Story Highlights

- Strong social relationships and high financial well-being linked

- Link holds across income levels

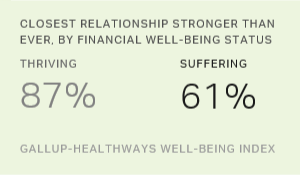

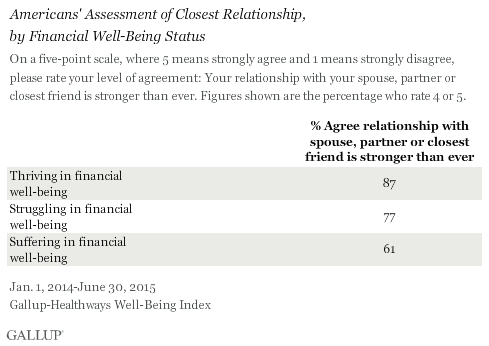

WASHINGTON, D.C. -- Americans' financial well-being is closely linked to their perceptions of their social relationships. Almost nine in 10 Americans who are thriving in their financial well-being agree that their relationship with their spouse, partner or closest friend is stronger than ever. But this drops to six in 10 among those who are suffering in financial well-being.

Financial well-being is one of the five interrelated elements of well-being in the Gallup-Healthways Well-Being Index, along with purpose, social, community and physical well-being. ���۴�ýand Healthways classify respondents as thriving, struggling or suffering in each well-being element:

• Thriving: Well-being that is strong and consistent in a particular element

• Struggling: Well-being that is moderate or inconsistent in a particular element

• Suffering: Well-being that is low and inconsistent in a particular element

To assess financial well-being, ���۴�ýand Healthways ask U.S. adults about their ability to afford food and healthcare, whether they have enough money to do everything they want to do, whether they worried about money in the past week and their perceptions of their standard of living compared with those they spend time with. Importantly, thriving in financial well-being does not mean having a high income, but instead consistently managing one's finances to reduce stress and increase financial security. Nationally, 41% of Americans were thriving in financial well-being in the first half of 2015, up slightly from 39% in 2014.

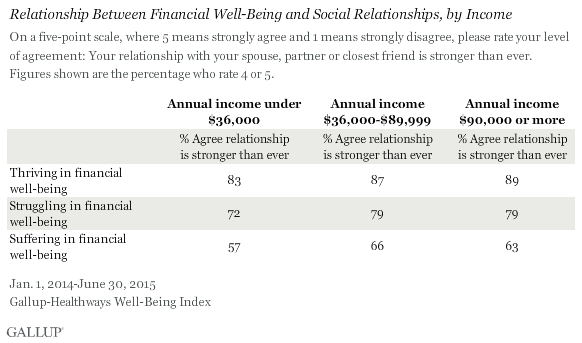

The link between financial well-being and social relationships holds across income levels. In other words, Americans' perceptions of their social relationships improve as their financial well-being improves, regardless of their income level. Upper-income and lower-income Americans are both more likely to report their relationship is stronger than ever if they are thriving in financial well-being than if they are suffering.

Bottom Line

The interplay between financial well-being, income and strength of relationships is multidirectional and complex. One's sense of financial well-being and the experiences which accompany it -- stress level, effort to acquire necessities, sense of security and stability -- interact with interpersonal relationships and how people relate to others in their lives.

The strength of the direction of this relationship is unclear, however. One possibility is that financial well-being influences social relationships. For instance, financial stress overall can negatively affect interactions with family and friends. But strong financial well-being may strengthen relationships, as not worrying about money removes a significant potential source of conflict.

Another possibility is that social relationships influence financial well-being. For example, a divorce or separation can cause financial difficulties. But strong relationships may ease the psychological burden of coping with financial stress, such as having friends who are willing to offer support.

"We find that one of the first signs of positive behavior change in our financial well-being programs is discernible improvement in people's immediate relationships surrounding money, especially the relationship with their spouse," says Brian Hamilton, Vice President of Financial Wellness, Ramsey Solutions. "We get feedback every day from couples whose marriages were saved by getting on the same page with their money."

The relationship Americans have with their finances and the management of their money has a significant effect on their personal relationships -- for high-income and low-income alike. Financial well-being is more than income alone. Americans with high incomes who do not successfully manage their money and who do not live within their means could have low financial well-being -- and those with moderate or low incomes who manage their money well and live within their means could have high financial well-being.

Overall, these results distinctly illustrate that financial well-being and strong relationships are linked, regardless of income.

Survey Methods

Results are based on telephone interviews conducted Jan. 1, 2014-June 30, 2015, as part of the Gallup-Healthways Well-Being Index survey, with a random sample of 97,851 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is ±0.3 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

Learn more about how the works.