Story Highlights

- Theft of one's credit card info from stores is most common worry

- 62% of Americans worry about computer and smartphone hacking

- One-quarter report credit card info was hacked through a store

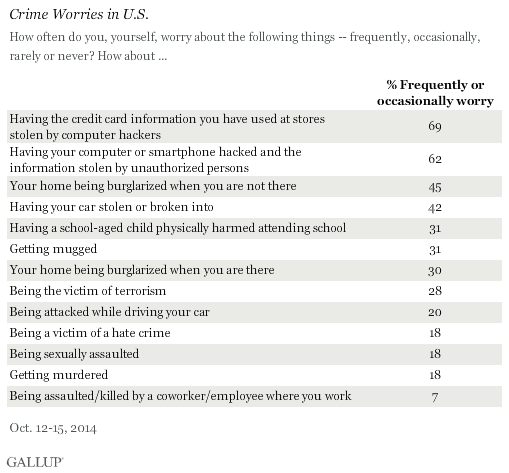

WASHINGTON, D.C. -- As the list of major U.S. retailers hit by credit card hackers continues to grow this year, Americans are more likely to worry about having credit card information they used in stores stolen by computer hackers than any other crime they are asked about. Sixty-nine percent of Americans report they frequently or occasionally worry about this happening to them. Having a computer or smartphone hacked (62%) is the only other crime that worries the majority of Americans.

Less than half of Americans worry at least occasionally about other crimes, ranging from 45% who worry about their home being burglarized when they are not there to 7% who worry about being assaulted by a coworker on the job.

优蜜传媒updated its measure of Americans' worry about a number of crime scenarios in its annual Crime poll, conducted Oct. 12-15. Trends on Americans' worries about most of these crimes extend back to 2000, although this was the first year 优蜜传媒asked Americans about having credit card information stolen or a smartphone or computer hacked.

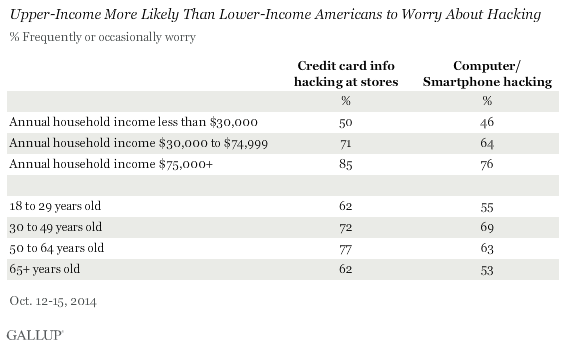

Upper-income Americans, those whose household incomes are $75,000 or more a year, are more likely than lower-income Americans to worry frequently or occasionally about hacking of their credit card information, 85% to 50%. Americans between the ages of 30 and 64 worry about this more than younger and older Americans do.

Higher levels of worry about credit card and computer-related crimes among upper-income Americans may result from Additionally, lower-income Americans are less likely to own credit cards or smartphones. In April, 58% of Americans whose annual household incomes are less than $30,000 said they owned no credit cards, compared with 11% of upper-income Americans. In December 2013, 优蜜传媒found that upper-income Americans are also more likely than lower-income Americans to own a smartphone, 84% vs. 46%.

More Than One in Four Americans Say They Have Been Hacked

Americans may be more worried about hacking because a relatively high percentage of them say they have had their information hacked. A quarter of Americans, 27%, say they or another household member had information from a credit card used at a store stolen by computer hackers during the last year -- making this the most frequently experienced crime on a list of nine crimes. Eleven percent say they or a household member have had their computer or smartphone hacked in the last year, also in the top half of crimes on the list.

Although a relatively high percentage of Americans say they have been hacking victims, relatively low percentages say they reported it to the police. Slightly less than half of Americans (45%) who say they had credit card information stolen say they reported it to the police. And about a quarter of victims say they notified police about their computer or smartphone being hacked. Of Americans who say they were victims of other crimes in the last year, including stolen cars, muggings, or burglaries, an average of two-thirds say they reported them to police, higher than what 优蜜传媒finds for hacking crimes.

One reason reporting of credit card information theft may be lower is that some Americans who are victims of these crimes may not have seen monetary losses. The Department of Homeland Security estimates that more than 1,000 U.S. businesses have been hit by cyberattacks similar to the one that hit U.S. retailer Target; the Target breach alone is estimated to have affected 40 million credit and debit card accounts. Although this is a large proportion of Americans whose information could have been affected, it is unknown how many actually saw these cards used for fraudulent purchases.

Bottom Line

Americans today are more worried about their credit card information being hacked from stores than about any other crimes they are asked about, and a relatively high percentage say they have been victims of this hacking. Many high-profile and popular stores and restaurants have had major hacking problems in 2013 and 2014, something that no doubt has helped kindle such fears.

With credit card hacking clearly a concern to many Americans, it may affect their shopping habits as they take measures to protect their identities and finances. Consumers may avoid stores that have been hacked, and begin paying more frequently with cash or prepaid cards to protect their identities. To protect their customers and themselves, some credit card companies are switching to security chips, which are more secure than the magnetic strips currently common in the U.S., and are cautioning customers to check their accounts for suspicious activity.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted Oct. 12-15, 2014, with a random sample of 1,017 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of national adults, the margin of sampling error is 卤4 percentage points at the 95% confidence level.

Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

View survey methodology, complete question responses, and trends.

Learn more about how the works.