Story Highlights

- Optimism still well below pre-pandemic levels

- Current situation a concern while future looks brighter

- Owners want candidates to focus on rebuilding the economy

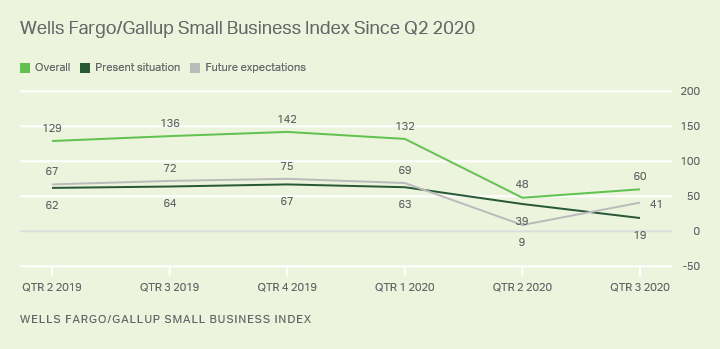

WASHINGTON, D.C. -- The latest results of the Wells Fargo/���۴�ýSmall Business Index Survey indicate that small-business owners continue to face significant financial challenges as a result of the global pandemic. The current index score of 60 is up from April's 48, but the results remain far below pre-pandemic levels which reached as high as 142 in Quarter 4, 2019.

The Wells Fargo/���۴�ýSmall Business Index is a calculation that takes into account the present and future levels of optimism on six key financial dimensions: Overall financial situation, revenue, cash flow, capital spending, hiring and credit.

The current readings reflect significantly different perceptions of what is going on currently, contrasted with expectations for the future. The current conditions component of the Index has declined since April, signifying further concern on the part of small-business owners about what is happening to their businesses now. At the same time, small-business owners are significantly more optimistic about their future situation and have become more positive about the future since April. This is based on small-business owners' opinions that the situation will be getting better on all six of the key components of the Index.

Line graph. The Wells Fargo ���۴�ýSmall Business Index from the second quarter of 2019 until the present. Overall, the index currently stands at 60, with views of the current economy at 19 and the future at 41.

Election Issues Important to Owners

The majority of small-business owners are engaged in the upcoming presidential election with 59% saying that the candidate who wins in November will have a significant impact on their business. Another 24% say the outcome will have a minor impact. At the same time, just about half of small-business owners (48%) report that the candidates are discussing issues most important to them as owners.

| Qtr 3, 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candidates discussing issues important to you as a small-business owner | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yes | 48 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| No | 52 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Impact of election outcome on owners | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Major impact | 59 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Minor impact | 24 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not much impact at all | 17 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| WELLS FARGO SMALL BUSINESS INDEX | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

