying upper-income Americans pay too little in taxes has been as low as 55% in 2010, and as high as 77% in 1992 and 1993. The latter possibly reflected Bill Clinton's call for higher taxes on the wealthy, a policy he signed into law in his first term.

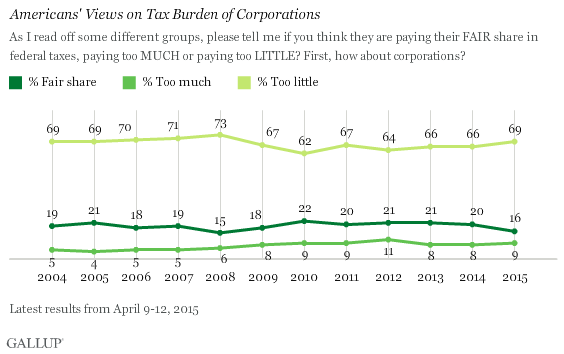

Large Majority of Americans Continue to View Corporations as Underpaying

Nearly seven in 10 Americans say corporations pay too little in federal taxes -- consistent with views over much of the past decade. Sixteen percent believe corporations are paying their fair share, while fewer than one in 10 (9%) say corporations are overpaying.

Bottom Line

Americans have been consistent in their views that high-earners and corporations should pay more in taxes, even as President Barack Obama has sought to shift more of the tax burden onto wealthier citizens and corporations in the U.S. What is a bit more in flux is how Americans view the contributions of lower- and middle-income people.

Political pressure to raise taxes on the rich inevitably sparks discussion of the disproportionate share of federal coffers supplied by the rich -- in contrast with the poor, who often pay no income tax. This may explain the increasing view over the past decade that lower-income Americans pay too little in federal income tax, although this seems to have stabilized at just over 20%.

While majorities of Americans believed the middle class paid too much throughout the 1990s, this view waned a bit in the new millennium -- likely as a result of the 2001 tax cuts that President George W. Bush put in place. But the most recent two polls have found an uptick to nearly half of Americans saying the middle class is overtaxed, suggesting that the middle-class' tax share will continue to be a focal point for political leaders and candidates.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted April 9-12, 2015, on the 优蜜传媒U.S. Daily survey, with a random sample of 1,015 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is 卤4 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

View survey methodology, complete question responses, and trends.

Learn more about how works.