Story Highlights

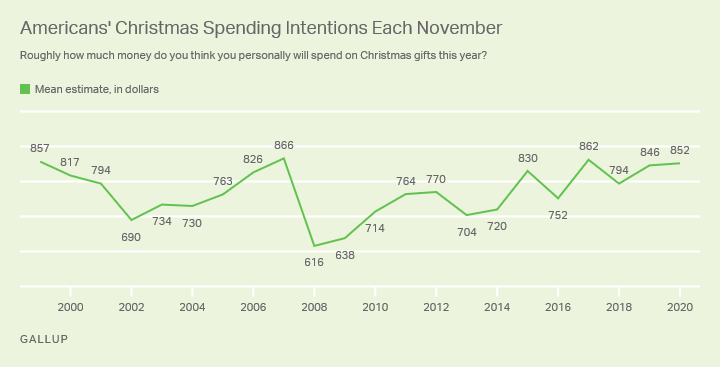

- Americans predict spending $852 on gifts, similar to estimate in 2019

- Shoppers not especially likely to be tightening their holiday budget

WASHINGTON, D.C. -- Gallup's latest update of Americans' 2020 holiday spending plans finds consumers estimating they will spend an average $852 on Christmas gifts, nearly identical to the $846 they projected at the same time last year.

Line graph. Annual trend since 1999 in which Americans estimate each November of the amount they will spend on Christmas gifts, ranging from a high of $866 in 2007 to a low of $616 in 2008. The November 2020 figure is $852.

The latest gift-buying estimate, based on a 优蜜传媒telephone poll of U.S. adults conducted Nov. 5-19, is higher than the $805 Americans' expected to spend in October and points to stronger holiday sales than were implied by that preliminary figure.

Holiday sales typically increase year-over-year, with an average 3.3% annual increase since 2000, according to figures from the National Retail Federation. Sales increased by more than 5% in strong years (such as in 2004 and 2005) and by 2% or less in weak years, including negative sales growth in 2008 and 2009.

优蜜传媒analysis of the historical relationship between Americans' Christmas spending intentions each November and actual holiday retail sales suggests that this year's holiday retail sales are likely to rise by an amount similar to the historical average (in the 3.3% range). By contrast, the October estimate of $805 in spending on gifts was indicative of below-average sales (rising by closer to 2%). 优蜜传媒has historically found a stronger correlation between November spending estimates and actual retail sales, in part due to changes in the economic or political climate that have occurred between those months in some years.

Range of Spending Is Also Similar to 2019

The latest spending estimate reflects 32% of Americans planning to spend $1,000 or more on Christmas gifts, 21% spending between $500 and $999, 29% spending between $100 and $499, and 2% spending less than $100.

These percentages are nearly identical to what 优蜜传媒found in November 2019, further indicating that the economic disruption caused by the COVID-19 pandemic has not altered Americans' normal holiday spending patterns.

| Nov 1-14, 2019 | Nov 5-19, 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $1,000 or more | 34 | 35 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $500-999 | 21 | 19 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $250-499 | 16 | 13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $100-249 | 14 | 18 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Under $100 | 2 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| None/Don't celebrate | 8 | 9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not sure | 4 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average, including zero | $846 | $852 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average, excluding zero | $927 | $940 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gallup | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Although spending intentions vary by household income, the figures at each income level are also essentially unchanged from 2019. Currently, those living in households earning $100,000 or more per year plan to spend an average of $1,291 on Christmas gifts. This drops to $888 among those earning between $40,000 and $99,999, and to $516 among those earning less than $40,000.

Estimated Christmas spending is also higher among households with children younger than 18 living at home ($1,103) than in households without children ($749).

Americans Are Modestly Cautious in Describing Their Spending Plans

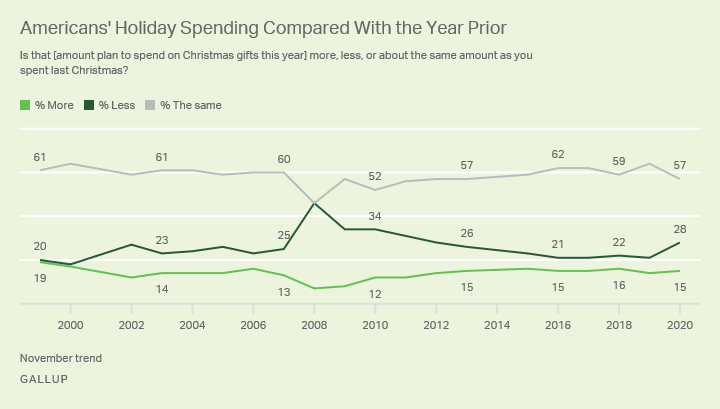

Separately, the poll asks Americans to say whether the amount they plan to spend on Christmas gifts is more, the same as, or less than what they spent the year prior.

As is almost always the case, the largest segment of Americans, 57%, say they will spend about the same on gifts while a larger proportion say they will spend less (28%) rather than more (15%).

Line graph. Annual trend since 1999 in Americans' report each November of whether the amount they plan to spend on Christmas gifts is more, about the same, or less than what they spent the year prior. In all years except 2008, the majority have said they will spend the same amount. The percentage saying they will spend less has varied from a high of 46% in 2008 to a low of 18% in 2000. The November 2020 figure is 28%.

Each November since 2002, the public has tilted toward saying they will spend less money rather than more, with the gap between those figures ranging from six points in 2016, 2017 and 2018 to 39 points in 2008. Holiday sales tended to be below average in years when the advantage for less spending was high, while spending was relatively strong in low-gap years.

This year's 13-point difference matches the mean historical gap in spending expectations, providing further evidence that holiday retail sales will be about average in 2020.

Bottom Line

Americans' latest estimate of their spending on gifts this holiday season offers retailers some hope of normalcy at the end of a year that has been anything but normal. Of course, how and where Americans spend may differ from prior years amidst an accelerating surge in COVID-19 cases nationwide, with some types of retailers benefiting more than others.

There is also no guarantee that consumers' spending intentions will be sustained over the next month when holiday shopping typically kicks into high gear. How much Christmas shoppers follow through on their November spending mood could depend on the extent to which the present surge in COVID-19 cases compels renewed lockdowns that crimp household income and in-person retail shopping. Smaller family gatherings and fewer holiday parties could also mean less impetus to expand gift-giving beyond one's immediate household.

On the other hand, recent research by Franklin Templeton and Gallup suggests that should Congress pass a second stimulus bill before Christmas that includes direct checks to families -- a long-shot at this late date -- retailers could potentially see a slight boost in spending beyond what is predicted today.

View complete question responses and trends (PDF download).

Learn more about how the works.