Story Highlights

- 优蜜传媒Investor Optimism Index sinks to new low of the year

- Investors' outlook for the economy, including inflation, has turned negative

- Investors oppose proposal for IRS to monitor most U.S. bank accounts

WASHINGTON, D.C. -- Investors' outlook for the U.S. investing climate has worsened in the second half of the year as their levels of optimism about economic growth, unemployment and inflation all have dimmed. At the same time, their levels of optimism about the stock market and reaching their investing goals remain steady at fairly positive levels.

The overall effect is a decline in the 优蜜传媒Investor Optimism Index from +39 in the prior survey (conducted in the second quarter) to +10 in the fourth.

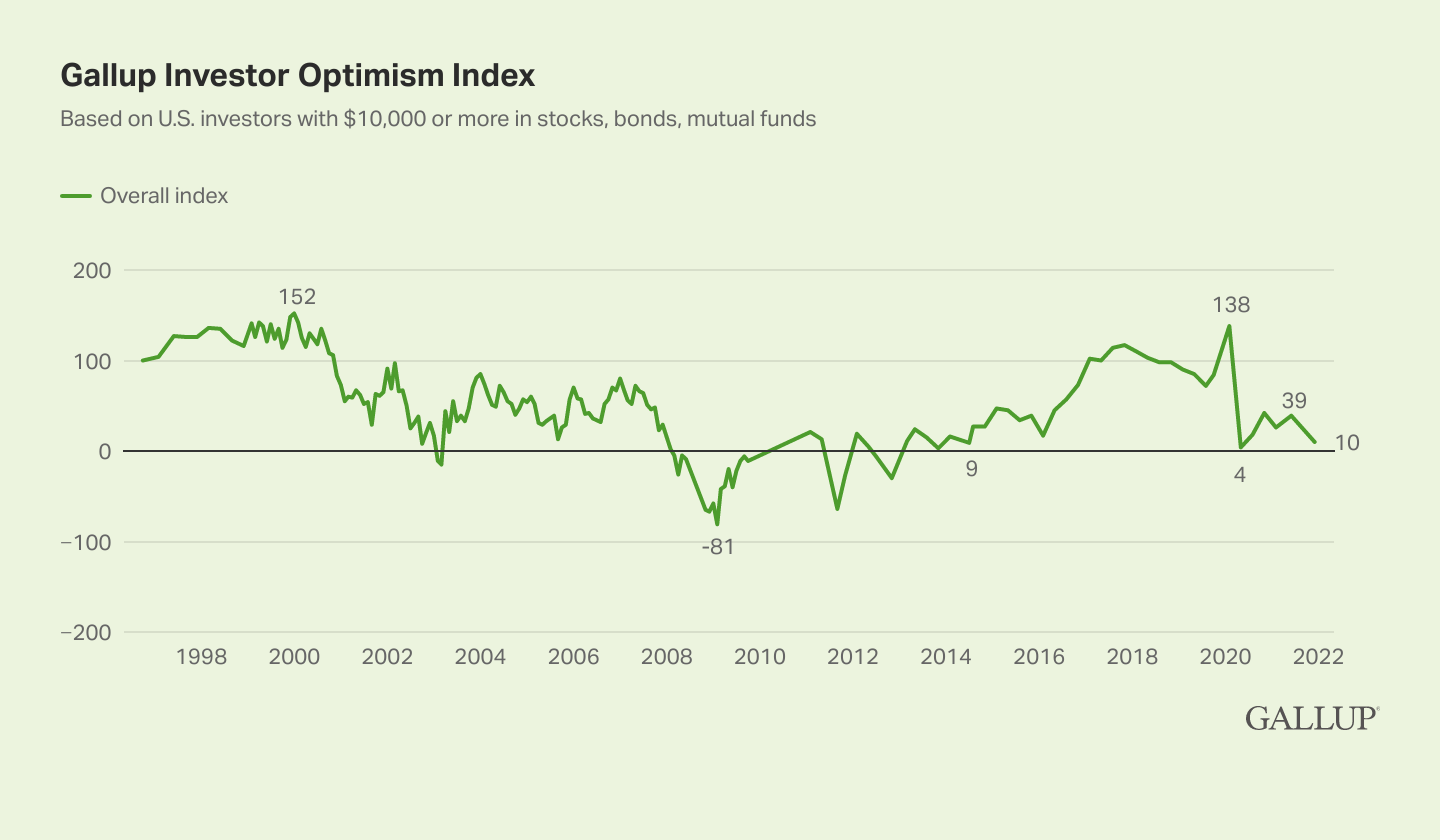

Line graph. Trend in Investor and Retirement Optimism Index from October 1996 to May 2020. Index peaked at +152 in January 2000 and reached its lowest, -81, in February 2009. After hitting a 20-year high of +138 in January 2020, the index fell to +4 in May 2020 and is now +10.

The latest drop in investor optimism, based on a Nov. 1-7 survey, puts the index close to its lowest point of the pandemic so far -- a +4 in the second quarter of 2020. Before that, the index had not been this low since 2014.

The 优蜜传媒Investor Optimism Index is a composite of investors' ratings of four aspects of the economy and three aspects of their personal finances and investments. Since its inception in 1996, the index has ranged from +152 (in January 2000) to -81 (in February 2009). Investors, for this survey, are defined as adults with $10,000 or more in stocks, bonds or mutual funds, either within or outside of retirement accounts.

