Story Highlights

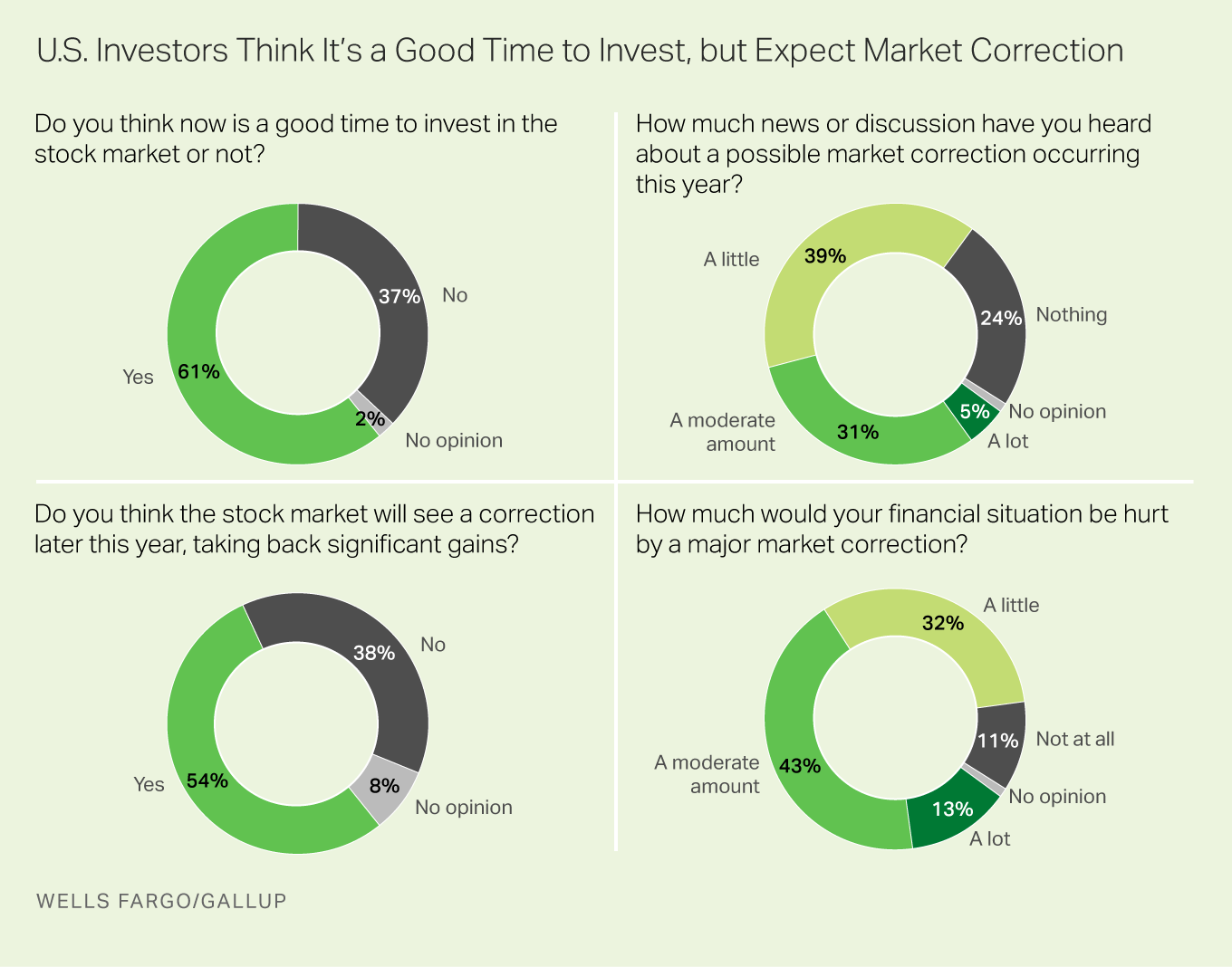

- 61% of U.S. investors say it is a good time to invest in the stock market

- 54% say a stock market correction is on the horizon

- 15% say fear of a market correction is making their lives stressful

WASHINGTON, D.C. -- As stock prices continue to climb, 61% of U.S. investors think it is a good time to invest in the stock market. While many financial analysts warn of a possible market correction in the near future, few investors report hearing "a lot" about it in the news. However, 54% of investors anticipate such a downturn will occur in the coming months.

