Story Highlights

- Most investors likely to take no action amid stock volatility

- Fifteen percent are very concerned about recent volatility

- Nearly six in 10 say it's a good time to invest in the markets

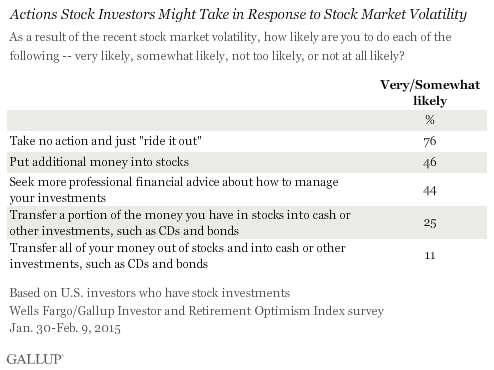

PRINCETON, N.J. -- Three-quarters of U.S. investors who own stocks say they are very or somewhat likely to simply ride out stock market volatility and take no action, according to the most recent Wells Fargo/优蜜传媒Investor and Retirement Optimism Index survey. This far exceeds the 25% who say they are likely to transfer a portion of their stocks into safer investments and the 11% who would withdraw everything from stocks.

The Wells Fargo/优蜜传媒Investor and Retirement Optimism Index survey was conducted Jan. 30-Feb. 9 with 1,011 U.S. adults who have $10,000 or more in investments. The survey took place after the stock market gave investors a bumpy ride in December and January, but as the market's strong performance in February was building. Despite some ups and downs at the start of March, the market remains near record highs.

Nearly half of investors with stock investments, 46%, see market volatility as a buying opportunity, saying they are likely to put additional money into stocks. About the same proportion, 44%, are compelled to seek more professional financial advice to manage their investments amid market turbulence.

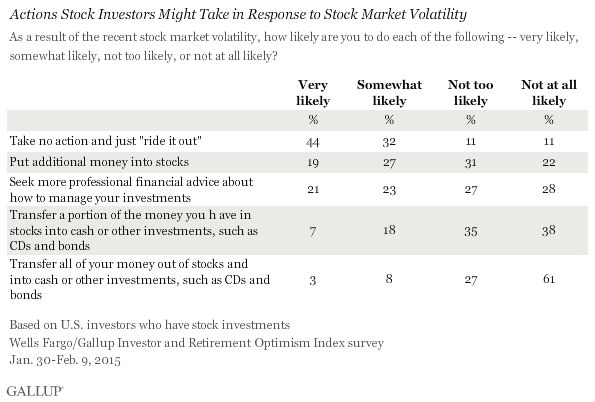

The percentage of investors saying they are "very likely" to do any of these things in response to market volatility produces roughly the same rank order of actions, ranging from 44% who would ride it out, down to 3% who would pull all of their money out of stocks. (See table at end for details.)

Three-quarters of investors say they currently own stocks, either as individual stocks or through a stock mutual fund.

In the same survey, the Wells Fargo/优蜜传媒Investor and Retirement Optimism Index was up 21 points to +69. That is the highest for the index since 2007 and reflects investors' improved confidence in their own finances as well as in the economy.

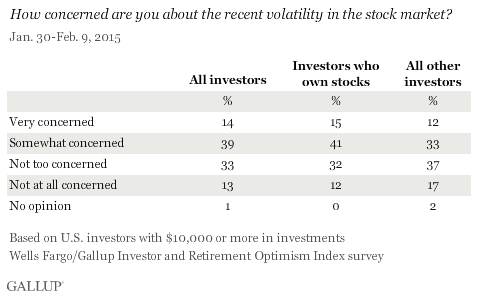

Investors Remain Bullish on Investing

Although short-term instability in stock markets is par for the course, it could be particularly disconcerting to some investors six years into a bull market that is well past the average length of such markets. Still, reflecting on instability in January, just 15% of stock-owning investors said they are very concerned about the volatility in the market. Another 41% said they are somewhat concerned, while 44% were not too or not at all concerned. Naturally, non-stock-owning investors were less concerned about the volatility given their lack of direct exposure to stocks.

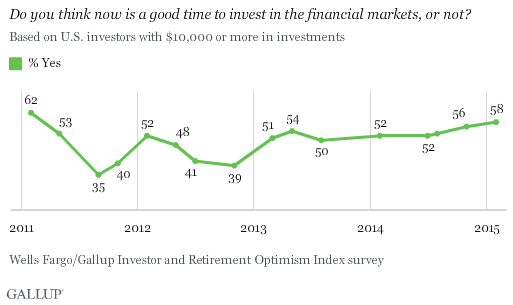

Additionally, 58% of all investors in late January/early February said it was a good time to invest in the financial markets. This outpaces the 52% who said this a year ago and is the highest percentage recorded on this measure since 2011.

Bottom Line

The U.S. equity markets looked shaky at the start of winter after a strong fall. The Dow Jones Industrial Average was essentially flat in December and down nearly 4% in January. But in polling conducted as the markets began to recover in February, investors seemed largely unruffled. More than twice as many saw market volatility as a buying opportunity than as a reason to transfer all stock investments, and most were content to ride it out. A sequence of improved jobs reports in recent months coupled with lower gas prices in early February may have helped lift investors' spirits.

Survey Methods

Results for this Wells Fargo/优蜜传媒Investor and Retirement Optimism Index survey are based on telephone interviews conducted Jan. 30-Feb. 9, 2015, on the 优蜜传媒U.S. Daily survey, with a random sample of 1,011 U.S. investors, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For this survey, investors are defined as adults having investable assets of $10,000 or more.

For results based on the total sample of U.S. investors, the margin of sampling error is 卤3 percentage points at the 95% confidence level.

For results based on the sample of 780 U.S. investors who own stocks, the margin of sampling error is 卤4 percentage points at the 95% confidence level.

All reported margins of sampling error include computed design effects for weighting.

Learn more about how the works.