Story Highlights

- Many consumers say their trust has declined a little or a lot

- Patterns of consumer trust vary by industry

- Trust isn't just about age; companies must manage it well

The bad news just keeps coming. Like a steady drip, announcements of the latest data security breaches seem to happen on a monthly -- if not weekly -- basis.

Two recent high-profile security breaches have called attention to this issue: Health insurer Anthem's breach jeopardized the personal records of an estimated 78.8 million people, and the well-publicized hack of Sony Pictures leaked numerous confidential documents, including embarrassing email exchanges among the company's executives. Cyberattacks are occurring with alarming frequency in organizations large and small.

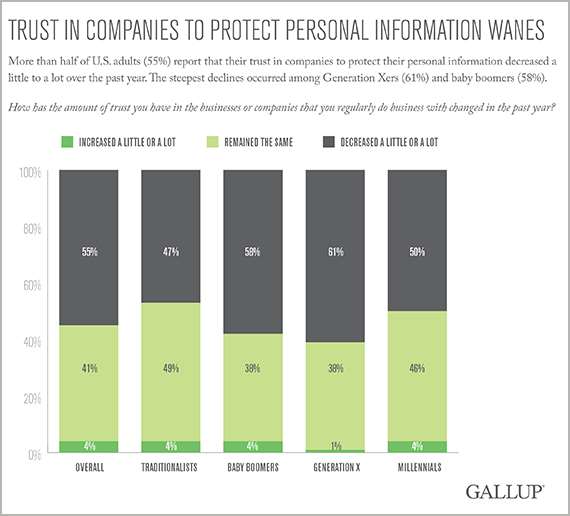

Considering these and other security breaches, it's not surprising that American consumers' trust in companies to protect their personal information is shaken. Overall, only about two in 10 Americans say they have a lot of trust in the companies they regularly do business with to keep their personal information secure. And more than half of U.S. adults report that their trust decreased a little or a lot (55%) over the past year.

But a deeper analysis of the data shows that when it comes to keeping their personal information secure, consumers have much more trust in certain businesses than others -- and that trust also varies by generation. Businesses that can effectively manage consumer perceptions of trustworthiness stand to gain an advantage over their competitors.

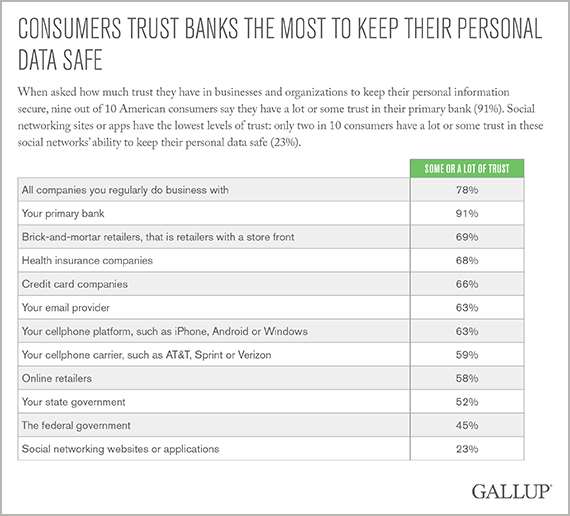

Consumers Trust Banks the Most, Social Networks or Apps Least

When it comes to keeping their personal information secure, consumers have much more trust in certain businesses than they do others. About nine in 10 consumers (91%) have a lot or some trust in their primary bank in keeping their personal data safe. Trust in bricks-and-mortar retailers (69%), health insurance companies (68%) and credit card companies (66%) lag behind banks considerably, as does trust in email providers and cellphone platforms (63%).

Consumers also have lower trust in their state government (52%) and the federal government (45%) in keeping their personal information secure. And they place the least amount of trust in social networking sites and applications, with only about two in 10 (23%) having a lot or some trust that these sites and apps will keep their personal data safe.

Trust Decreased a Little to a Lot

When 优蜜传媒asked U.S. adults how their amount of trust in companies that they regularly do business with had changed in the past year, more than half of U.S. adults (55%) report that their trust in companies to protect their personal information decreased a little to a lot.

But this slide in the amount of trust varies by generation. About six in 10 (61%) of Generation Xers (born 1965 to 1979) and 58% of Baby Boomers (born 1946 to 1964) say their trust decreased a little to a lot. The oldest generation (Traditionalists, born 1945 or earlier) and the youngest (Millennials, born 1980 to 1996) were somewhat less likely to say this: 50% of Millennials and 47% of Traditionalists say their trust has decreased a little to a lot.

Further, Baby Boomers and Generation Xers are least likely to say that, overall, they put some or a lot of trust in the companies they regularly do business with to keep their personal data secure.

Consumer Trust To Keep Information Secure Varies by Industry

Clearly, one's generation plays an important, if not complicated, role in consumers' trust -- but it's not the only factor. When analyzing survey results by industry, all four generations trust their primary banking institution the most to protect the security of their personal information. On the other end of the scale, all four generations trust online retailers and social networking websites or applications the least.

In other industries, however, there are meaningful differences in trust levels among generations. The largest differences in trust levels among generations emerge for federal and state governments, where Millennials have the highest amount of trust. About half of Millennials have some or a lot of trust in the federal government (51%), compared with less than four in 10 traditionalists (38%) who say the same, the lowest level among the generations. When it comes to trust in state government, trust is a bit higher: 61% of Millennials have some or a lot of trust, compared with 48% of Generation Xers who say the same, the lowest level among the generations.

Considerable Room for Improvement

In some cases, one's generation might relate to consumer trust. For example, older Americans might have had more opportunities in their lifetimes to hear about or experience a data breach themselves -- such as personal information being stolen or being sold without permission. On the other hand, younger Americans are technology natives who grew up with the Internet and social media, which may have made them accustomed to not expecting their personal information to stay secure.

But if one's generation alone was the main factor affecting American consumers' trust, analysis would have uncovered meaningful differences in trust levels across all industries. Instead, Gallup's findings suggest that consumer trust is less affected by generational differences than by consumers' experiences with the demonstrated performance of specific industries.

Some industries, such as banking, consistently manage consumer trust well across all generations. Others, such as social networking sites, consistently manage trust poorly across all generations. Still others, such as state and federal governments, see substantial inconsistencies in trust across the generations.

Clearly, many organizations have considerable room to improve perceptions of trustworthiness. The first step to improving trust among consumers is to conduct comprehensive diagnostic work to discover where an organization's "trust disconnects" occur. Managing the consistency of consumers' perception of trustworthiness across an organization offers a potential advantage over competitors. Social networking websites and applications likely have a long journey ahead of them to gain trust from consumers, both young and old.

Survey Methods

Results are based on a 优蜜传媒Panel Web study completed by 11,043 national adults, aged 18 and older, conducted Nov. 20-Dec. 1, 2014. The 优蜜传媒Panel is a probability-based longitudinal panel of U.S. adults who 优蜜传媒selects using random-digit-dial phone interviews that cover landline and cellphones. 优蜜传媒also uses address-based sampling methods to recruit Panel members. The 优蜜传媒Panel is not an opt-in panel and panel members do not receive incentives for participating. For results based on this sample, one can say that the maximum margin of sampling error is 卤1 percentage point, at the 95% confidence level. Margins of error are higher for subsamples. In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

Learn more about how the works.