When bank failures battered the economies of Eastern Europe in the 1990s, wild inflation and vanished savings shook the public's faith in the financial system. These concerns only deepened with the recent global economic crisis, which arguably hit Europe and Central Asia (ECA) harder than any other developing region. As the Findex team's new shows, a lack of trust in banks continues to shape the ways people in the region use formal financial services.

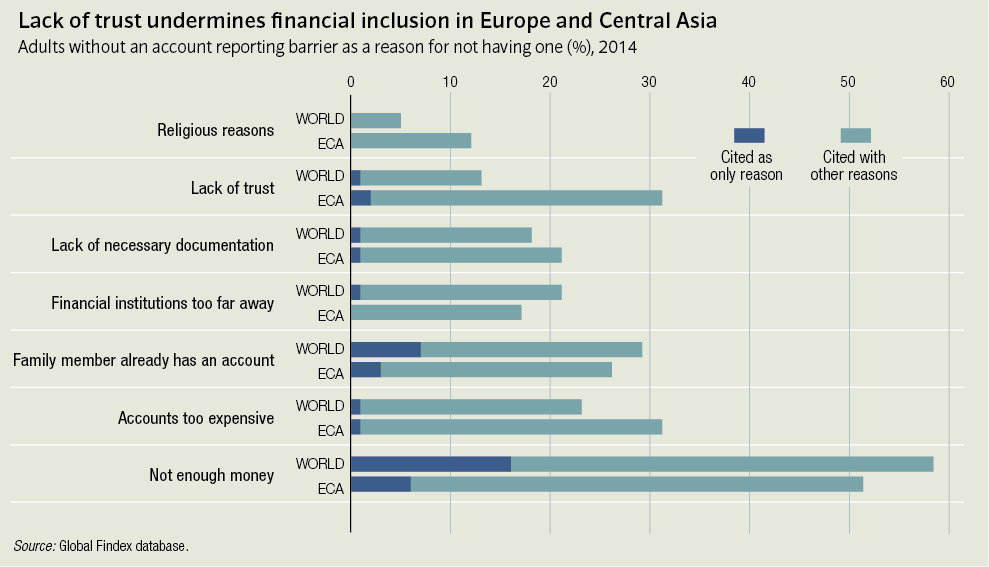

In addition to tracking how adults around the world use financial services such as accounts and payments, the Global Findex database survey explores the obstacles to greater financial inclusion. About 2 billion adults worldwide lack a bank account, and when asked why that is, most of the "unbanked" list two factors. More than half of unbanked adults in ECA and globally say they don't have enough money to use an account, making poverty the most frequently cited reason for being unbanked. However, only 16% of unbanked adults globally and 6% of unbanked adults in ECA cite it as the only reason for not having an account.

One legacy of ECA's financial turmoil is that 30% of unbanked adults -- more than twice the global average -- say they don't trust banks enough to open an account, a number that spikes to 55% in Ukraine. Widespread suspicion of financial institutions also probably helps explain why just 8% of ECA adults save money at a bank, compared with 27% worldwide. And formal savings even lags among those who do use formal financial services. Of adults in ECA who have an account, 15% use formal savings, compared with 42% worldwide.

Despite this, use of financial services is on the rise in ECA. Fifty-one percent of adults in the region have an account at a financial institution or through a mobile money provider, up from 43% in 2011. Some economies -- Romania, Kazakhstan and Albania -- have seen especially big gains, while account ownership stagnated in Hungary, Armenia, Macedonia, Moldova and Turkey.

Inequality persists amid this progress. Less than half (47%) of women in ECA have an account, compared with 56% of men. Although certain economies have achieved relative gender equality in account ownership -- including Belarus, Georgia and Uzbekistan -- the regionwide gender gap is virtually unchanged from 2011. The same is true of the income gap: 44% of adults belonging to the poorest 40% of households in ECA have an account, compared with 56% of those in the richest 60% of households.

If weak trust in financial institutions contributes to lower formal savings and account ownership, it doesn't seem to have much of an effect on digital payments. Seventy-two percent of adults in ECA who have an account make or receive payments through their account; among developing regions, only sub-Saharan Africa has a higher share. Widespread use of card-based payment technologies helps explain this. Fifteen percent of adults in ECA use credit cards, while 23% use debit cards; in the developing world, only Latin America and the Caribbean has comparable figures. Employers are also a major force behind ECA's adoption of digital payments. Of the 37% of adults in the region who work for wages, 60% have their earnings wired into a financial institution account -- the highest share in any developing region.

The Findex team's addresses the opportunities to expand financial inclusion for 105 million of the world's 2 billion unbanked adults living in ECA. This note explains how to expand these opportunities, especially among those who view banks with suspicion. For more information on the Global Findex: .