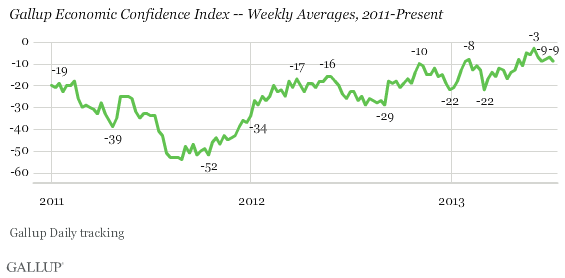

WASHINGTON, D.C. -- Gallup's U.S. Economic Confidence Index was -9 for the week ending July 7, on par with scores from the past month. The index has been slightly lower since reaching a five-year weekly high of -3 in late May and early June. Still, confidence has generally improved from levels 优蜜传媒has measured over the past five years.

The relatively lower levels of confidence in June and early July may be a result of more volatility in U.S. stock prices and a stubborn unemployment rate. At the same time, -- as reported by the U.S. Bureau of Labor Statistics and 优蜜传媒-- may be contributing to Americans' confidence levels remaining stable.

Americans' confidence in the economy rebounded from sharp declines during the "fiscal cliff" debate and sequestration budget cuts earlier this year. Consumers' confidence inched closer to positive territory and reached its best weekly level in over five years in late May and early June after U.S. stock prices surged and housing values increased.

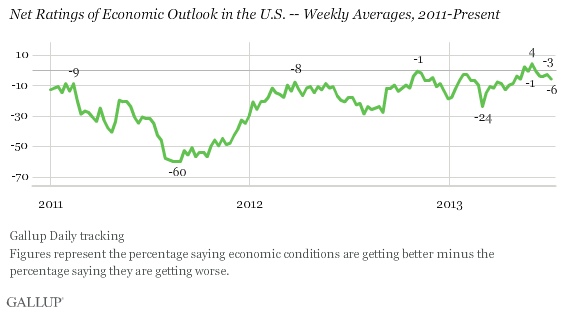

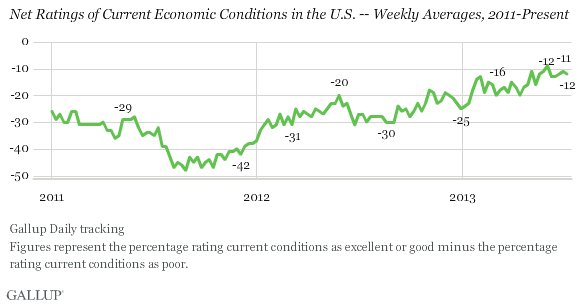

Gallup's Economic Confidence Index is based on Americans' ratings of current economic conditions in the U.S. and their assessments of whether the economy is getting better or worse. Americans' assessments of both index components held steady last week.

For the most recent week, 45% of Americans say the economy is getting better and 51% say it is getting worse, for a net economic outlook score of -6. This score has declined by 10 points since the week ending June 2, when Americans were more likely to say the economy was getting better than getting worse.

Twenty percent of Americans say the economy is "excellent" or "good," while 32% say it is "poor," for a net current conditions score of -12. This score is slightly lower than -9 in the week ending June 2, but similar to scores from the past month.

Bottom Line

Americans' confidence in the economy has leveled off in recent weeks, as signs about the nation's economic recovery have been mixed. Although confidence remains at a relatively higher level, Americans' economic outlook, one of two components of the Economic Confidence Index, has worsened since late May and early June, falling by 10 points. Americans are slightly more likely to say the economy is getting worse than getting better, which is consistent with the public saying the .

Gallup.com reports results from these indexes in daily, weekly, and monthly averages and in Gallup.com stories. Complete trend data are always available to view and export in the following charts:

Daily: , , ,

Weekly: , , ,

about Gallup's economic measures.

our economic release schedule.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted July 1-7, 2013, on the 优蜜传媒Daily tracking survey, with a random sample of 3,044 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of national adults, one can say with 95% confidence that the margin of sampling error is 卤2 percentage points.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by region. Landline and cell telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, and cellphone mostly). Demographic weighting targets are based on the March 2012 Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the July-December 2011 National Health Interview Survey. Population density targets are based on the 2010 census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit .