Story Highlights

- Four-year trend of state uninsured rate reductions reversed in 2017

- First time since 2014 that no states had a lower rate than previous year

- States that enacted Medicaid expansion had larger reductions since 2013

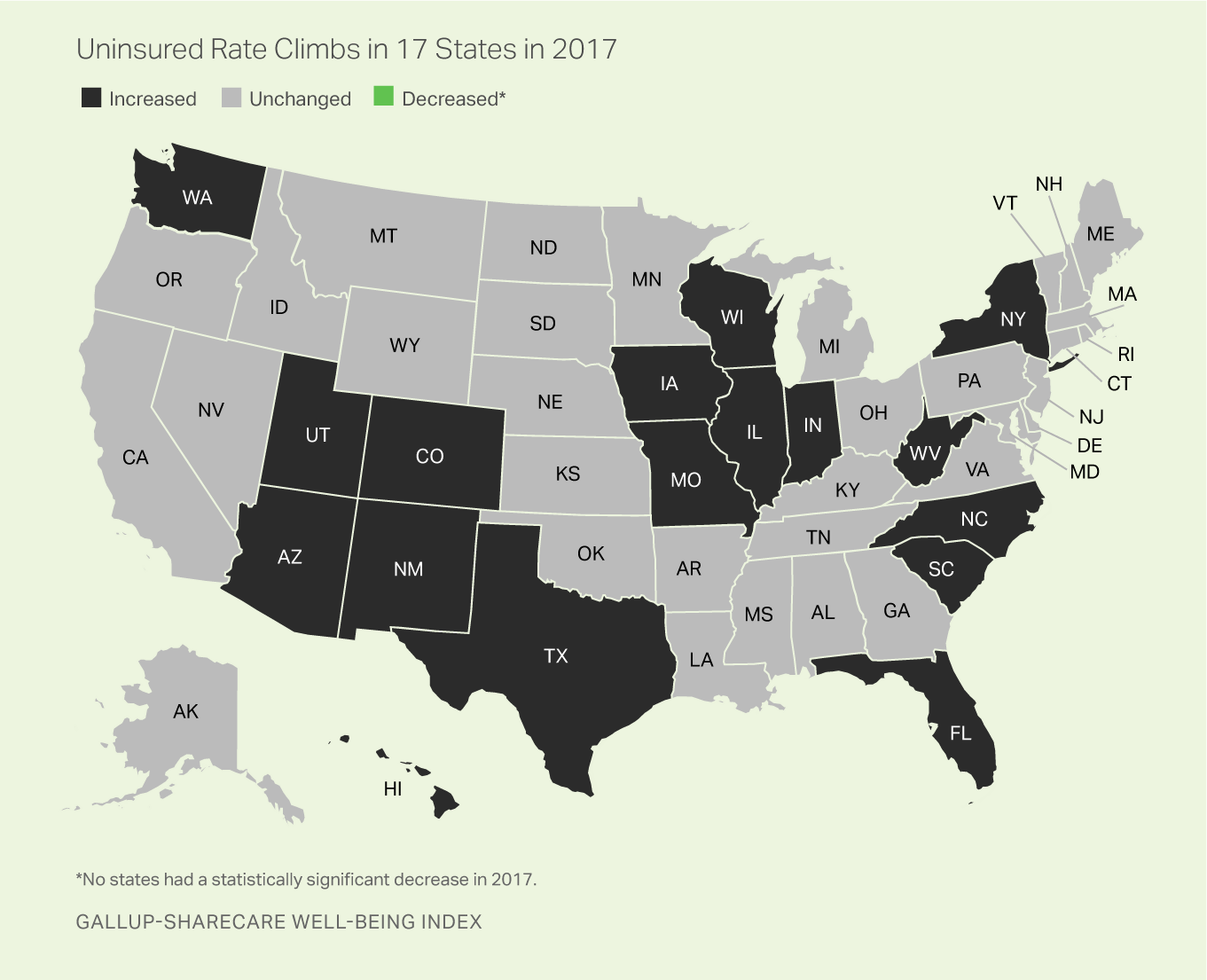

WASHINGTON, D.C. -- The uninsured rate rose by statistically significant margins in 17 states in 2017, the first time since the full implementation of the major mechanisms of the Affordable Care Act (ACA) in 2014 that any state had a rate increase. Also, for the first time since 2013, no states had a lower uninsured rate than the previous year.

Among the 17 states with meaningful increases, the uninsured rates for four states rose at least three percentage points: West Virginia, New Mexico, Iowa and Hawaii. The remaining states with statistically significant increases were Arizona, Colorado, Florida, Illinois, Indiana, Missouri, New York, North Carolina, South Carolina, Texas, Utah, Washington and Wisconsin.

