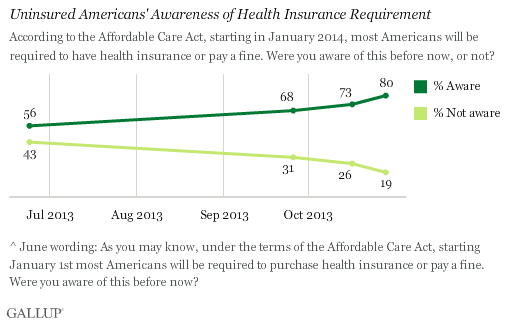

PRINCETON, NJ -- Uninsured Americans are increasingly conscious of the "Obamacare" requirement that most Americans need to carry insurance or pay a fine. Eighty percent of uninsured Americans now say they are aware the healthcare law requires this, up from 73% earlier this month and 56% this summer.

The latest results are based on Oct. 18-29 优蜜传媒Daily tracking of uninsured Americans' knowledge and awareness of the 2010 Affordable Care Act and its provisions, as the law is more fully implemented in the coming months.

In order for health insurance to remain affordable for Americans under the Affordable Care Act, as many Americans as possible need to carry insurance, particularly those who are healthy and least likely to use the healthcare system. That is one reason the government included the requirement, or "individual mandate," in the legislation.

One key in reaching the goal of universal coverage is making uninsured Americans aware that they need to get insurance. Clearly there has been significant progress toward that goal in recent months. 优蜜传媒will continue to track awareness of the health insurance requirement to see whether it continues to rise.

Most Uninsured Plan to Get Insurance

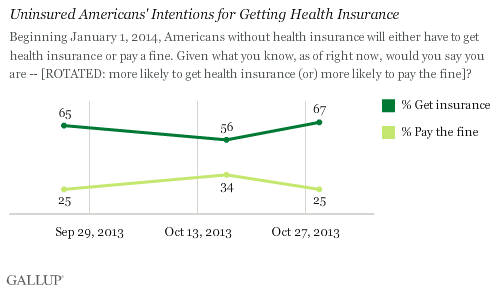

After Americans are aware of the insurance requirement, the next major step is to get them to sign up for health insurance. 优蜜传媒has consistently found most uninsured Americans saying they plan to get insurance rather than pay the fine that would be levied on those without insurance. The percentages have fluctuated a bit since 优蜜传媒began tracking them; currently, 67% intend to get insurance and 25% plan to pay the fine.

If those who plan to pay the fine indeed follow through on their intentions, and everyone else gets insurance, that would still leave about 5% of Americans without health insurance, given that 18% of all Americans are .

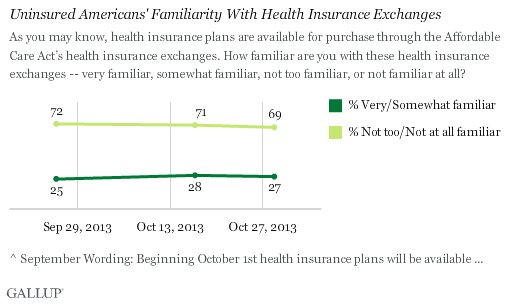

No Increase in Familiarity With Health Insurance Exchanges

Uninsured Americans are no more familiar with the health insurance exchanges -- presumably the place those who need insurance are most likely to get it -- than when the exchanges first opened a month ago. Currently, 27% of the uninsured say they are very or somewhat familiar with the exchanges, while 69% are not familiar.

The exchange website's technical issues have been major news since the exchanges opened. It is not clear whether those problems are contributing to the lack of familiarity, which could be the case if people have attempted to access the website but have been unable to. The relative lack of familiarity with the exchanges also could be attributable to people waiting until closer to the deadline to get insurance. It may also be related to the fact that less than half of the uninsured who plan to get insurance, 44%, say they will get it from an exchange. Another 35% say they will get insurance elsewhere, and the remainder are unsure of whether they will purchase from an exchange.

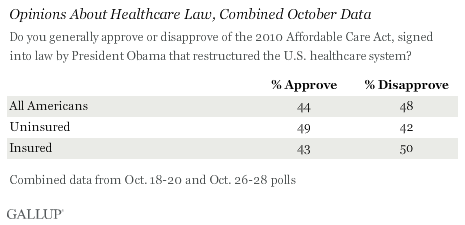

Uninsured Give "Obamacare" Modestly Positive Reviews

Uninsured Americans are slightly more likely to approve (49%) than disapprove (42%) of the Affordable Care Act. That is a more positive evaluation of the law than among insured Americans, who are more likely to disapprove than approve of the law.

One would expect the uninsured to be more positive toward the law because they are its primary beneficiaries, with the government now providing them new and presumably more affordable insurance options. Still, the fact that less than half approve can hardly be considered a strong endorsement of the law. It could be that many uninsured Americans do not like some of the law's specifics, particularly the requirement that they carry health insurance. Younger and healthier Americans especially may not see health insurance as worth the financial investment, even if the law gives them a greater range of options than before.

The relatively tepid evaluation of the law among the uninsured is not attributable to their political leanings -- which are of support for the law. The uninsured are a lot more likely to identify or lean Democratic (47%) than Republican (27%).

In June, 优蜜传媒found 54% of uninsured Americans approving and 39% disapproving of the healthcare law. Although it appears that the uninsured are less positive toward the law now than in June, it is not certain that is the case, because the difference between the two polls' results are not statistically meaningful.

Implications

Awareness of the healthcare law's insurance requirement is steadily increasing, marking significant progress on a basic goal toward making the Affordable Care Act work. Still, a nontrivial 19% of uninsured Americans remain unaware that they need to get health insurance or be subject to a fine.

Awareness is just the first step in realizing the law's goals; those who do not have insurance still need to get it. The majority of the uninsured say they do plan to get insurance, but again, the percentage is far short of the ideal goal of universal coverage.

Despite the gains in awareness, uninsured Americans are no more familiar now with state and federal health insurance exchanges than they were before the exchanges opened at the beginning of October. Gallup's data suggest the exchanges may not be quite so pivotal in getting the uninsured to sign up because less than half say they plan to get insurance through them. Rather, many uninsured plan to get insurance through other means, such as their employer, to meet the requirements of the law.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted Oct. 18-29, 2013, on the 优蜜传媒Daily tracking survey, with a random sample of 730 uninsured adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of uninsured adults, one can say with 95% confidence that the margin of sampling error is 卤5 percentage points.

Results for the ACA approval item are based on interviews with 373 uninsured Americans conducted Oct. 18-20 and Oct. 26-28. For results based on this sample, the margin of sampling error is 卤6 percentage points.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by region. Landline and cell telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, and cellphone mostly). Demographic weighting targets are based on the March 2012 Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the July-December 2011 National Health Interview Survey. Population density targets are based on the 2010 census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

View methodology, full question results, and trend data.

For more details on Gallup's polling methodology, visit .