Social Security is a mainstay of older Americans' financial wherewithal, and -- long considered the "third rail" of American politics -- a system Americans greatly value even as it faces an uncertain future.

The actuarial key to the Social Security program is maintaining a positive balance between those who are working and sending money into the system, and those who are retired and drawing money out of the system. Demographics are now working against this process. The huge baby boom generation is reaching retirement age (many are already there), older people are living longer, and there are fewer younger people entering the workforce to pay into the system. Excess monies have been placed into a trust fund over the years, and the system will have to begin dipping into these funds within a year or two. are that by 2035, the trust fund will be exhausted, and benefits will need to be cut if other action is not taken. As : "A slow-moving crisis is approaching for Social Security, threatening to undermine a central pillar in the retirement of tens of millions of Americans."

The key here is "slow-moving" since this is one of those public policy areas where the problem is evident far in advance, even though its effects are not being felt in the short term. This provides ample opportunity for elected representatives to punt the crisis down the field, given the political reality that short-term impacts usually have much more powerful control over behavior than long-term consequences.

As my colleague Megan Brenan has recently reviewed, ���۴�ýresearch shows that older Americans are extraordinarily dependent on Social Security. Some 57% of retirees indicated in our April survey this year that Social Security is a "major" source of income in their retirement, eclipsing by far the second and third sources -- retirement accounts such as 401(k)s and IRAs, and work-sponsored pension plans.

The dominance of Social Security as retirees' most important source of income has been consistent since ���۴�ýfirst began asking about it in 2002. At that point, 58% of retirees said Social Security was a major source of income, essentially the same as today. In each of the past 17 years, Social Security has topped the list of major sources of income for retirees.

An important element of Social Security is its disproportionate impact on retirees with lower incomes. Essentially, the lower the overall income a retiree reports, the more important Social Security is as a component of that income. An analysis of an aggregate of ���۴�ýdata over the past 10 years shows that 78% of retirees making less than $30,000 in annual household income say Social Security is a major source of their retirement funds, along with 65% of those making $30,000 to less than $50,000. For these people, apparently, Social Security is the bulk of their retirement.

Even among retirees making $50,000 to less than $75,000 a year, about half (49%) report Social Security as a major source of income.

(Social Security is much less likely to be a major source of income among retirees making $75,000 a year and more, but this lucky group is only about 22% of all retirees. Older people with higher incomes by definition depend on other sources of income, I should note, since the maximum Social Security can pay to any one recipient is $3,770 a month, or about $45,000 a year -- and that's for the unusual person who had consistent high incomes during their working years and waited to retire until 70.)

Taken as a whole, Americans consistently say that they want Social Security benefits retained with no cuts, confirming why Social Security is called the third rail of politics -- the public simply does not want it touched. This result shows up in essentially every Social Security-related poll I have reviewed.

that "74 percent of Americans say Social Security benefits should not be reduced in any way," and previous Pew found that only 6% favored cutting government spending on Social Security. A last year found that six in 10 Americans would prefer to reverse the 2017 tax bill rather than cut entitlement programs like Social Security if necessary to reduce the deficit. ���۴�ýpolling historically has found that Americans would rather raise Social Security taxes than reduce benefits. A 2014 conducted for the National Academy of Social Insurance found "77% of respondents … agree it is critical to preserve Social Security benefits for future generations, even if it means increasing Social Security taxes paid by working Americans."

While they greatly value Social Security, Americans are certainly aware that the Social Security system's future is parlous.

An AP-NORC poll this year found that only 24% of Americans were confident that the Social Security system would be able to pay out at least the same benefits in five years that it is paying out now, while 39% said they were not confident this would happen. A Quinnipiac poll earlier this year showed that less than half of Americans, 45%, thought that the Social Security system would be able to pay "a benefit" when they were eligible to receive it ("a" benefit could in theory be as low as a dollar a month, of course). A Pew Research poll last December showed that 16% of Americans thought there would be enough money to provide benefits to older Americans when they were ready to retire, another 42% said there would have to be reduced benefits, and 42% said there would not be enough money in the system for them when they retired.