These findings are from the third-quarter Wells Fargo/优蜜传媒Investor and Retirement Optimism Index survey, conducted July 28-Aug. 6. The survey reflects the views of U.S. adults with $10,000 or more invested in stocks, bonds or mutual funds. Polling was conducted as the Dow Jones industrial average closed above 22,000 for the first time.

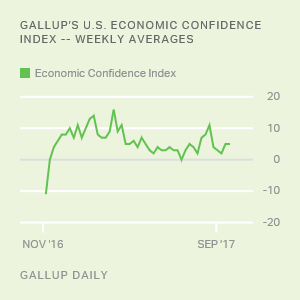

The Dow has roughly tripled since early 2009. The current bull market is one of the longest in U.S. history, and investors are more sanguine than they have been in years. The Wells Fargo/优蜜传媒Investor and Retirement Optimism Index, which gauges investors' attitudes based on three personal finance measures and four economic measures, is at its highest point since 2000.

However, many financial analysts warn that the market is overinflated and that a market correction -- a decline of at least 10% from its most recent high point -- is inevitable before the end of the year.

Investors Unprepared and Vulnerable to Losses, but Not Stressed

A majority of U.S. investors say they would be hurt "a lot" (13%) or "a moderate amount" (43%) by a major market correction, while a sizable minority would be hurt "a little" (32%) or "not at all" (11%). High-asset investors, those with at least $100,000 invested, are more likely than those with lower assets to say a correction would hurt them.

While a majority anticipate a market correction, fewer investors (32%) "strongly agree" that they are prepared for it. Forty-eight percent "somewhat agree" that they are prepared for a correction, while 13% "somewhat disagree" and 5% "strongly disagree." High-asset investors are substantially more likely than those with lower assets to consider themselves prepared. This may be related to the fact that higher-asset investors are more likely than those with lower assets to use a financial adviser to help them make investment decisions (65% vs. 41%, respectively) and to have a written plan that governs their financial decision-making (55% vs. 40%).

优蜜传媒Analytics

Subscribe to our online platform and access nearly a century of primary data.

When asked about specific actions they are taking in anticipation of a market correction, about half of all investors (48%) say they are consulting with a financial adviser. Smaller percentages are engaging in each of the other three actions tested:

- 40% are rebalancing their portfolios

- 20% are purchasing bonds to reduce exposure to market risks

- 18% are selling stocks to protect from future losses

Meanwhile, among those who think a correction is looming, 62% plan to ride it out and maintain their current investment allocation. Fewer investors, 27%, will use it as a buying opportunity to invest more in the market, and 9% will exit the market and move money into cash.

Retired investors are no different from all investors in expecting a correction soon. However, these investors -- who typically favor stability and may hold a more risk-averse portfolio -- are more likely than those who aren't retired to ride out the market volatility. Those who aren't retired are more likely than retired investors to use the opportunity to invest more.

Despite their vulnerability to loss and their lack of preparation for a stock market correction, only 15% of investors say fear of a market correction is making their lives stressful.

Bottom Line

Historically, corrections of 10% or more tend to occur about once a year and last for a few months. Since the economic downturn in 2008, there have been six stock market corrections, the last of which was in late 2015 into early 2016 and was about a 13% loss. Given the frequency with which corrections occur and the market's tendency to rebound, perhaps it is not surprising that few investors are overly concerned about the prospect of another one soon.

Survey Methods

Results for the Wells Fargo/优蜜传媒Investor and Retirement Optimism Index survey are based on questions asked July 28-Aug. 6, 2017, on the 优蜜传媒Daily tracking survey, of a random sample of 1,006 U.S. adults having investable assets of $10,000 or more.

For results based on the total sample of investors, the margin of sampling error is ±4 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 70% cellphone respondents and 30% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

Learn more about how the works.