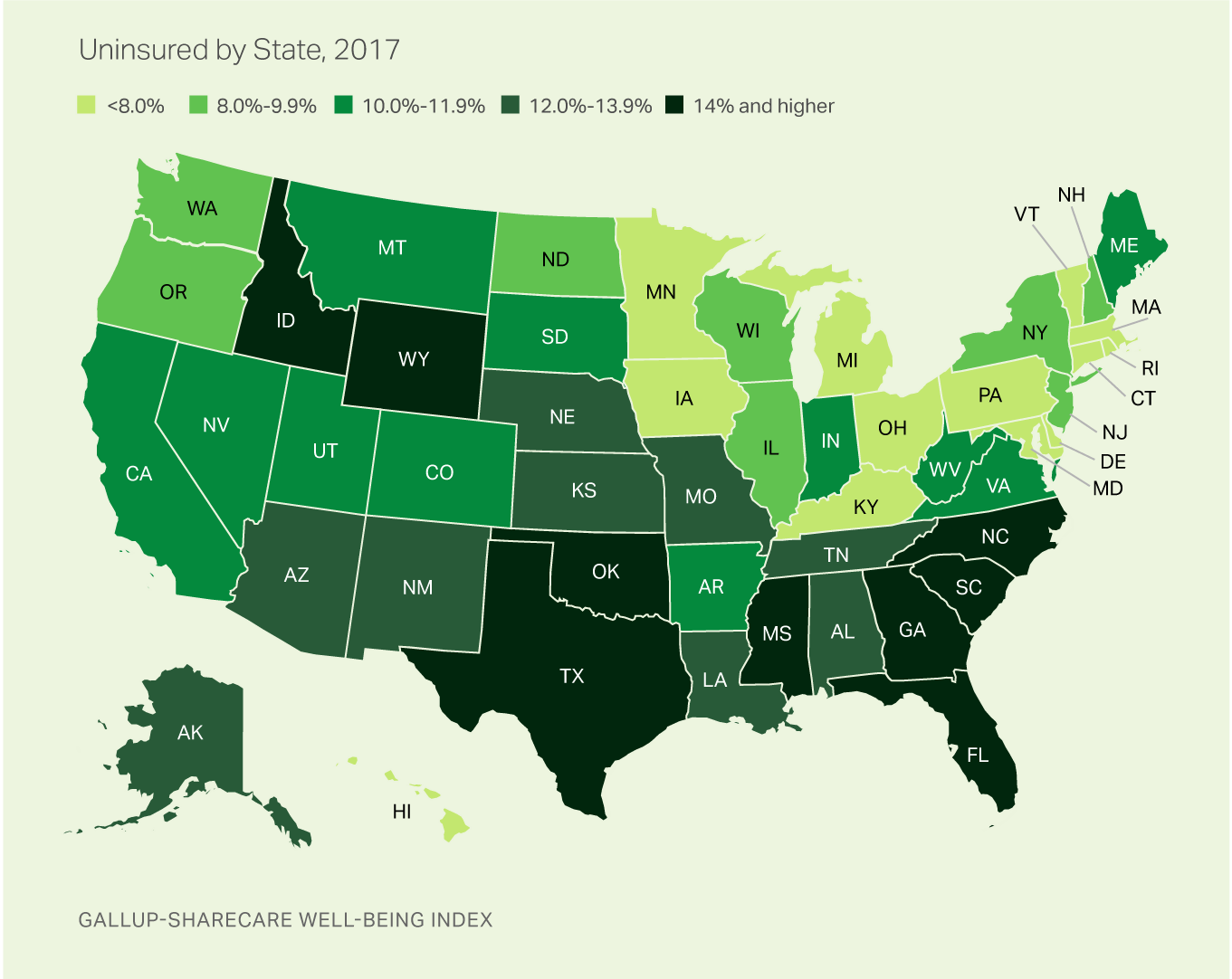

Nationwide, the uninsured rate climbed to 12.2% by the final quarter of 2017, up 1.3 points since the low point of measured in the last quarter of 2016. Since Gallup-Sharecare's measurement began in 2008, the national uninsured rate reached its highest point in the third quarter of 2013 at 18.0%, and thus the current rate, although up, remains well below this level.

These data, collected as part of the Gallup-Sharecare Well-Being Index, are based on Americans' answers to the question, "Do you have health insurance coverage?" The state-level data are based on daily surveys conducted from January through December 2017 and include state-level sample sizes that range from 465 randomly selected adult residents in Delaware to more than 17,000 in California.

