Story Highlights

- Investors with financial advisers have more confidence in stock strategy

- Investors with advisers also more optimistic about market performance

- Confident investors also more likely to engage in key consumer behaviors

Editor's Note: The research below was conducted in partnership between Franklin Templeton and Gallup.

WASHINGTON, D.C. -- The coronavirus pandemic has led to volatility and uncertainty in the financial markets, creating an additional concern for Americans who have money invested in the stock market. New results from the Franklin Templeton-优蜜传媒Economics of Recovery Study suggest that amid heightened economic uncertainty, financial advisers play a significant role in helping investors feel they can still manage risks effectively. Investors with financial advisers feel substantially more confident in their investment approach, and they are more likely to have engaged in several activities that have been curtailed by the pandemic, such as flying and staying in hotels.

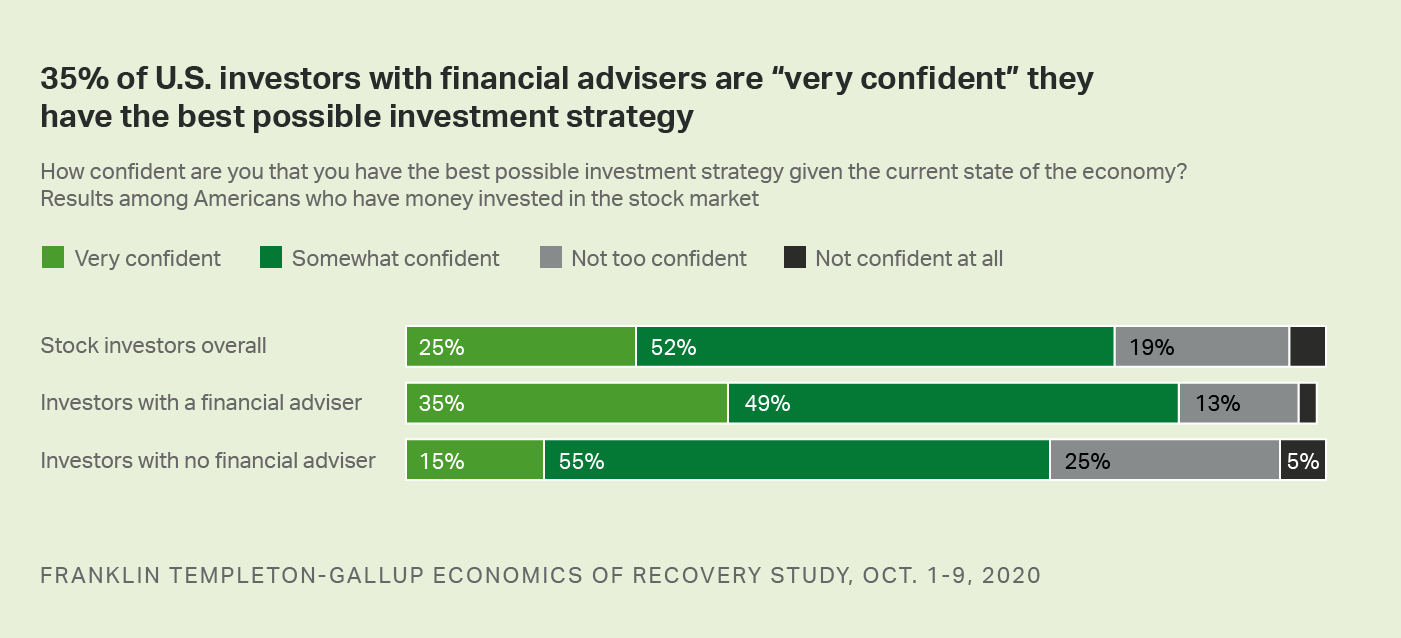

Overall, almost half of stockowners (48%) say they are working with a financial adviser. Those with advisers are more likely than those without advisers to be "very confident" they have the best possible investment strategy -- 35% vs. 15%, respectively. Conversely, those without a financial adviser are twice as likely to say they are "not too confident" or "not confident at all" (30% vs. 15% of those with financial advisers).

Bar graph. American investors' levels of confidence in their investment strategies, based on whether or not they have a financial adviser. 84% of investors with a financial adviser are very or somewhat confident, compared with 70% of those without a financial adviser who say the same.

These results are based on more than 5,002 web-based surveys completed Oct. 1-9 as part of the Franklin Templeton-优蜜传媒Economics of Recovery Study. This study is conducted via an opt-in web panel. The sample has been adjusted statistically to ensure it represents key subgroups in their proper proportions of the U.S. adult population.

In general, investors with higher incomes are more likely to be confident in their investment strategy. However, even withinboth lower and higher income groups, working with a financial adviser is associated with greater economic confidence. Among investors with annual household incomes below $120,000, those with advisers are more than twice as likely as those without to be "very confident" in their investment strategy; the same is true among investors with incomes of $120,000 or more.

| Stock investors overall | Investors with a financial adviser | Investors with no financial adviser | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Household income less than $120K | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Very confident | 23 | 33 | 14 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Somewhat confident | 52 | 51 | 54 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not too confident | 22 | 14 | 27 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not confident at all | 4 | 2 | 5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Household income $120K or more | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Very confident | 32 | 42 | 18 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Somewhat confident | 53 | 46 | 61 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not too confident | 13 | 10 | 16 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not confident at all | 3 | 1 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FRANKLIN TEMPLETON-GALLUP ECONOMICS OF RECOVERY STUDY, Oct. 1-9, 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Investors with financial advisers are also more likely to have an optimistic view of the stock market's performance. Thirty-five percent of investors with an adviser -- versus 22% of those without one -- say the market is "much higher" or "somewhat higher" today than it was before the pandemic began.

Confidence Is Key to Economic Activity and Recovery

COVID-19 has introduced a great deal of uncertainty into Americans' lives, which has its own consequences in terms of reduced spending and decreased economic activity. As in all economic downturns, financial confidence matters a great deal in the current recession.

In the current survey, the connection between financial confidence and public consumption is clear. Those who are very confident in their investment strategy are more likely to have dined indoors at a restaurant in the past 24 hours, and to have reserved a hotel, rented a car or booked a flight for use within 30 days. These differences are present among both lower-income and higher-income investors.

| Household income less than $120K | Household income $120K or more | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | % | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| "Very confident" investors | All other investors | "Very confident" investors | All other investors | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Booked a flight that leaves within 30 days | 33 | 13 | 39 | 13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reserved a hotel for use within 30 days | 36 | 12 | 37 | 15 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rented a car for use within 30 days | 29 | 8 | 33 | 8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dined indoors at a restaurant in past 24 hours | 32 | 15 | 46 | 14 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FRANKLIN TEMPLETON-GALLUP ECONOMICS OF RECOVERY STUDY, Oct. 1-9, 2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Implications

Human decision-making -- including decisions about financial matters -- is about 30% rational and 70% emotional, according to a recent 优蜜传媒review of behavioral economics studies. Given the heightened anxiety generated by the COVID-19 pandemic, financial advisers' expertise and perspective may help investors better navigate the country's uneven and prolonged recovery. The current findings highlight the relationship between advice and investor confidence as financial advisers address clients' concerns.

To receive ongoing updates about findings from the Franklin Templeton-优蜜传媒Economics of Recovery Study, please . To learn more about the study, please .