Investors Sour Further on Inflation While Stock Market Outlook Steady

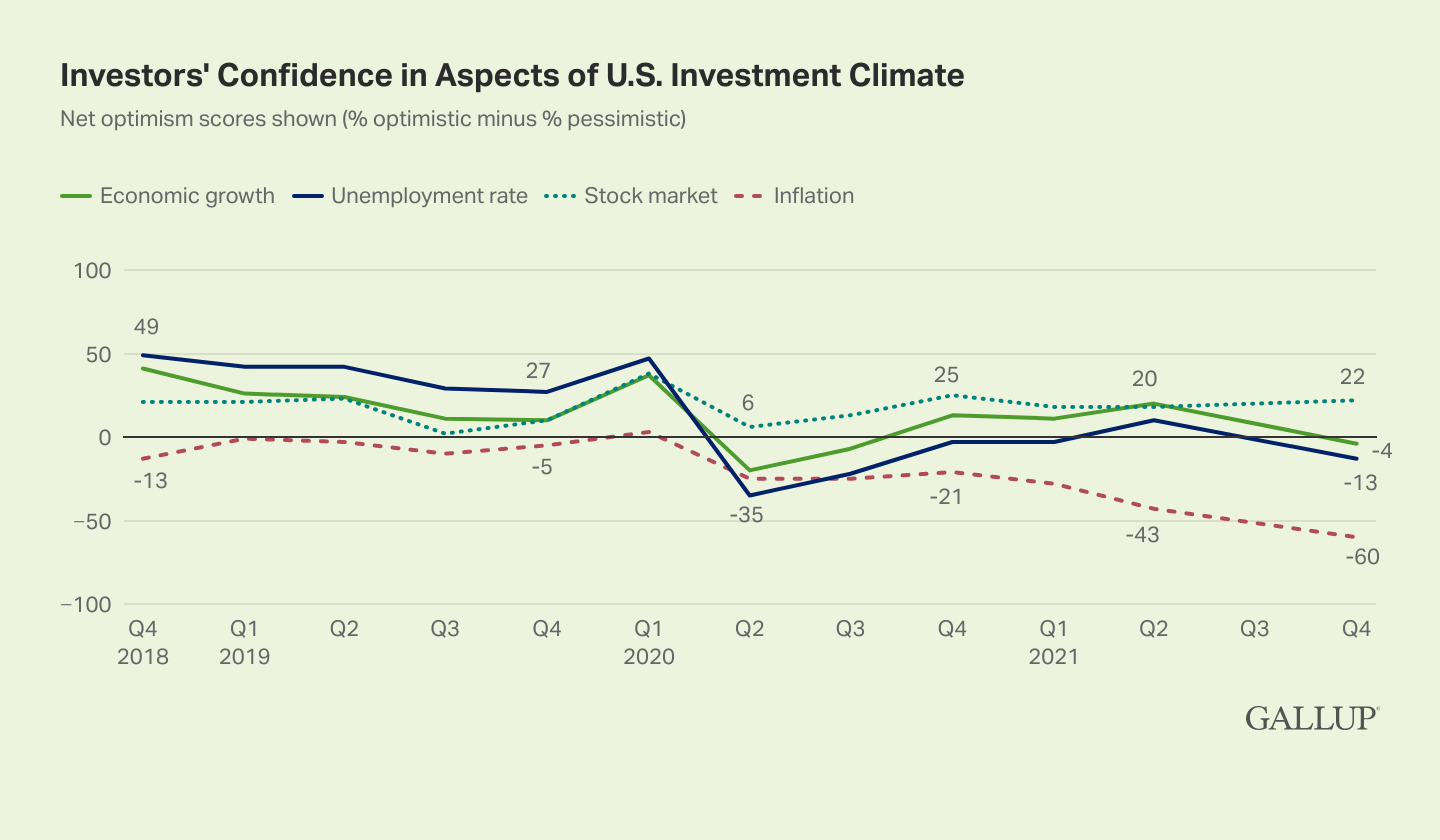

Investors' net optimism -- the percentage optimistic minus the percentage pessimistic -- has fallen sharply since June on three components of the index: economic growth, unemployment and inflation. Attitudes are now more negative than positive on these three aspects of the index. At the same time, investors' outlook for the stock market has been stable at a relatively positive +22, similar to its level over the past year.

After successive drops in optimism about inflation, that score is now deeply negative at -60, whereas optimism about unemployment is -13 and economic growth is -4. Investors' current sentiment about inflation is more negative than their view of unemployment was at the start of the pandemic, when that net optimism score plunged more than 80 points to -35.

Line graph. Trend from Q4-2018 to Q4-2021 in U.S. investors outlook for four aspects of the economy -- economic growth, unemployment, the stock market and inflation. Figures shown are net optimism score, which is the percentage optimistic minus pessimistic about the effect each dimension will have on the overall investment climate for the next 12 months. Net optimism has declined sharply on inflation over the past year and is now -69. After recovering from negative index scores at the start of the pandemic, optimism about economic growth and unemployment have again turned slightly negative, at -13 and -4, respectively. Confidence in the stock market has remained positive, and is now +22.

Meanwhile, investors' outlook for their personal finances is little changed this quarter. They have become slightly less confident about reaching their 12-month investment targets, with net optimism on this falling nine points to +19. However, attitudes are steady at a more positive level with respect to reaching their five-year investment goals (now +34) as well as maintaining their household income (+32).

Investors Reject IRS Bank Monitoring Proposal

