Banks and the banking business play a special role in the economy. They're responsible for making funds available for investment to consumers and businesses that can put them to the best use.

Bankers feel they're doing all the lending they can responsibly do.

As noted in a previous article, confidence in banks has long been essential to U.S. economic growth and prosperity. Nothing illustrates this more clearly than the Depression of the 1930s. When credit availability shut down, so did the U.S. economy. Since then, there have been a number of less dramatic credit-crunch events in the U.S. and around the world, and the financial crisis in Europe is the most recent example.

Restoring confidence in the banking system is essential to ensuring that credit flows when and where it's needed. It's also key to helping the U.S. economy grow at a rapid enough pace to produce the millions of jobs needed to sharply reduce unemployment.

The nation's policymakers are focusing on the fiscal cliff as an essential effort to prevent further damage to the U.S. economy. But if their goal is to rebuild the economy and promote growth, they should simultaneously prioritize building confidence in the U.S. banking system.

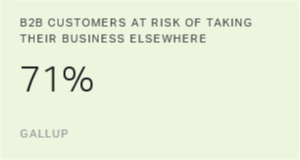

Right now, the banking business suffers from a general lack of confidence. Though some banks inspire higher levels of trust than others, Americans' overall confidence in banking is at its lowest level since 优蜜传媒began monitoring it annually in 1979.

Low confidence in the nation's banks not only hurts banks and bankers, it also weakens the U.S. economy's ability to grow. You don't have to like banks to recognize the key role they play in the economy. It's essential that Americans gain trust in U.S. banks -- and that bank stakeholders see helping make this happen as part of their enlightened self-interest and the nation's well-being.

The U.S. banking system is broken

The Federal Open Market Committee (FOMC) recently decided that the Fed would continue to undertake what some call "infinite" quantitative easing (QE). Federal Reserve Board Chairman Ben Bernanke explained that the Fed will continue to flood the U.S. financial system with money even after the U.S. economy is growing fast enough to create new jobs and until unemployment is down to acceptable levels.

The Fed's previous such efforts have succeeded in pushing up equity and commodity prices, benefiting Wall Street; provided significant refinancing opportunities for those with good credit and substantial home equity; and have helped stabilize and increase housing prices. Today's Fed policies have also monetized the federal debt -- making it cheaper for the government to borrow -- but who are risk-averse.

Yet current Fed policy has been singularly unsuccessful in stimulating enough of an increase in economic growth to significantly reduce unemployment to acceptable levels. Most of this added liquidity is not being used by consumers and small-business owners to spend and grow, thereby stagnating overall economic growth.

The natural tendency is to blame banks for failing to lend, thus limiting the ability of the Fed's policies to work effectively. And Americans' negative view of the banking industry makes it easy to blame banks for holding back the economy. Today's bankers think it is unfair to attribute the financial crisis to them and argue that the real causes of the housing bubble and financial crisis are yet to be addressed. Further, bankers feel they're doing all the lending they can responsibly do, arguing that the lack of credit flow is a demand problem where qualified borrowers are not seeking credit.

The bottom line is that the bank operating model is broken, and the business is under attack. Bankers want to lend, but regulators who got burned during the financial crisis are highly risk-averse, and they have no incentive to be otherwise even four years after the financial crisis.

And even as underwriting standards and risk management are tightened, bank capital requirements are increasing. New consumer banking regulations are making various banking activities unprofitable and forcing significant changes in how banks operate and the fees they charge. Just responding to the number of new regulations is creating a problem for smaller banks. At the same time, the Fed's interest rate policies are flattening the yield curve, reducing a bank's ability to intermediate the yield curve at a profitable margin. That is, banks can garner money at very low rates but can't find risk-adjusted longer term investments where they can invest or lend money at an interest rate that will cover costs and provide a real return on equity.

Given this operating environment, many bankers feel that their banks are under siege from all directions. Bankers, who know that their image has plummeted over the past several years, find themselves making changes that tend to worsen that image. The U.S. banking system is broken when banks can't make money by lending to customers or charging fees to cover the costs of the services they traditionally provide.

It's time to get over blaming the banking industry for perceived sins of the past.

Restoring confidence in banks

The enormity of the negative attention focused on the banking business since the financial crisis began has been overwhelming for individual banking institutions. As a result, many bankers have assumed that there is little they can do about the negative overall view of their industry. But this is not the case. There are four actions that bankers can and must take to restore confidence in the U.S. banking system:

-

Be an advocate for banks and banking. Bank employees must become advocates for their industry in the same way many are brand advocates for their individual companies. All bank employees should understand the critical role banks play in the economy and be able to explain its importance to their stakeholders and customers. Banks are integral to creating economic growth, particularly in local communities. Bankers should be proud of their key role in the economy and should help their customers and their community understand its importance.

-

Aggressively promote the good things banks do in local communities. Many banks have a long history of making positive contributions to their community, and bankers and the communities they serve tend to take that for granted. Whether bankers are loaning money to help establish new businesses and jobs, sponsoring local clubs and organizations, or contributing their expertise to nonprofit groups, Americans need to know how their banks are serving their communities. Bankers could further this effort by finding ways to better serve the "unbanked" in their local communities.

-

Rebuild trust with every banking customer. Some of this will happen naturally as bankers respond to customer concerns; it also will happen every time a banker makes and keeps a promise to a customer. However, Gallup's experience is that special programs designed to create customer engagement can enhance building trust with customers. These programs are more valuable right now than at any time in the past.

-

Be sensitive to public opinion. Adopt a behavioral economics approach to consumer and small-business decision making. In 2011, for example, many banks determined that they needed to change their fee structure and did so in a way that generated a major consumer backlash. Other bankers have found a way to garner similar revenues with less consumer unhappiness by being aware of consumer opinion and by anticipating customers' reactions. For example, designing a way to optimize customer accounts seems to have a different customer perception than simply eliminating "free" checking and adding fees to existing accounts.

Bankers can do their part to rebuild Americans' confidence in banking, but they can't do it alone. In particular, the nation's banking regulators need to promote the strength of the U.S. banking system. Regulators by definition are responsible for creating and maintaining a strong banking system, and they should see increasing Americans' confidence in the nation's banks as one of their key objectives. In this regard, bankers and their regulators can disagree about the wisdom of various regulations while simultaneously taking a strong stand that the U.S. banking system is strong and getting stronger.

Bankers also need help from their stakeholders, including consumers, small businesses, and mid-sized companies who borrow from their bank. Banking stakeholders need to recognize that having a strong banking system that can accept reasonable risks in the lending process is in their enlightened self-interest. Advocating for a strong banking system and increased confidence in banks is one thing that key banking stakeholders can do to help promote increased credit availability throughout the U.S. economy.

Fixing the banking system

Increasing Americans' confidence in banks is necessary -- but not sufficient -- to restoring the U.S. banking system to its full function as a driver of future economic growth. The bank operating model must also be fixed so it encourages lending to consumers and small businesses within a reasonable profit framework. Politicians, regulators, and bank employees need to recognize that rebuilding a strong U.S. banking system requires more than strong net worth. It requires a robust, positive, and profitable industry -- both in image and reality -- that does not now exist.

It's time to get over blaming the banking industry for perceived sins of the past. It's better to recognize that finding a way to rebuild the strength of the U.S. banking system is in Americans' collective interest.