The ACA marketplace exchanges opened on Oct. 1, 2013, and most new insurance plans purchased during the last quarter of that year kicked in on Jan. 1, 2014. Medicaid expansion among 24 states (and the District of Columbia) also went into effect at the beginning of 2014, with seven more states expanding since that time. Expanded Medicaid coverage as a part of the ACA broadens the percentage of qualifying low-income Americans to 138% of the federal poverty level. The onset of these two major mechanisms of the ACA at the beginning of 2014 makes the 2013 uninsured rates the natural benchmark point for comparison to measure the effects of that policy.

Medicaid Expansion States Not Immune to Uninsured Increase

Of the 17 states that had significant increases in their uninsured rates last year, 10 have expanded Medicaid. These results indicate that while Medicaid expansion continues to be associated with greater reductions in the uninsured rate since 2013, it has not generally insulated states from the increase that occurred in 2017.

The uninsured rate among all Medicaid expansion states edged up from 8.2% in 2016 to 9.1% in 2017, while the rate of non-expansion states similarly increased from 14.5% to 15.9%. Overall, however, states that have expanded Medicaid continue to have greater reductions in their combined uninsured rate since 2013, collectively reducing their rate by 42% compared with 21% among non-expansion states.

| Medicaid expansion states | Medicaid non-expansion states | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2013 | 15.8% | 20.2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | 8.2% | 14.5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 9.1% | 15.9% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Change since 2013 (pct. pts.) | -6.7 | -4.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| % Reduction since 2013 | 42.4% | 21.3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gallup-Sharecare Well-Being Index | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Massachusetts Continues to Set National Standard for Uninsured

For the 10th year in a row, Massachusetts had the lowest uninsured rate nationally in 2017 at 4.0%. The number of states with uninsured rates of under 7% increased from Massachusetts alone in 2013 to 10 in 2016. In 2017, however, this number has been cut in half and is now limited to Massachusetts, Minnesota, Vermont, Hawaii and Rhode Island.

Texas had the highest rate in 2017 for the 10th straight year at 22.5%; nevertheless, this remains down compared with the 27.0% measured in 2013. In general, Southern and Southwestern states have the highest uninsured rates in the U.S.

From 2008 to 2013 -- before key provisions of the ACA were fully implemented -- Massachusetts was the only state with an uninsured rate below 7%. This was due in part to a statewide insurance system enacted under former Gov. Mitt Romney.

Implications

A number of factors have likely played a role in the increase in the uninsured rate across many states in 2017. One factor is an increase in rates of insurance premiums in many states for some of the more popular ACA insurance plans. For enrollees with higher incomes who do not qualify for government subsidies, the resulting hike in rates could have had the effect of driving them out of the marketplace.

After peaking in 2016 at 12.7 million, there was an approximately in ACA marketplace insurance enrollment in 2017, followed by another in 2018's enrollment period. The open enrollment period for 2018 was characterized by a significant reduction in public marketing and a shortened enrollment period of , about half as long as previous periods. Insurers, in turn, have increasingly from the ACA exchanges, resulting in fewer choices and less competition in many states.

Other potential factors include political forces that may have increased uncertainty surrounding the ACA marketplace. Numerous high-profile attempts were made to repeal and replace the plan. Although none fully succeeded legislatively, the elimination of the ACA's individual mandate penalty as a part of the tax reform plan signed into law in December 2017 could result in reducing participation in the insurance marketplace in future open enrollment periods.

President Donald Trump's decision in October 2017 to end cost-sharing reduction payments could also potentially result in the uninsured rate rising further. The cost-sharing payments have been made to insurers in the marketplace exchanges to offset some of their costs for offering lower-cost plans to lower-income Americans.

Survey Methods

Results are based on telephone interviews conducted Jan. 2-Dec. 30, 2017, as a part of the Gallup-Sharecare Well-Being Index, with a random sample of 160,498 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error for the uninsured rate is 卤0.2 percentage points at the 95% confidence level. The margin of sampling error is 卤1 to 卤2 percentage points for most states, but climbs as high as 卤3.5 percentage points for states with small populations such as North Dakota, Wyoming, Vermont and Alaska. All reported margins of sampling error include computed design effects for weighting.

Statistical change testing is based at the 90% (p<.10) confidence level and includes design effect for more conservative results that incorporate the imperfectness of the randomness of the state samples.