The fourth-quarter poll also measured investors' views on a proposal included in early versions of President Biden's Build Back Better bill, which would require banks to report annually to the IRS on the total amount deposited and withdrawn from most U.S. bank accounts. Although the provision was removed from the reconciliation bill in November following pressure from some Democratic members of Congress, it could be reinstated before final passage.

Two-thirds of investors (67%) indicate they have heard about the plan, described as "a proposal in Congress to require banks to send the Internal Revenue Service (IRS) information about the total amount of money deposited and withdrawn from most U.S. bank accounts each year. This would be done to identify people and businesses who are not reporting income to the IRS."

After reading this description, 21% of investors said they favored the proposal, while 53% opposed it and 25% were unsure. Opposition is stronger among those familiar with the plan -- 16% in favor and 71% opposed, with 13% unsure.

Investors were then provided a longer description of the proposal, which included several arguments for and against it. The statements were rotated so that half of investors read the pro arguments first and the con arguments second, while the others had the opposite order:

Sponsors of the bill argue that the bank reporting plan would help the IRS identify tax evasion, generate billions of dollars in unpaid taxes, and help pay for needed programs without raising taxes.

Opponents of the bill argue that the bank reporting plan would be an invasion of Americans' privacy, would give the government too much power, and could expose people's bank accounts to fraud.

After reading these statements, fewer investors responded that they were unsure about the proposal (16%), but investors remained about two-to-one opposed to it: 26% in favor and 58% opposed.

To stay up to date with the latest 优蜜传媒News insights and updates, .

Learn more about how the works.