Story Highlights

- 21% say stocks are the best investment, down six points from 2019

- Appeal of stocks fades in high- and low-income households alike

- Still, U.S. stock ownership remains stable, at 55%

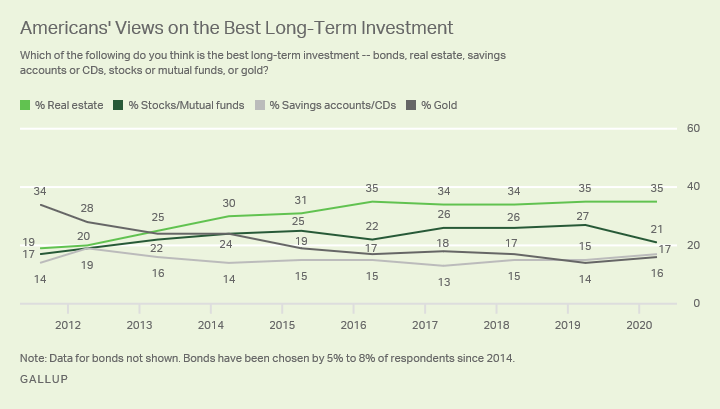

WASHINGTON, D.C. -- Americans have become less likely to view stocks or mutual funds as the best long-term investment after U.S. markets dropped by more than a third as the economic implications of the coronavirus outbreak set in last month. The current 21% naming stocks as the best investment is down six percentage points from last year and is the lowest ���۴�ýhas recorded since 2012. Real estate continues to rank first, while gold and savings accounts trail stocks.

Real estate, at 35%, remains the most favored investment to Americans, as has been the case since 2013, when the housing market was on the rebound. More than a third of Americans have named real estate as the top investment since 2016.

Roughly one in six Americans view savings accounts or CDs (17%) and gold (16%) as the best long-term investment. Gold finished first in 2011 and 2012, a time when real estate was seen as risky after the subprime mortgage crisis. But as stocks and real estate values have climbed in recent years, gold has faded -- with the percentage naming it as the best investment now at about half of what it was 2011.

Relatively few Americans say that bonds (8%) are best. While savings, gold and bonds have each seen small, individually insignificant increases since last year, their collective seven-point increase in these non-stock investments illustrates how Americans' perspectives have shifted in this new economic environment.

Stockowners, themselves, have also soured on stocks or mutual funds as the best long-term investment -- with the percentage naming stocks dropping from 37% in 2019 to 30% now.

These data are from Gallup's annual Economy and Personal Finance survey, conducted April 1-14.

Stocks' Appeal Drops Sharply Among High- and Low-Income Households Alike

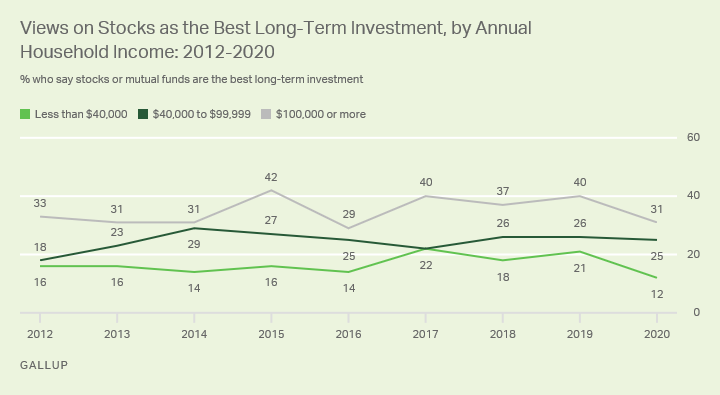

High-income Americans have consistently been much more likely than middle- and low-income Americans to view stocks or mutual funds as the best long-term investment.

But while middle-income Americans are as likely now as they were in 2019 to say that stocks are the best investment, the percentages among high- and low-income households saying the same each fell by nine points. Americans in low-income households are the least likely they've ever been in Gallup's trend to view stocks as the most opportune investment.