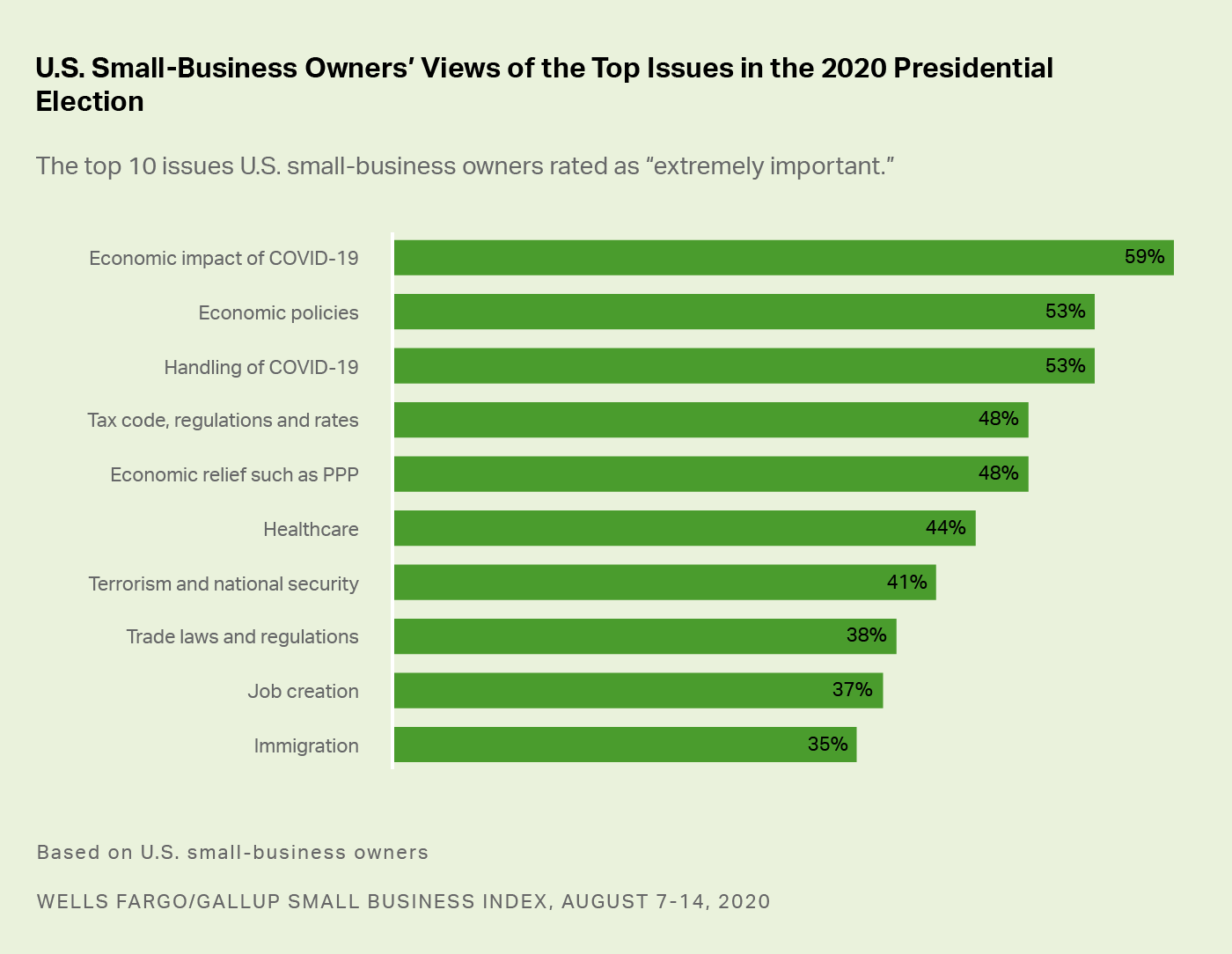

When asked to rate the importance of a president's actions to their business, owners attach the highest importance to three areas: the economic impact of COVID-19, the overall handling of COVID-19, and economic policies, with majorities describing each as "extremely important."

Horizontal bar graph. U.S. small business owners views of the most important issues in 2020 presidential election. 59% of small business owners cite the economic impact of COVID-19 as the most important issue in the 2020 election, followed by 53% who say more generic economic policies are most important. A similar amount, 53%, report the handling of the COVID-19 situation is the most important issue.

Owners also give relatively high importance ratings to policies relating to economic relief from the consequences of COVID-19, such as PPP (48%), tax policies (48%) and healthcare (44%).

