WASHINGTON, D.C. -- After years of seeing young and educated Poles leave their country in droves, Poland's government is hoping that a new law that exempts millions of young Poles from paying income tax will stop the country's brain drain. However, this may still not be enough to convince young Poles who, like many of their young counterparts worldwide, have consistently been more likely than their elders to want to move.

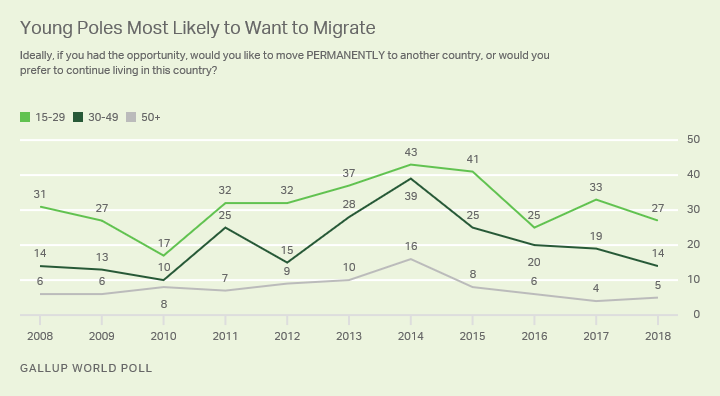

In Gallup's most recent survey in Poland, conducted in 2018, 27% of Poles between the ages of 15 and 29 said they would like to leave their country, almost double the 14% of those between the ages of 30 and 49, and more than five times the 5% of those aged 50 and older.

The new tax law, which takes effect on Thursday, will exempt millions of Poles younger than 26 from the country's 18% income tax rate in order to help bring opportunities that Polish leaders have said "match those available in the West." While young Poles are not the most likely in the world, or even in the European Union, to want to move, other 优蜜传媒indicators also suggest Poland's government needs to try to change perceptions.

Far from being a top desired destination country, results from Gallup's Potential Net Migration Index show Poland would experience a net brain drain and youth drain if everyone who wanted to leave the country actually left. Overall, the total adult population for Poland would drop by 13%, and the country would see its college-educated population drop by 11% and its 15 to 29 population drop by 27%.

Read more about Gallup's research on international migration and see how other countries worldwide could change through migration.

For complete methodology and specific survey dates, please review .

Learn more about how the works.