Despite the Massive Sell-Off, U.S. Stock Ownership Is Stable

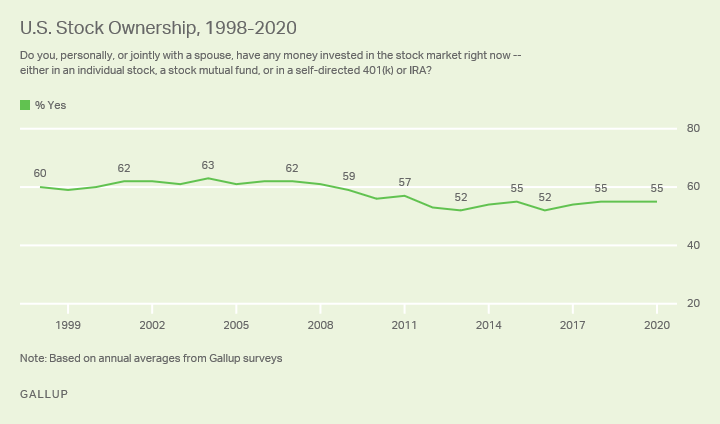

Fifty-five percent of Americans report having money invested in the stock market right now -- either in an individual stock, a mutual fund, or a self-directed 401(k) or IRA -- which is unchanged since 2018.

Before the Great Recession, about six in 10 Americans owned stock. But ownership dipped slightly in the years that followed and has yet to go back to that level, reaching a low of 52% in 2013 and 2016.

Americans Split on Whether Investing Is a Good Idea

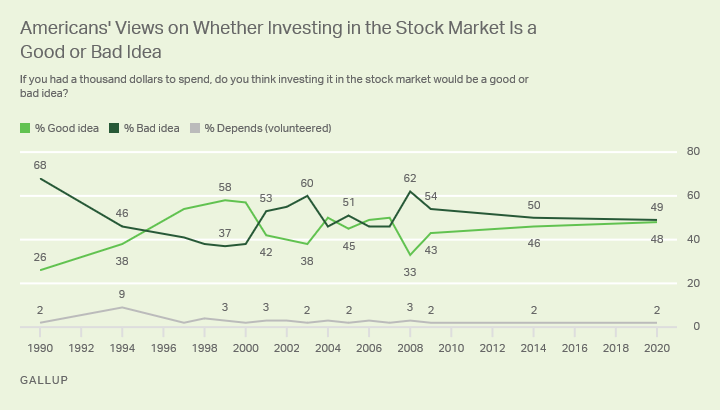

When asked whether they'd invest in the stock market if they had $1,000 to spend, U.S. adults are about as likely to say investing would be a good idea (48%) as to say it would be a bad idea (49%) -- similar to the mixed views ���۴�ýfound in its last measurement in 2014.

In sporadic measurements over the past 30 years, Americans have generally leaned toward saying it would be a bad idea to invest. Americans were most negative about the prospect of investing in 1990, the first time ���۴�ýasked the question. But their views on investing became more positive as the U.S. economy grew during the 1990s, including a high of 58% calling it a good idea to invest in 1999.

The dot-com bubble crash of 2000 sucked the enthusiasm out of Americans' ideas about investing, however, and they have been mostly negative -- and mixed at best -- since.

Among high-income households, about two in three adults (65%) say that investing a thousand dollars in the stock market would be a good idea, while less than half of middle-income (47%) and low-income households (39%) say the same.

A majority of stock owners themselves (57%) believe such an investment would be worthwhile, while more than a third of non-investors say it would be a good idea.

Bottom Line

Stocks' appeal may have dimmed after the recent end of the longest bull market in U.S. history, although they still maintain their rank as the second most valued investment. But it's possible that the economic fallout from COVID-19 could scramble Americans' preferences, with the stock market in peril and the real estate market's future unclear. In 2011, in the aftermath of the global financial crisis that caused both stock and housing values to plummet, gold was perceived as the supreme investment -- but its glimmer is now less than half of what it was then.

View complete question responses and trends (PDF download).

Learn more about how the works.