���۴�ýresearch from 2015 found that 51% of nonretired Americans thought they would not receive a Social Security benefit when they retired. Well over six in 10 of those under 50 thought that they would not be able to receive a benefit. This is not new. Some 36 years ago, a ���۴�ýanalysis reported that "63% of employed Americans were afraid they might not receive benefits at all when they reached retirement age, while another 16% believed benefits might not be as good as they are now."

Americans' concern about Social Security in the future is also evident from Gallup's yearly April survey asking nonretirees to project how important a source of retirement income Social Security will be when they retire. As our recent report shows, only 33% of nonretirees in 2019 think that Social Security will be a major source of income when they retire, well below the 47% who say that personally directed retirement savings accounts will be a major source for them.

Gallup's prior research has also shown that nonretirees closest to retirement age are the most likely to say Social Security will be a major source of retirement income, while younger people are much less confident in the system. But even among nonretirees aged 50 to 64, the view of Social Security as a major source of retirement income is a relatively low 41% (based on an analysis of aggregate data from the past five years.) Among those younger than 50, fewer than three in 10 count on Social Security as a major source of retirement income.

What Can or Should Be Done?

As I noted earlier, it is evident that elected representatives in Washington have been and remain quite willing to avoid dealing with Social Security in the short term, a perhaps not surprising result of a self-preservation instinct stemming from the fact that the looming Social Security crisis will not hit before any current official comes up for re-election.

At the same time, Social Security is hardly a top-of-mind concern for the average American, either. The crisis in Social Security is not imminent, checks are still arriving, and less than one-half of 1% of Americans mention Social Security when we ask the public, month after month, to name the most important problem facing the nation.

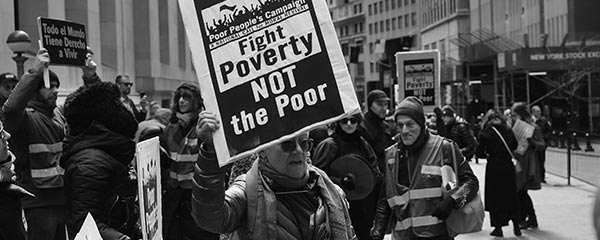

The results are different, however, when the public is asked about Social Security directly. Earlier this year, Social Security ranked fourth in importance to Americans out of a list of 12 possible priorities for the president and Congress to deal with, behind only education, healthcare and the economy. This put it ahead of other issues dominating the political discourse today, including immigration, climate change and income inequality.

Broadly speaking, of course, there are many possible ways to change the Social Security system that would help keep it going in the decades ahead. These include tweaking the amount of money paid into the system by workers, adjusting the ages at which people are eligible to receive Social Security, changing how much money people get, changing eligibility for Social Security for those with higher incomes in retirement, and multiple other possible alterations.

Over the years, various research endeavors have asked Americans about possible changes. This research has shown in general that Americans have a preference for increasing taxes rather than lowering benefits. Older ���۴�ýpoll research found that a majority of Americans agreed with only two potential changes out of the list tested -- limiting benefits for wealthy retirees and requiring higher-income workers to pay more into Social Security. A done for the National Academy of Social Insurance also showed support for raising the income cutoff point where workers no longer pay into the system. Some of Social Security research has been quite complex, offering tradeoffs and other devices to isolate support for alternatives. Other questions in the last decade asked about .

Overall, however, it's probably too early to assess the American people's acceptance of the long list of potential tweaks to the Social Security system, in part because there has been little widespread agreement and discussion among public officials on specific proposals.

So far in this 2020 presidential election cycle, we haven't heard much about Social Security, as Democratic candidates appear to be more focused on healthcare, income inequality and climate change. Addressing Social Security's problems has also not been an apparent priority for the Trump administration, and one finds scant mention of Social Security on Donald Trump's 2020 re-election .

The retired population in America greatly depends on Social Security as a major part of their income. Most Americans value Social Security, and most want Social Security benefits to be retained. How this latter objective is going to be achieved when the Social Security trust fund begins to run dry in about 15 years' time remains one of the nation's major policy challenges.