This post is part of Gallup's ongoing series on the shifting landscape for financial institutions. It provides insights into channel optimization, emerging customer behaviors and preferences, product penetration and relationship growth, engaging the most critical affluent and business customers, and reshaping banks' overall value proposition.

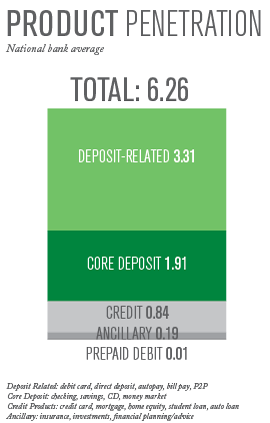

Banks provide an increasing number of financial services outside of traditional deposits and credit, yet many customers do not take full advantage of these services. 优蜜传媒research shows that while the average customer has 6.26 products with their primary bank, only .93 of those products are not deposit or deposit-related services.

Most customers their local branch, which makes local branch staff instrumental in educating customers about the bank's complete offerings. That said, many of a bank's business lines can be highly specialized and complicated, and they require a dedicated team of professionals to properly advise clients. Since the branch manager is typically held accountable for branch sales growth and financial performance, this role has the key responsibility of fostering solid partnerships with other business lines and ensuring the branch can satisfy all of a customer's financial needs. If branch managers can build productive and trusting relationships between branch staff and other line-of-business specialists within the bank, their customers will have access to a broader pool of resources to help them reach their financial goals and improve their financial well-being.

To execute on this strategy, a branch manager must be able to answer three questions related to each business line:

- What products and services are available to customers? Branch managers should research the capabilities of each business line to understand what products and services are available to customers. They should also find out which business line representatives cover the geographic territory surrounding a branch. Much of this research can be accomplished using the bank's intranet, but branch managers should follow up with business line partners to gain more context about their overall capabilities.

- What does the ideal customer for each business line look like? Each bank customer has a unique set of financial assets and needs. Some of their needs require the help of a specialist above what the retail branch staff can directly provide. Branch managers should become familiar with the individual customer needs that best fit each business line to match the customer with the right specialist. Business line specialists can also provide questions for branch managers and their staff to ask of customers and help uncover their needs.

- How can customers benefit from working with the business line? When a customer brings more of their business to a bank, the bank is rewarded with higher revenue and hopefully higher profits. Branch managers should understand what benefits and value a customer gains from expanding their relationship with the bank. Discounts and additional perks are good places to start when researching customer benefits, but other benefits such as better service, increased capabilities and access to more resources are just as valuable.

To actively promote a culture of partnership, branch managers must know the answers to the three questions above, but they must also share what they've learned with their staff and encourage staff to individually reach out to each business line. This proactive outreach can help staff members increase their own knowledge and begin to build relationships that provide tremendous value to branch customers. When possible, business line representatives should be invited to do in-person introductions to the branch staff during daily or weekly team huddles. Business line representatives should also be educated on the capabilities available to customers within the branch. They can confidently refer customers to the branch if they know what solutions are possible.

Branch managers should regularly focus on business line partnerships with the branch so they become part of the sales culture. Managers should hold branch staff accountable by including partnership conversations in regular performance reviews and coaching interactions. It is important to set realistic goals for the type and quality of interactions originated by branch staff and their partners. The initial focus of these goals should be on activities instead of outcomes to establish the right behaviors and allow developing partnerships to become a normal part of the process. As the branch staff becomes more comfortable with partnerships, managers can look for opportunities to coach them on increasing the quality and effectiveness of customer interactions that have the potential for partnerships.

Business lines outside of the retail bank branch are more likely to gain customer referrals when they can build solid partnerships with branch staff. Branch teams interact with more customers on a daily basis than other business lines. Branch staff can also gain referrals from different business lines because their customers have financial needs that can be solved with the capabilities of the branch. Strong partnerships within the bank bring a broader offering of capabilities to each customer and increased revenue possibilities for the bank. Understanding how to satisfy all of those needs is a key to success.