Each sample of national adults includes a minimum quota of 70% cellphone respondents and 30% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

Learn more about how the works.

| Without health insurance 2013 | Without health insurance 2016 | Without health insurance 2017 | Change in uninsured 2017 vs 2016 | Expanded Medicaid by July 1, 2016 | 2017 sample size | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | % | (pct. pts.) | (Yes/No) | (n=____) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alabama | 17.7 | 13.6 | 13.3 | -0.3 | No | 2,704 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alaska | 18.9 | 11.7 | 13.7 | 2.0 | Yes | 469 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Arizona | 20.4 | 11.0 | 13.6 | 2.6 | Yes | 3,287 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Arkansas | 22.5 | 10.2 | 11.4 | 1.2 | Yes | 1,608 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| California | 21.6 | 10.5 | 10.7 | 0.2 | Yes | 16,333 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Colorado | 17.0 | 9.3 | 11.5 | 2.2 | Yes | 3,346 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Connecticut | 12.3 | 6.2 | 7.7 | 1.5 | Yes | 1,738 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Delaware | 10.5 | 8.0 | 7.5 | -0.5 | Yes | 414 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Florida | 22.1 | 14.6 | 16.0 | 1.4 | No | 9,630 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Georgia | 21.4 | 15.6 | 16.8 | 1.2 | No | 4,967 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hawaii | 7.1 | 3.2 | 6.5 | 3.3 | Yes | 547 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Idaho | 19.9 | 14.0 | 16.5 | 2.5 | No | 1,104 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Illinois | 15.5 | 7.7 | 9.3 | 1.6 | Yes | 4,819 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Indiana | 15.3 | 8.6 | 10.1 | 1.5 | Yes | 3,187 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Iowa | 9.7 | 3.9 | 7.2 | 3.3 | Yes | 2,031 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Kansas | 12.5 | 12.3 | 13.3 | 1.0 | No | 1,528 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Kentucky | 20.4 | 7.8 | 7.8 | 0.0 | Yes | 2,275 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Louisiana | 21.7 | 12.5 | 12.8 | 0.3 | Yes | 2,271 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Maine | 16.1 | 9.1 | 10.5 | 1.4 | No | 866 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Maryland | 12.9 | 7.3 | 7.8 | 0.5 | Yes | 2,982 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Massachusetts | 4.9 | 3.2 | 4.0 | 0.8 | Yes | 3,422 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Michigan | 12.5 | 7.0 | 7.1 | 0.1 | Yes | 4,778 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Minnesota | 9.5 | 5.6 | 6.3 | 0.7 | Yes | 3,073 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mississippi | 22.4 | 17.2 | 19.3 | 2.1 | No | 1,419 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Missouri | 15.2 | 10.4 | 12.5 | 2.1 | No | 3,237 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Montana | 20.7 | 11.3 | 10.9 | -0.4 | Yes | 939 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nebraska | 14.5 | 11.2 | 13.8 | 2.6 | No | 1,283 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nevada | 20.0 | 11.2 | 11.4 | 0.2 | Yes | 1,304 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Hampshire | 13.8 | 7.6 | 8.6 | 1.0 | Yes | 710 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Jersey | 14.9 | 9.3 | 9.9 | 0.6 | Yes | 3,931 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Mexico | 20.2 | 9.0 | 12.8 | 3.8 | Yes | 1,325 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New York | 12.6 | 7.0 | 8.2 | 1.2 | Yes | 9,596 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North Carolina | 20.4 | 13.6 | 15.0 | 1.4 | No | 5,388 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North Dakota | 15.0 | 6.9 | 9.8 | 2.9 | Yes | 471 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ohio | 13.9 | 7.4 | 7.6 | 0.2 | Yes | 5,723 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oklahoma | 21.4 | 16.3 | 17.7 | 1.4 | No | 2,431 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oregon | 19.4 | 9.1 | 8.3 | -0.8 | Yes | 2,735 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pennsylvania | 11.0 | 6.3 | 7.1 | 0.8 | Yes | 7,116 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rhode Island | 13.3 | 7.0 | 6.8 | -0.2 | Yes | 546 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| South Carolina | 18.7 | 13.1 | 15.2 | 2.1 | No | 2,513 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| South Dakota | 14.0 | 9.9 | 11.8 | 1.9 | No | 453 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tennessee | 16.8 | 11.8 | 12.3 | 0.5 | No | 3,663 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Texas | 27.0 | 20.5 | 22.1 | 1.6 | No | 12,440 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Utah | 15.6 | 9.7 | 11.8 | 2.1 | No | 1,955 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Vermont | 8.9 | 6.1 | 6.4 | 0.3 | Yes | 435 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Virginia | 13.3 | 9.8 | 10.9 | 1.1 | No | 4,375 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Washington | 16.8 | 7.2 | 8.7 | 1.5 | Yes | 4,365 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| West Virginia | 17.6 | 6.1 | 10.3 | 4.2 | Yes | 898 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wisconsin | 11.7 | 6.2 | 8.3 | 2.1 | No | 2,968 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wyoming | 16.6 | 12.9 | 16.5 | 3.6 | No | 464 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gallup-Sharecare Well-Being Index | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||