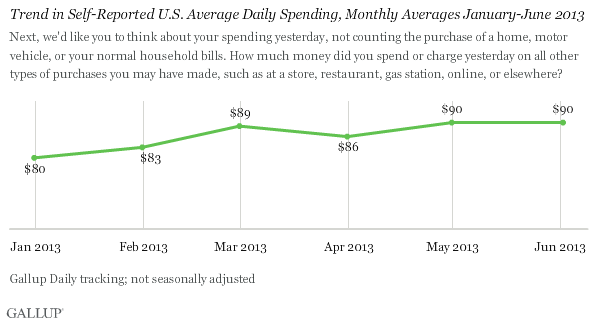

WASHINGTON, D.C. -- Americans' self-reported daily spending averaged $90 in June, unchanged from May and not much different from March's $89. Consumer spending has remained essentially flat since March, .

These results are based on 优蜜传媒Daily tracking interviews, conducted by landline and cellphone, with more than 13,000 Americans from June 1-27. Gallup's consumer spending measure is essentially a discretionary spending measure and is generally more closely related to chain-store sales and online sales than overall retail sales. Self-reported spending results are not seasonally adjusted.

Gallup's measure of Americans' self-reported spending has not weakened despite many economists anticipating consumer spending to deteriorate after federal lawmakers did not renew the payroll tax cut and let the sequester go into effect. This leveling in spending may be due in part to the gains on Wall Street during the first half of the year. Spending may also reflect Americans' and the refinance benefits record-low mortgage rates had been providing.

Longer term, Americans' self-reported spending is much stronger than it was from late 2008 to late 2011, but it continues to trail behind early 2008 spending, before the recession gained momentum.

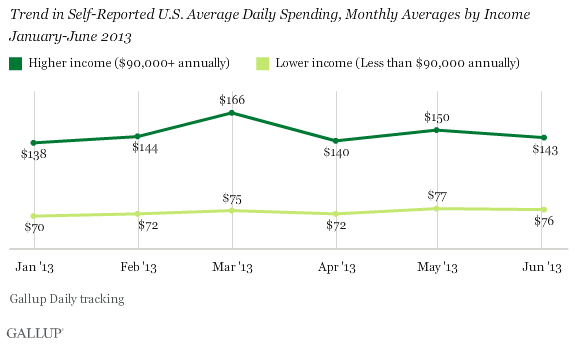

Upper-Income Spending Essentially Flat

Spending is flat across income groups. Upper-income spending averaged $143 last month, not much different from the $150 in May and essentially the same as April's $140. Lower- and middle-income daily spending averaged $76 in June, not much different from the $77 per day in May and March's $75.

It appears -- at least to this point -- that neither the payroll tax nor the sequester has had a disproportionately negative impact on lower- and middle-income spending as might have been expected. Nor have the gains on Wall Street and in housing values had a disproportionately positive effect on upper-income spending.

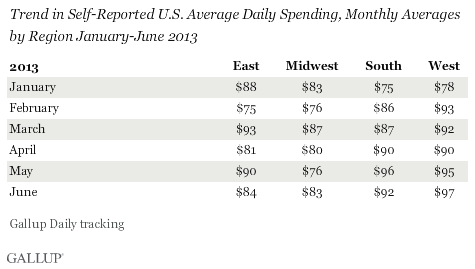

Americans Living in the West Spending the Most, Followed by the South

Residents living in the West report the highest average daily consumer spending in June, at $97, which could be a result of the strong housing recovery in cities across the region. Southern residents report the next highest average, $92, likely benefiting from both the energy industry and housing. Those living in the East ($84) and Midwest ($83) lag behind, at least in part a result of the apparent slowdown in manufacturing.

Implications

The lack of change in Gallup's self-reported consumer spending for June is consistent with the U.S. economy's modest growth during the second quarter following what was a surprisingly weak first quarter. Gallup's consumer spending measure is also in line with its Payroll to Population employment measure, which is showing no increase in June in full-time employment over the past 12 months.

The lack of increased consumer spending is somewhat disappointing given Americans' relatively . However, it is hard for spending to increase without real job growth. Further, as this disconnect illustrates, economic confidence is often a necessary but not sufficient reason for consumer spending to increase.

Looking ahead, American consumers face the additional headwind of considerably higher interest rates, after their surprisingly rapid increase during recent weeks. Higher rates may be of benefit to some Americans, particularly savers and retirees. On the other hand, higher interest rates typically do not benefit those looking to buy autos or houses. Higher rates are also likely to end the consumer benefits associated with mortgage refinancing.

It remains to be seen whether American consumers will continue to show high levels of economic confidence given the higher interest rate levels. But even if they do, it is not clear if the result will be the much needed increase in consumer spending.

Gallup.com reports results from these indexes in daily, weekly, and monthly averages and in Gallup.com stories. Complete trend data are always available to view and export in the following charts:

Daily: , , ,

Weekly: , , ,

about Gallup's economic measures.

our economic release schedule.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted as part of the 优蜜传媒Daily tracking survey June 1-27, 2013, with a random sample of 13,694 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia, selected using random-digit-dial sampling.

For results based on the total sample of national adults, one can say with 95% confidence that the margin of sampling error is 卤1 percentage points.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by region. Landline and cell telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, and cellphone mostly). Demographic weighting targets are based on the March 2012 Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the July-December 2011 National Health Interview Survey. Population density targets are based on the 2010 census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit .