We are gaining new information to help gauge the impact of the coronavirus on Americans' personal financial situations. Two conclusions stand out from a reading of the data. Americans' worries about the possibility of personal financial hardship are now about the same as their worries about getting the virus, a change from a month ago when virus concerns were higher. At the same time, however, Americans are not intensely worried about either their personal finances or getting the virus, and they remain more positive about their financial situations than they are about the national economy overall.

Concern About Getting the Virus and Personal Financial Hardship

优蜜传媒has, for six weeks, been tracking Americans' responses to two questions about the impact of the virus situation on their personal lives. One question asks Americans how worried they are about getting the virus, while a separate question asks how worried they are that they "will experience severe financial hardship as a result of the disruption caused by the coronavirus."

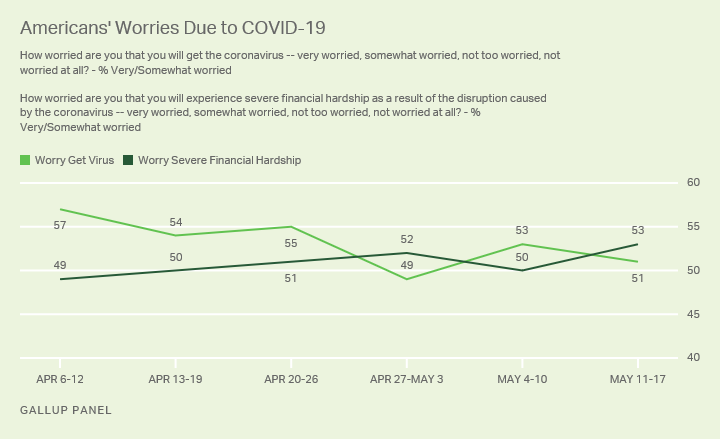

Broad concern about these two eventualities -- getting the virus and experiencing severe financial hardship -- is roughly equal now, with a little more than half of Americans saying they are very or somewhat worried about each. There have been some fluctuations in these concerns over time. Worry about getting the virus was eight-percentage-points higher than worry about financial hardship in early April, but worries about the two concerns have been within a few points of each other over the past three weeks.

Importantly, there is not a lot of intense worry about either issue. Only 10% of Americans in the week ending May 17 said they were very worried about getting the virus, while 17% were very worried about severe financial hardship. (The majority of those who are concerned say they are "somewhat" worried). The trends show little change in the "very worried" percentages over time.

These two categories of worries are not evenly distributed throughout the population.

- Only about a third (34%) of Americans are worried about both getting the virus and severe financial hardship.

- At the other end of the spectrum, 30% are not worried about either eventuality.

- The remainder of Americans are worried about one or the other -- 17% worried about the virus but not concerned about financial hardship, and 19% worried about financial hardship but not the virus.

As would be expected, given the high degree of partisanship in Americans' virus-related views, there are substantial differences in these "worry" measures between Democrats and Republicans.

Eight in ten Democrats are worried about at least one of the two issues, and about half are worried about both. By contrast, a much smaller 55% of Republicans are worried about at least one of the two issues, and only 15% of Republicans are worried about both. Democrats who worry about only one issue tilt toward worrying about getting the virus. Republicans who worry about only one issue tilt toward worrying about financial hardship.

Concern About National Economy Higher Than Concern About Personal Finances

We have ample evidence from decades of survey research that Americans have a predictable tendency to be more negative about elements of life at the national level than at the local level, including such things as crime, schools, Congress and the media. This phenomenon certainly appears to apply in the current situation. Americans' assessments of the national economy appear significantly more dire than when they assess their personal financial situations.

In April, 优蜜传媒updated questions asking Americans to rate the U.S. economy and to rate their personal financial situations. Both questions used the same scale. Ratings of the overall economy are dismal, having fallen as low as they have been since the Great Recession. Specifically, 27% of Americans in April rated the U.S. economy as excellent or good, 34% said it was only fair and 39% said it was "poor." When asked about their personal financial situation, the results were also down, but remained significantly more positive -- 49% of Americans rated their economic situation as excellent or good, and only 15% said it was poor (with 36% saying it was only fair).

Similarly, 74% said that the U.S. economy was getting worse, contrasted with 50% who said their personal financial situation was getting worse. (Gallup's May update of this measure shows a slight drop in the percentage of Americans saying the U.S. economy is getting worse; we did not update the personal finance measures in May).

Pew Research recently reported similar evidence that Americans are more worried about the impact of the virus on the national economy than on their personal situations. Their results show , while less than half -- 41% -- say that the outbreak is a major threat to their personal financial situation.

There are numerous other measures showing just how parlous Americans judge the national economy to be.

- Similar to Gallup's Economic Confidence Index noted above, the has shown the largest drop in that index's history. The . (Both have leveled off more recently).

- Three-quarters of Americans now say the nation is in either a recession or a depression, the highest such percentage since 优蜜传媒began tracking this measure in late March.

- A long-standing 优蜜传媒trend question finds that 22% of Americans say it is a good time to find a quality job, down from as high as 67% three months ago.

- Well over half of Americans in 优蜜传媒polling say it may be a year or more before the economy recovers, and a CNN poll a drop in Americans' confidence that the economic problems are only temporary.

- Both Gallup and data show that Americans increasingly report a drop in consumer spending, which obviously hurts the national economy. The percentage (in 优蜜传媒data) who say they are spending less is on par with measurements from 2009-2010.

Available survey data measuring Americans' personal financial situations appear to be significantly less dire than data measuring views of the national economy. Although, with the exception of the 优蜜传媒and Pew data referenced previously, we don't have a lot of directly comparable data, national to local. Additionally, interpreting data on personal finances is often a case of looking at the glass as half empty or half full. Nevertheless, Americans' views of their personal financial situations do not appear to be catastrophic in my assessment; most measures show well less than half of Americans have significant financial concerns.

- Relatively few Americans say they are having to draw on savings or going into debt, and this hasn't changed since 优蜜传媒began tracking this measure in early April. Over six in 10 say they are saving at least a little.

- Over half of Americans in 优蜜传媒data (57%) say they can continue practicing social distancing and school and business closures as long as necessary without suffering financial hardship. Only 11% say they are currently experiencing financial hardship.

- In April, there was no meaningful change in the percentage of Americans who said they had enough money to live comfortably. There was no change in the percentage of non-retired Americans who said that they would have enough monthly in retirement to live comfortably.

- Pew Research shows that is down to 41% from 49% in late March.

- CNN reports that about while another 33% say it has caused moderate hardship ("that affects you somewhat but does not jeopardize your current standard of living"). Slightly more than half say they have experienced no financial hardship at all.

- The finds that 39% of Americans report that their household financial situation worse than last year.

Bottom Line

What do these results tell us? The main takeaway: we don't find significant negative impact of the coronavirus situation on Americans' personal financial situations, and there are few signs it has been getting worse over the past two months. There is, by contrast, significantly more negativity when Americans are asked to rate the U.S. economy in general, representing the predictable phenomenon of things looking worse the farther from home they get.

There is no precise framework of expectations to use in gauging how much personal financial hardship the American public should be reporting at this point in the evolution of the coronavirus situation. As a result, and as noted above, the interpretation of the data we have is a matter of framing the results against vague standards.

The basic facts do show clear evidence that some small, but not insignificant, portion of the population is experiencing acute financial hardship, including, for example, the 17% who say they are very worried about severe financial hardship, and the 11% who say they are currently experiencing financial hardship. The finding that 50% of Americans say their personal financial situation is getting worse shows a recognition of potential financial impact, although we don't know to what degree that "worse" situation is.

At the same time, these percentages are not extremely high on an absolute basis, and where comparisons are available, not nearly as high as attitudes about the national economic picture. This could reflect a number of factors. Even with a relatively high unemployment rate, the vast majority of Americans who want work are working, and checks sent to many Americans as a result of the government stimulus plan may be ameliorating some of the financial angst so far. Also, although the cutback in spending evident in our data is harmful for the economy overall, it may be helping Americans keep their finances more in balance.

The fact that worry about financial hardship is as high as worry about getting the virus is important from a political-policy standpoint. Elected officials, particularly state governors, are having to balance both concerns as they begin to loosen social isolation mandates and reopen businesses.

Line graph. Americans' worries about financial hardship due to COVID-19 and their concern about contracting the disease. In Gallup's May 11-17 survey, 51% of Americans said they were very or somewhat worried about catching the disease, and 53% reported they were very or somewhat worried about experiencing severe financial hardship due to COVID-19.