Story Highlights

- Higher- and lower-income Americans less likely to view taxes paid as fair

- Middle-income Americans' views steady

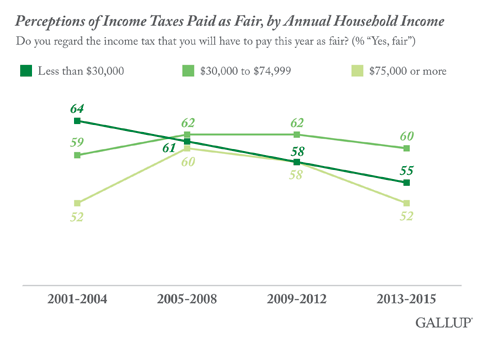

PRINCETON, N.J. -- Americans' perceptions of the fairness of their federal income taxes have diverged along income lines in recent years. From 2005 to 2008, roughly six in 10 Americans in each income group said what they paid in income taxes was fair. Since then, higher- and lower-income Americans have grown less likely to consider it fair, while middle-income Americans have remained largely content.

These findings are based on aggregated data from Gallup's annual Economy and Personal Finance poll, conducted each April. The 15-year trend data on perceptions of tax fairness are divided into four groups, which generally correspond to the first and second presidential terms for George W. Bush (2001 to 2004 and 2005 to 2008) and Barack Obama (2009 to 2012 and 2013 to 2015).

In the early part of Bush's presidency, lower-income Americans (defined here as those whose annual household income is less than $30,000) were most likely to perceive their tax burden as fair, at 64%. That was far greater than the 52% of higher-income Americans -- those whose annual household income is $75,000 or more -- who believed their taxes were fair. Appropriately, middle-income Americans fell in between the two groups, at 59%.

By Bush's second term, 2005 through 2008, perceptions of tax fairness converged, with averages of between 60% and 62% of each income group saying their taxes were fair, likely reflecting the impact of the federal income tax cuts enacted in Bush's first term. Higher-income Americans in particular became more likely to say their income taxes were fair.

The basic federal income tax burden for most Americans has not changed since President Obama took office in 2009. The Bush income tax cuts were set to expire in 2010, but Obama and Congress extended them for all taxpayers through 2012 and made them permanent for all but the highest income earners in 2013. As part of the Affordable Care Act, many higher-income Americans have also been subject to higher capital gains taxes and higher taxes to fund Medicare.

Nevertheless, perceptions of tax fairness have shifted modestly by income group over the last eight years, including a six-percentage-point decline in perceived fairness among lower-income Americans and an eight-point decline among higher-income Americans. Even now, however, the majority in each income group believe the taxes they pay are fair, with middle-income Americans most likely to hold that view.

Higher-income Americans' perceptions of tax fairness may to some degree reflect the reality that some are paying more in federal taxes if not federal income taxes. But the decline in higher-income Americans' perceived fairness is evident among both those making up to $100,000, whose tax burden has not changed, and those making above it.

There is not an obvious reason why lower-income Americans perceive their taxes as less fair. However, an analysis of the data show that lower-income Americans who identify as Republican have become less likely to view their taxes as fair since Obama took office, while lower-income Democrats' opinions are unchanged. That is a different pattern than that observed among middle-income Americans. Middle-income Republicans are less likely to view their taxes as fair since Obama took office, but middle-income Democrats are more likely to say their taxes are fair. Thus, the trends in views of tax fairness by party offset each other among middle-income Americans, resulting in no change among the group as a whole.

Americans' Perceptions of Tax Fairness Little Changed

Gallup's 2015 update on public opinion toward taxes, conducted April 9-12, shows 56% of all Americans saying the amount of income taxes they pay is fair. That is little changed from the last four years but down significantly from a recent high of 64% in 2003, reflecting the trends by income group discussed previously. The current 56% majority believing their taxes are fair is also higher than what 优蜜传媒measured from 1997 through 2001, before the Bush tax cuts took effect.

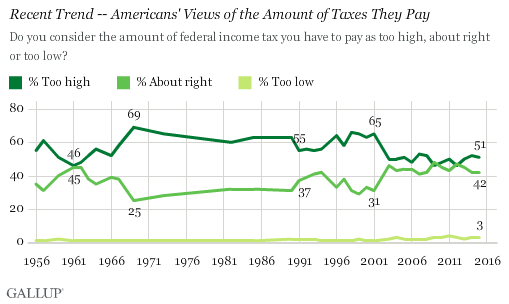

Gallup's other long-term trend question on taxes asks Americans whether they believe the federal income tax they pay is too high, too low or about right. Typically, a majority regard their taxes as too high, including 51% this year. Most of the rest say their taxes are "about right."

The 51% believing their taxes are too high is little changed from recent years and remains on the lower end of what 优蜜传媒has measured historically, likely as a result of the lower income tax rates Americans have been paying since the 2001 and 2003 tax cuts took effect. The record-high 69% saying their taxes were too high was measured in early 1969, after Richard Nixon won the election to replace Lyndon Johnson in the midst of the protracted Vietnam War and the "Great Society" expansion of government programs.

Not surprisingly, higher-income Americans are most likely to say their taxes are too high, with lower-income Americans least likely to agree. In recent years, the differences by income group have not been very large, including 48% for lower-income Americans, 50% for middle-income Americans and 55% for higher-income Americans.

Implications

As Tax Day approaches, more Americans continue to say their taxes are fair than to say they are not. In recent years, though, there has been a growing disparity in perceptions of fairness by income group. Middle-income Americans are the most likely to believe their taxes are fair, and their views on the matter have changed little. But lower- and higher-income Americans are less likely than roughly a decade ago to view their taxes as fair, even though the tax rates for most people in these groups have not changed.

The disparities in perceptions of tax fairness are not large, and the majority in each income group still see their taxes as fair. It is not essential to the functioning of government for the vast majority of citizens to perceive their taxation levels as fair. However, if more Americans view their taxes as fair, the government's actions and policies may have more legitimacy. Along these lines, between 85% and 90% of Americans said their taxes were fair in 优蜜传媒polls conducted during World War II.

Historical data on this question may be found in

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted April 9-12, 2015, with a random sample of 1,015 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is ±4 percentage points at the 95% confidence level.

For results based on three- or four-year aggregates of income groups, the margin of sampling error is ±4 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

View complete question responses and trends.

Learn more about how works.