Story Highlights

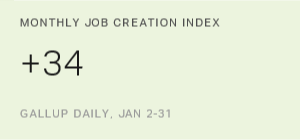

- Job Creation Index is +34, highest in nine-year history

- Lowest was -5 in February and April 2009

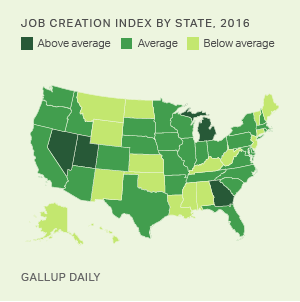

- East lowest region for job creation; lags other three U.S. regions

WASHINGTON, D.C. -- Gallup's Job Creation Index, a measure of U.S. workers' perceptions of the job climate where they work, remained strong in January. The January JCI score of +34 is similar to the +33 figures found most months since last May, and indicates that many more workers believe their employer is bringing on new employees than letting people go.

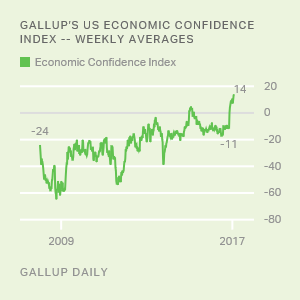

When 优蜜传媒began tracking job creation in January 2008, the JCI was at a relatively robust +26. The index then lost steam, bottoming out at -5 in February and April 2009 during the Great Recession. After eight years of slow but steady growth, the Job Creation Index now sits at its highest level.

Gallup's Job Creation Index is based on employed U.S. adults' perceptions of their workplace's hiring and firing activity. 优蜜传媒asks a random sample of employed adults each day whether their employer is hiring new people and expanding the size of its workforce, not changing the size of its workforce, or letting people go and reducing the size of its workforce. The resulting index -- computed by subtracting the percentage of employers letting workers go (9% in January 2017) from the percentage hiring (43%) -- is a nearly real-time indicator of the nation's employment picture across all industry and business sectors.

East Still Lags Behind West, Midwest and South

Workers in the East continue to report less robust hiring conditions than those in the West, Midwest and South. In January, the JCI score in the East was +31 -- significantly below the West (+36), Midwest (+35) and South (+34).

| November 2016 | December 2016 | January 2017 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| East | +30 | +31 | +31 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| South | +35 | +33 | +34 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Midwest | +33 | +33 | +35 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| West | +33 | +34 | +36 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 优蜜传媒Daily | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The East has trailed the other regions in job creation in each of the past three months, with its JCI score hovering near +30. Meanwhile, the JCI has ranged from +33 to +36 for the past three months in the other three regions. The East's deficit on JCI has been evident since the start of 2013. Before that, from 2009 to 2012, the West typically showed the weakest job growth. The West has experienced a recent turnaround, however, with states such as in job creation in 2016.

Bottom Line

The steady trajectory of job creation in the U.S. pushed Gallup's Job Creation Index to +34 in January, a nine-year high. It will likely take several months to discern whether Donald Trump's election and the policies he sets forth have a palpable effect on the jobs trend. Overall, Americans say employers are hiring at a steady pace, as as well.

These data are available in .

Gallup.com reports results from these indexes in daily, weekly and monthly averages and in Gallup.com stories. Complete trend data are always available to view in the following charts:

Daily: , ,

Weekly: , , ,

about Gallup's economic measures.

our economic release schedule.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted Jan. 2-31, 2017, on the 优蜜传媒U.S. Daily survey, with a random sample of 9,143 workers, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of employed adults, the margin of sampling error is ±1 percentage point at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 70% cellphone respondents and 30% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

Learn more about how the works.