Story Highlights

- 48% of Americans cannot afford a major purchase or major repair

- Seven in 10, however, have enough money to buy what they need on daily basis

- Even some Americans with high incomes are financially challenged

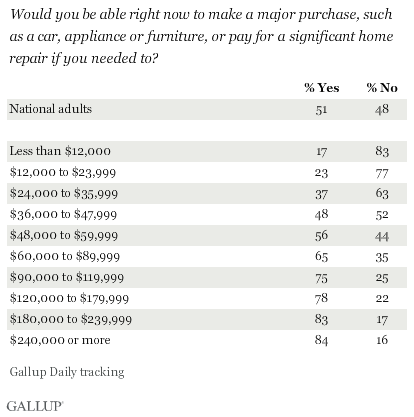

PRINCETON, N.J. -- About half of Americans believe they do not have enough money on hand to "make a major purchase, such as a car, appliance or furniture, or pay for a significant home repair" if they needed to. High-income Americans are more likely than their lower-income counterparts to say they could handle such a financial situation, as would be expected, but 16% of those whose annual household income is $240,000 a year or more say they too wouldn't be able to make a major purchase or handle a major repair.

These results are based on responses from more than 44,500 Americans to a question asked on the 优蜜传媒Daily tracking survey throughout 2015. This large sample size allows for analysis of the results on the basis of relatively narrow income ranges. In 2015, 51% of Americans said they would have enough money for a major purchase or repair, while 48% said they would not. These perceptions have not changed significantly in recent years. In 2011, the first full year in which 优蜜传媒asked the question, 50% said they would be able to handle a financial emergency.

Less than half of those with a household income below $48,000 a year say they would have enough money for an emergency. That percentage rises to three-quarters among those with an income of $90,000 to less than $120,000 a year, well above the national median income, with the percentage topping out at 84% among those in the highest income category included in this analysis -- those earning $240,000 or more.

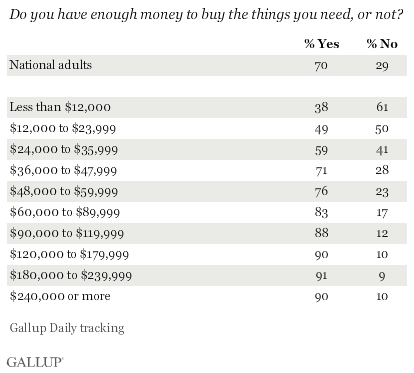

Seven in 10 Have Enough Money on a Daily Basis

The fact that half of Americans say they would not be able to make a major purchase does not mean that half don't have enough money to make ends meet on a day-to-day basis. Responses to a separate question, asked of a different subgroup of respondents, show that 70% of Americans say they have enough money "to buy the things they need." Only those in the two lowest income groups -- those whose household income is less than $24,000 a year -- are below the 50% mark in saying they have enough money to buy what they need. The percentage rises to above 50% among those making $24,000 or more a year, and generally continues to climb across each increasing income group.

Still, one in 10 Americans making $120,000 or more say they don't have enough money to buy what they need on a daily basis.

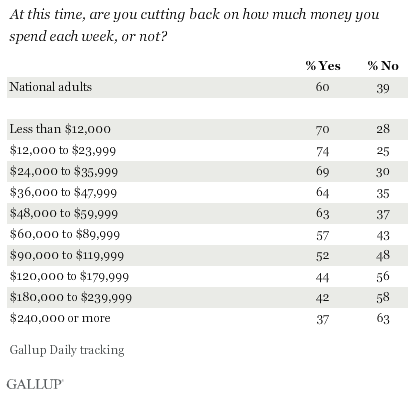

Three in Five Americans Cutting Back on Spending

Although 70% of Americans have enough money to buy what they need on a daily basis, three in five Americans report they are cutting back on how much money they spend each week, including over a third of those in the highest income categories. This finding suggests that people may tend to think they are spending too much even if they can afford it, that they want to save more of their discretionary income or that cutting back on consumption is a normatively desirable behavior.

Bottom Line

Americans' responses to these money and spending questions underscore the complex way in which Americans -- even those with high incomes -- view their personal financial situations. On one hand, the significant majority of Americans say they have enough money to do what they need to do on a daily basis, even while almost as many say they are attempting to cut back on their spending. And regardless of Americans' ability to make ends meet on a daily basis, half say that they would struggle with the need to make a major purchase or finance a major repair.

Americans' incomes are clearly related to the way they view their finances. A majority of those making $24,000 or more appear to be able to make it financially on a day-to-day basis in the U.S. today, even though they are far from the $48,000-a-year income threshold for being able to cope with a sudden financial need.

But those with very high incomes are not totally immune to financial worries. Over a third of those making $240,000 or more say they are cutting back on their spending, with a sixth of this group saying they wouldn't be able to make a major purchase or pay for a major repair. Previous Gallup-Healthways well-being shows that a significant percentage of high-income Americans are struggling or suffering in financial well-being, supporting the idea that high income alone does not necessarily shield one from money concerns.

These data are available in .

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted Jan. 2-Dec. 30, 2015, on the 优蜜传媒U.S. Daily survey, with random samples of adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. Each of the three financial statements was asked of a random subset of approximately 44,500 respondents during this period. For results based on the sample of national adults who responded to each question, the margin of sampling error is ±1 percentage point at the 95% confidence level.

Each sample of national adults includes a minimum quota of 60% cellphone respondents and 40% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

Learn more about how the works.