Impact of COVID-19 on Business Operations

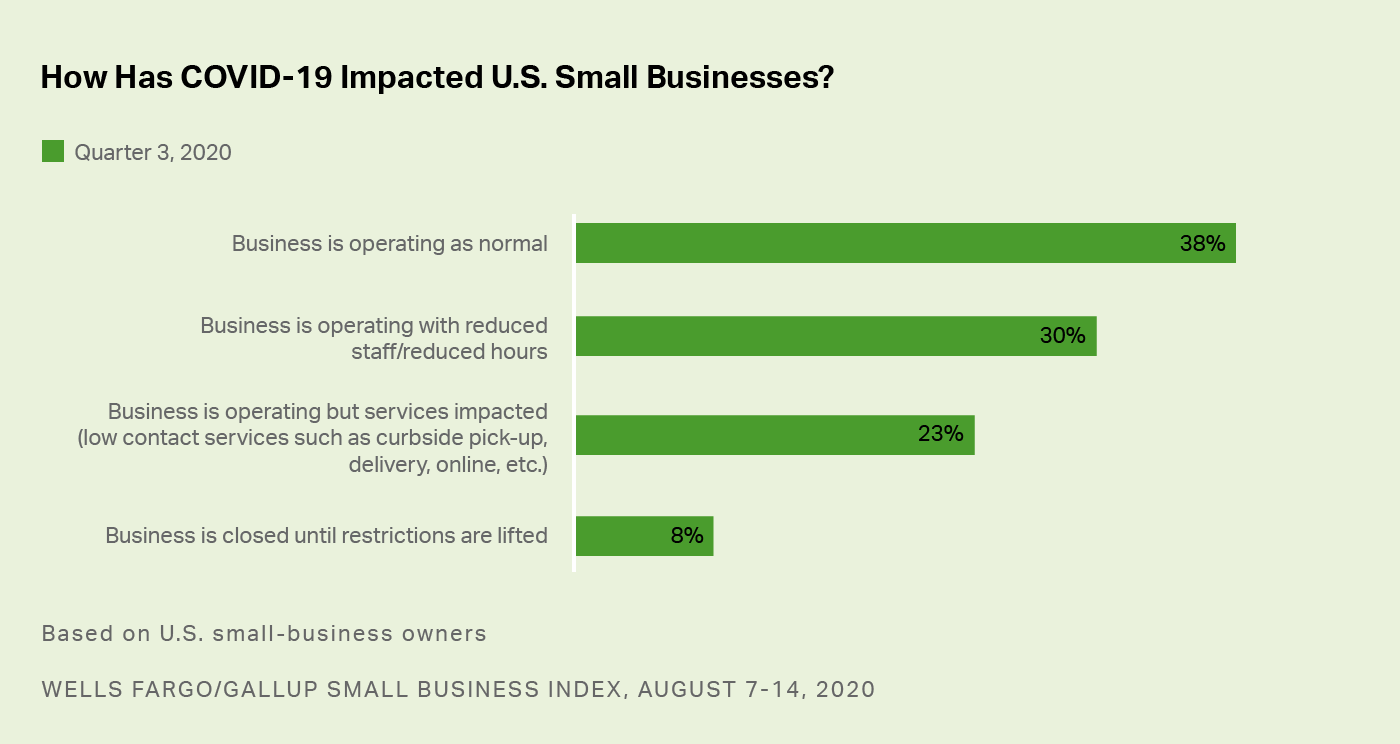

The latest Wells Fargo/���۴�ýSmall Business survey focused on how owners are coping with and responding to changes in their business as a result of COVID-19. Most broadly, 38% of owners say that their business is operating as normal as a result of COVID-19, while 30% say it is operating with reduced staff and hours. Another 23% say their business is operating but with services impacted. Eight percent of respondents to the survey say their business is closed temporarily due to restrictions.

Horizontal bar graph. COVID-19s impact on US small businesses in the third quarter of 2020. 38% of small business owners say they are operating as normal. 30% are operating with reduced hours. 23% are operating but their services are impacted. And, 8% are closed until restrictions are lifted.

Relatively few small-business owners believe the U.S. economy will rebound this year as a result of the pandemic. About half (48%) predict the economy will recover in the second half of next year or later.

And when thinking about their own business, a clear majority do not see a full recovery for up to a year or more.

| Qtr 2 2020 | Qtr 3 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Within weeks | 10 | 9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A few months | 34 | 17 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Up to a year | 32 | 26 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| More than a year | 13 | 32 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Never | - | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| WELLS FARGO SMALL BUSINESS INDEX | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Bottom Line

The COVID-19 pandemic has been keenly felt by the nation's small-business owners, who report having been hit hard in terms of restrictions on opening and how they serve their customers. Owners are significantly less positive about their current revenue, cash flow and spending. Yet, small-business owners have become somewhat more optimistic about the future compared with April, suggesting that owners see a brighter future ahead, even though many owners still believe that the recovery will take a year or more.

There is a significant level of interest in the looming presidential election among owners, and owners expect that the results will have a major impact on their business. About half say that the candidates are not adequately addressing small-business concerns. Owners suggest two broad areas of focus for the next president: dealing with COVID-19 and the economy.

For more information about Wells Fargo Works for Small Business, visit . Follow us on Twitter @WellsFargoWorks.

Learn more about how the works.