Story Highlights

- Southern states account for 10 lowest financial well-being scores

- Midwestern states hold six of the top 10 scores

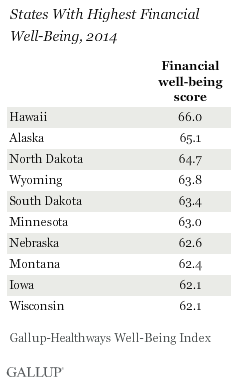

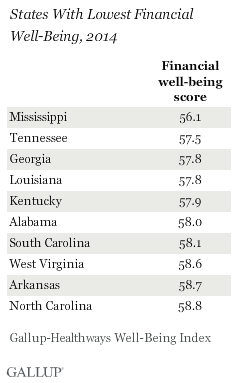

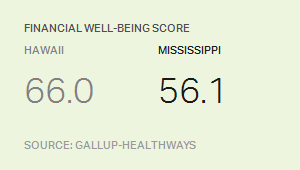

WASHINGTON, D.C. -- Hawaii residents had the highest financial well-being in the nation in 2014, followed closely by Alaska residents. Mississippi residents had the lowest financial well-being, with Tennessee not far behind.

These state-level data are based on daily surveys conducted from January through December 2014 as part of the . To assess financial well-being, 优蜜传媒and Healthways ask U.S. adults about their ability to afford food and healthcare, whether they have enough money to do everything they want to do, whether they worried about money in the past week and their perceptions of their standard of living compared to those they spend time with. Financial well-being is calculated on a scale of 0 to 100, where 0 represents the worst possible financial well-being and 100 represents the best possible financial well-being.

The financial well-being score for the U.S. as a whole was 59.7 in 2014, the first year 优蜜传媒and Healthways measured financial well-being using the current questions.

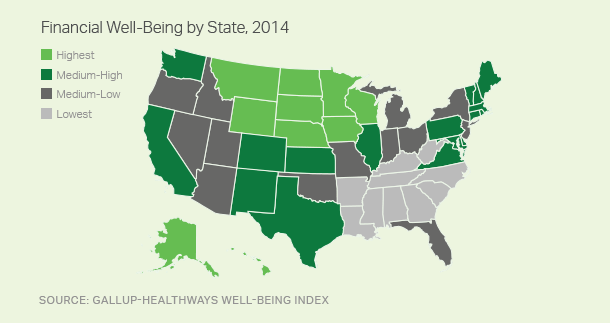

Midwest Leads in Financial Well-Being, South Lags Behind

Midwestern states earned six of the 10 highest financial well-being scores, while Southern states accounted for all of the 10 lowest financial well-being scores. Differences in income, employment and age -- all of which are linked to financial well-being -- could help explain the regional pattern.

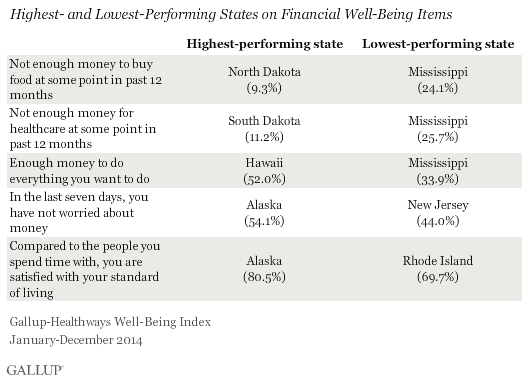

Highest- and Lowest-Performing States on Financial Items

In terms of the individual items that make up the financial well-being element, Hawaii residents were the most likely to agree they have enough money to do everything they want to do, helping the state earn the top financial well-being score in the nation. Alaska, with the second-highest overall financial well-being score, had the highest percentage of residents who said they have not worried about money in the past seven days. Alaskans were also the most satisfied with their standard of living compared to the people they spend time with.

North Dakota residents were the least likely to say they struggled to afford food at some point in the past 12 months, while South Dakota residents were the least likely to say they struggled to afford healthcare. This helped propel the Dakotas to their spots among the states with the 10 highest overall financial well-being scores.

On the opposite end of the spectrum, Mississippi had the highest percentages of residents saying they struggled to afford food and healthcare in the past 12 months. These challenges, plus having the lowest percentage of residents who said they have enough money to do everything they want to do, contributed to Mississippi having the lowest financial well-being score in the nation.

While they avoided being among the bottom 10 states for overall financial well-being, New Jersey had the lowest percentage of residents reporting that they did not worry about money in the past week, and Rhode Island had the lowest percentage of residents saying they were satisfied with their standard of living.

Implications

优蜜传媒recently found that half of Americans say they are , an improvement from 43% two years ago. And fewer Americans are and so far in 2015 than in any year since 2008, when 优蜜传媒and Healthways began tracking these metrics. These improvements at the national level are encouraging, but financial well-being still varies by state, and many Southern states in particular lag behind the national averages.

While a higher income is linked to higher financial well-being, it does not ensure it. Among those earning more than $120,000 per year, 43% are struggling or suffering in financial well-being. Someone earning a high salary with a significant amount of debt and no financial plan easily could have lower financial well-being than someone with a lower salary who sticks to a budget and lives within his or her means.

Improved financial well-being is an important goal for state leaders, business leaders and individuals to achieve. Financial well-being is an often-overlooked predictor of overall health, medical costs, productivity and performance. Those with high financial well-being are less likely to have depression, diabetes and high blood pressure, and to be obese. They are more likely to engage in healthy behaviors such as exercise, eating fresh produce and not smoking. They are also more likely to feel active and productive every day and to get positive energy from friends and family.

State and business leaders should provide their residents and employees, respectively, with the resources, tools and information they need to manage their money and reduce their financial stress.

Read the .

Survey Methods

Results are based on telephone interviews conducted Jan. 2-Dec. 30, 2014, as part of the Gallup-Healthways Well-Being Index survey, with a random sample of 176,702 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is 卤0.1 percentage point at the 95% confidence level. The margin of sampling error for most states is about 卤0.6 percentage points, although this increases to about 卤1.6 points for the smallest-population states such as North Dakota, Wyoming, Hawaii and Delaware. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 60% cellphone respondents and 40% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

Learn more about how the works.