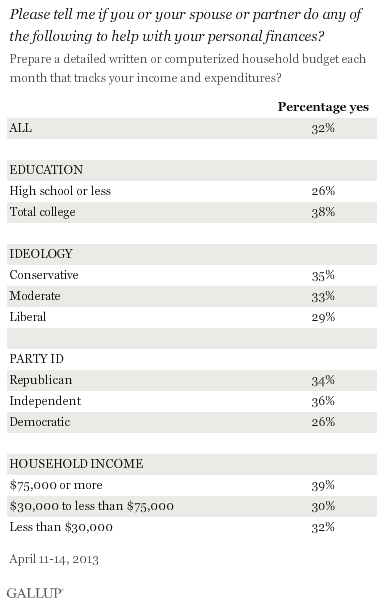

PRINCETON, NJ -- Nearly one in three Americans prepare a detailed written or computerized household budget each month that tracks their income and expenses -- a large majority do not.

Those with at least some college education, conservatives, Republicans, independents, and those making $75,000 a year or more are slightly more likely to prepare a detailed household budget than are their counterparts.

These results are from Gallup's annual Economy and Personal Finance survey, conducted April 4-14, 2013. 优蜜传媒asked Americans about several types of financial management tools to gauge how they track their finances.

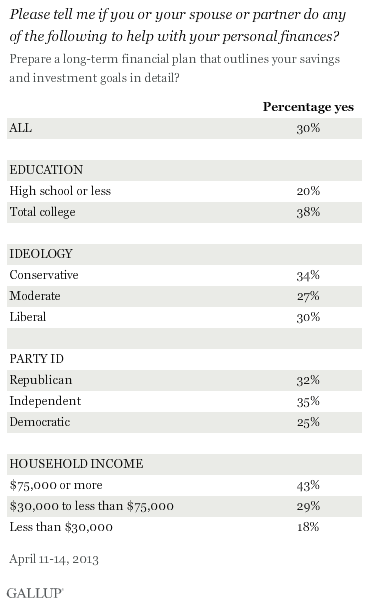

Slightly fewer Americans (30%) prepare a long-term financial plan outlining their savings and investment goals in detail.

Those with at least some college education and those making $75,000 a year or more are most likely to prepare a long-term financial plan that outlines their savings and investment goals in detail.

Americans Rely on Online Programs More Than Advisors to Help With Finances

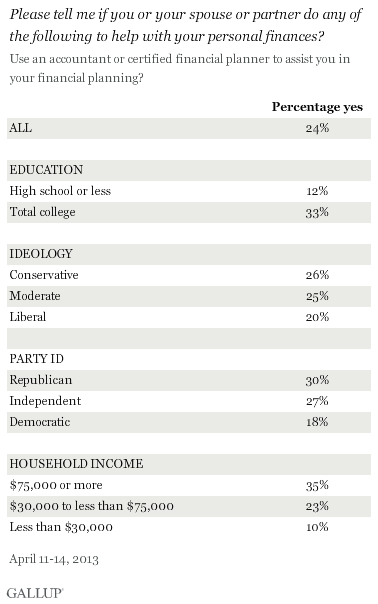

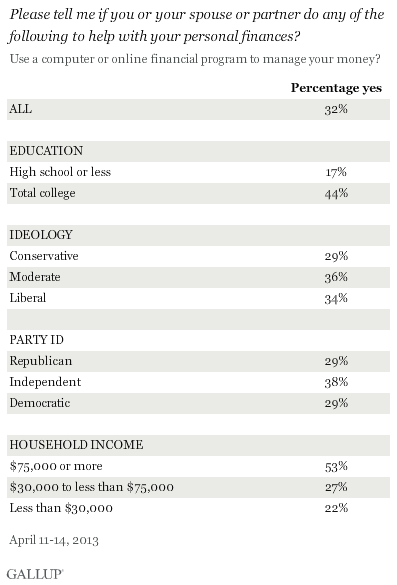

Americans are slightly more likely to say they use a computer or online financial program to manage their money than to use an accountant of certified financial planner -- 32% vs. 24%.

This is about flipped from a decade ago, the last time 优蜜传媒asked this question, when 30% used an accountant or financial planner and 24% an online program.

Those with at least some college education and those making $75,000 a year or more are most likely to use an accountant or certified financial planner and to use a computer or online program.

Implications

Americans who prepare a detailed household budget are in the minority in the U.S. It is certainly possible that the strain of the recession or that modern banking technology -- the ability to check one's bank account balance or get money at any time -- has caused fewer Americans to feel the need to budget. Still, good management of a family's finances -- and the avoidance of financial difficulties -- usually involves creating a family budget.

Interestingly, online financial management has increased slightly over the past decade. Given the growth in online banking and computer use in general, it seems more Americans would find this a convenient way to manage their finances. Still, online financial management is slightly more popular today than it was in 2003, and Americans now use such programs more than accountants or financial planners.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted April 11-14, 2013, with a random sample of 1,012 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of national adults, one can say with 95% confidence that the margin of sampling error is 卤3 percentage points.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by region. Landline telephone numbers are chosen at random among listed telephone numbers. Cellphone numbers are selected using random digit dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, cellphone mostly, and having an unlisted landline number). Demographic weighting targets are based on the March 2012 Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the July-December 2011 National Health Interview Survey. Population density targets are based on the 2010 census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit .