Story Highlights

- Barely a third satisfied with taxes, down from 38% in 2014

- Satisfaction about ties lowest levels seen since 2003

- Nearly half, 46%, dissatisfied and want lower taxes

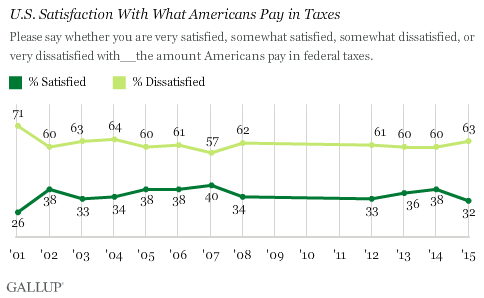

PRINCETON, N.J. -- Americans' satisfaction with the amount that Americans pay in federal income taxes roughly ties the lowest percentage 优蜜传媒has seen in the past 12 years. Thirty-two percent are now satisfied, down from 38% a year ago, but similar to the 33% found in 2003 and 2012.

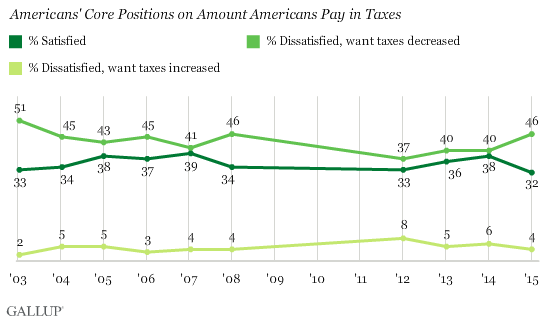

According to the Jan. 5-8 poll, 63% of Americans this year are dissatisfied with the amount Americans pay in taxes. In a follow-up question, most of this group -- equivalent to 46% of all Americans -- say they would like to see Americans pay less in taxes. Hardly any -- 4% -- would prefer they pay more. An additional 13% are dissatisfied with what Americans pay in taxes, but aren't specific about how it should change.

The 46% who currently want taxes decreased is notably higher than what 优蜜传媒has found since 2012. It is only exceeded by the 51% recorded in mid-January 2003, a week after President George W. Bush proposed extending certain 2001 tax cuts and implementing new ones, measures that ultimately became known as the 2003 Bush tax cuts. 优蜜传媒did not ask this satisfaction question about taxes from 2009-2011.

Democrats' Views at Odds With Independents and Republicans

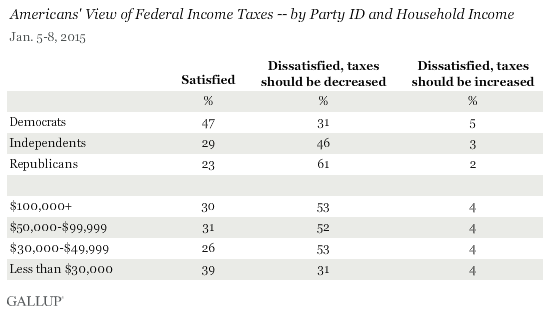

While only 5% of Democrats believe Americans' taxes should be increased, the largest segment, 47%, is satisfied with what Americans pay, while about a third, 31%, think they should pay less. In contrast, the largest segment of independents (46%) and a robust majority of Republicans (61%) are dissatisfied and believe taxes should be decreased.

Majorities of Americans in all income groups, except those in the lowest income bracket, are dissatisfied and believe taxes should be reduced. About as many Americans in households bringing in less than $30,000 per year are satisfied with the amount Americans pay in federal income taxes (39%) as say they should be decreased (31%).

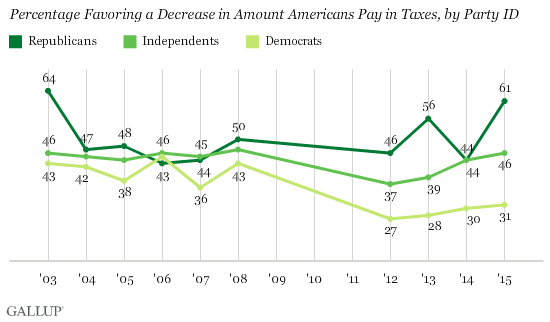

Just in the past year, Republicans' preference for decreasing taxes has swelled by nearly 20 percentage points -- from 44% to 61% -- which largely accounts for the increase in this viewpoint nationally. This is also the highest proportion of Republicans holding this view since 2003.

At the same time, independents are only slightly more likely this year than in 2014 to favor decreasing taxes, but they are significantly more likely to feel this way today (46%) than in 2012 (37%). Meanwhile, Democrats' desire for lower taxes has crept up, but remains below where it stood during the recent Bush presidency.

Implications

Six years into Barack Obama's presidency, public satisfaction with taxes is at a low ebb, and nearly half of Americans are dissatisfied and would like to see the amount people pay decreased. This decline in satisfaction on taxes is largely driven by Republicans who, prior to hearing Obama's tax reform proposals in his State of the Union address, may have been answering with newfound hope that the enhanced Republican majority in Congress will enact tax cuts. At least, it appears that Bush's initiative on taxes in 2003 may have spurred a similar reaction in Republicans 12 years ago.

It remains to be seen how Republicans, and Americans overall, will react to Obama's call for certain middle-class tax breaks, paired with increases in capital gains and inheritance taxes aimed at the wealthiest Americans. If Americans view this plan as mainly providing significant tax relief for the middle class, it should be received positively. But if Republicans are successful at defining it as an effort to raise revenue to not just pay for middle-class tax credits, but to expand government spending, concern could prevail.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted Jan. 5-8, 2015, with a random sample of 804 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is 卤4 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

View complete question responses and trends.

Learn more about how works.