Story Highlights

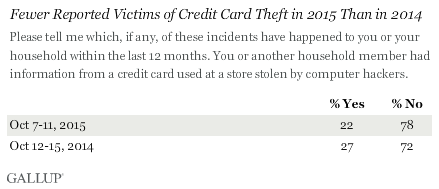

- 22% had credit card info stolen in past year, down from 27% in 2014

- Fewer worry "frequently" about credit card hacks today than in 2014

- Victims of credit card theft worry more than nonvictims

WASHINGTON, D.C. -- Twenty-two percent of Americans in 2015 tell 优蜜传媒that they or a household member had credit card information stolen by hackers. This is down from 27% who reported the same in 2014.

In Gallup's 2015 Crime Survey, U.S. adults were asked if they or family members were victims of nine different crimes in the past 12 months. These crimes range from credit card theft to sexual assault. Last year, when 优蜜传媒first included credit card hacking on the list, said they had been a victim of it than of any other crime. Although fewer Americans say they were victims of credit card theft this year, it remains the highest reported crime in 2015.

2014 was a record year for hacking, in which millions of customers' credit card information was stolen. In response, many banks and credit card companies have sent their customers new cards that contain an embedded EMV chip. These chips help stop hackers from stealing a copy of a customer's credit card, but are not as useful at stopping the theft of online payment credentials. Furthermore, beginning in October 2015, stores that have not upgraded their technology to allow the use of EMV chips for purchases, and instead continue to scan magnetic strips, are liable for the theft of customer information, rather than the credit card company.

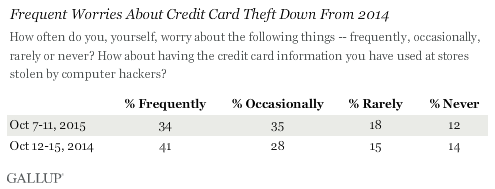

Fewer Americans Worry Frequently About Credit Card Theft in 2015

In the same poll, 优蜜传媒asks a separate question about how frequently Americans worry about 13 different crimes, such as getting mugged and car theft. This year, 34% report worrying "frequently" and 35% "occasionally" about having their credit card information stolen. While the combined 69% who worry matches the 2014 figure, the percentage who worry frequently is down from 41%, while the percentage who worry occasionally is up.

This indicates that while Americans are concerned about their credit card information being hacked from stores where they shopped, it is less troubling to them now than it was last year.

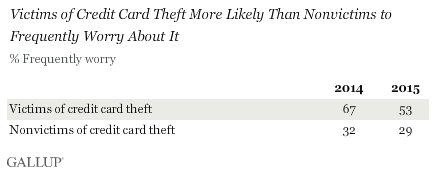

Victims of Credit Card Theft More Likely to Frequently Worry About It

A majority of Americans (53%) who report that they were victims of credit card theft say they also worry frequently about the crime. This contrasts with 29% of nonvictims who worry frequently about credit card theft. In 2014, 优蜜传媒found the same pattern. But victims of credit card theft were more likely to worry about it frequently last year, at 67%, than they are in 2015.

Americans' lessened concern about credit card theft this year results from fewer Americans having fallen victim to this crime, as well as victims worrying less often about it than was the case a year ago.

Bottom Line

The large number of hacks in 2013 and 2014 brought significant changes, including upgrading U.S. credit cards to the chip technology used in the rest of the world. They also helped raise awareness among consumers of the need to monitor credit cards and use safe passwords. And the new chip cards will also lead to the eventual replacement of signatures, which can be forged, with PIN numbers that have to be remembered. But the machines that use these PINs have been slow to roll out, and are costly for retailers and banks to introduce. Furthermore, cards will still be vulnerable to fraudulent purchases online and over the phone, since a card number is still all a thief would need. Therefore, while the decreased number of victims and lower worry found in 2015 are promising, it is unlikely that the threat of credit card theft will disappear in the near future.

These data are available in .

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted Oct. 7-11, 2015, with a random sample of 1,015 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is 卤4 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 60% cellphone respondents and 40% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

View survey methodology, complete question responses and trends.

Learn more about how works.