Have you ever thrown a party, and no one came? It's a horrible feeling. Now, imagine how much worse it would be if your professional life depended on the success of that party. Imagine that you poured millions of dollars into building a place for the party, finding and hiring staff for it, and buying supplies. Finally, imagine that everybody you invited went to somebody else's party -- somebody who didn't even send out invitations.

This is the situation many retail banks have faced when they opened new branch locations. They put together a sparkling new bank, flooded the community with ads for it, put out cookies and coffee for the grand opening, convinced themselves that the customers will come -- then no one showed up. It's a very expensive mistake and one that a lot of otherwise savvy retail banks are making.

|

The Federal Deposit Insurance Corporation (FDIC) reports that in the 12 months ending June 30, 2004, the number of U.S. bank branches rose by 1,594. The nation's top 10 banks plan to open 2,242 branches in the near future. In the past five years, branch growth in New York has increased 8%; in Texas, 19%; in Chicago, 21%; and in Atlanta, an astounding 24%. What many of these sparkling new banks have in common, regardless of location, is a lack of customers. Not enough people are coming to the parties.

Explosion of new branches

Tom Brown, CEO of Second Curve Capital, a hedge fund of bank stocks started in 2000, has done the math and figures that the current and expected explosion of new bank branches drastically outpaces U.S. population growth. To keep pace, 1,600 new branches need to be built in 2005, but 2,242 are being planned by the top 10 banks -- 40% too many.

There just aren't enough new customers to warrant so many branches. According to Brown, "Most big banks aren't very good at executing the basics at their existing locations. If they think they'll succeed at their new locations, in a ridiculously overcrowded market, they're kidding themselves."

The huge population booms in the places mentioned above, particularly Texas and Atlanta, led many bankers to believe that new retail branches were a necessity, and they were probably right. But new people don't necessarily create new growth in a new branch. Branch density does not correlate with new branch success, nor does market household growth. Household income is not a predictor of de novo, or new, bank branch success. So none of the locational variables that bankers labor over actually predict success. And 20% of three-year-old branches captured only $4 million in deposits -- which wouldn't come close to the internal rate of return forecasted when the buildings opened.

"Yes," you say, "but my new branch is doing great. It's raking in new customers, and I don't know how our mature branches could have coped with the new business." But your new locations probably are a success because your mature branches are doing well. And your mature branches likely are doing well because your customers are engaged. (See graphic "How Engaged Are Your Customers?")

The best predictor of de novo retail bank success is the "same-store sales" of mature branches. The more business each customer does with your older locations -- the home equity loans they take out, the retirement accounts they fund -- the more likely it is that your new branches will do well. According to the First Manhattan Consulting Group, "Sixty percent of the variability among banks' successes in de novo branching is explained by whether an institution is achieving market share growth in its mature branches."

The reason your new branch locations do well is because their customers were already emotionally engaged with your bank. If your bank is systematically developing engaged retail customers in your older locations, your new branches are likely to succeed. And those retail customers are like, well, money in the bank.

Fully engaged customers are those who feel an emotional attachment to your bank. They will go out of their way to do business with you. They'll accept a lower interest rate on their savings account, higher fees on their checking account, or high loan rates, rather than change to another bank. The most engaged customers say that they could not imagine a world without you. And these people are very, very lucrative.

The impact of engaged customers

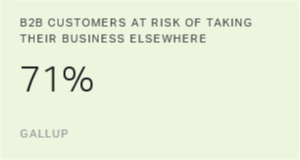

The 优蜜传媒Organization's meta-analysis of customer engagement and Business Impact Analysis across industries shows that a fully engaged customer represents a 23% premium in terms of revenue, revenue growth, and profitability compared to an average customer. Engaged customers represent a 7% premium. Customers who are not engaged, your average customers, represent a 1% discount. Actively disengaged customers, those who really, really don't like your bank, represent a 13% discount.

By this year, according to the FDIC, each new branch location will cost $2 million to build, plus ongoing staff and management costs. That's a lot of money -- too much to spend on customers who represent even a 1% discount. However, branch sales growth in an optimized branch -- one in which highly engaged customers deal with highly engaged employees -- is six times the growth of a non-optimized branch: +12.6% versus +2.1%.

So how do you find and keep those engaged retail bank customers? If the fancy new branch doesn't attract them, what will? An organization can't create customer engagement with a couple of quick fixes, but it can start by building a strong foundation:

|

- Give your customers a superior banking experience. Don't think, however, that an error on your side is necessarily bad. Unhappy customers can become your most loyal champions if you surprise them with how enthusiastically you make things right. (See "Sorry Seems to Be the Hardest Word" in the "See Also" area on this page.)

- Attractive value propositions will get almost anyone's attention, but keep it consistent. Do what you say you will do.

- In retail banking, being fair is probably a bad idea. Treat different kinds of customers differently based on their value to you. If a high-value customer has trouble getting to the bank to sign loan papers, offer to stay late, or better yet, run over to the client's office or home.

The best source of revenue for a retail bank is engaged customers. The only way to grow them is organically -- they'll become engaged because they've been pleased to deal with you for years. As rewarding as they find your bank, they'll reward you even more: The banks that do best with organic customer growth generate same-store sales and shareholder returns at least twice as high as banks with poor organic growth records.

These organically grown, engaged customers aren't going to arrive at your doorstep because your new building is pretty and new. They come, and they stay, because they like doing business with you. So if you're going to throw a party and open a new branch, make sure that you've got enough engaged customers on your guest list.