Story Highlights

- Investor index remains at nine-year high in fourth quarter

- Investors most upbeat about maintaining or increasing their income

- Republican and Democratic investors swap outlooks after election

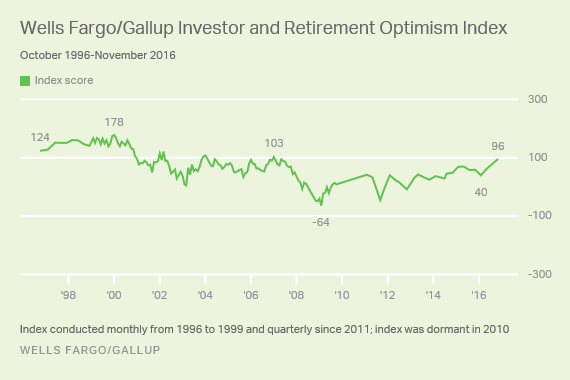

PRINCETON, N.J. -- After reaching a nine-year high in the third quarter, the Wells Fargo/优蜜传媒Investor and Retirement Optimism Index rose further in the fourth quarter to its highest point since January 2007. The index now stands at +96, up from +79 last quarter and from +40 in the first quarter after stock market volatility .

The fourth-quarter reading is based on telephone interviews conducted Nov. 16-20 with a nationally representative sample of 1,012 U.S. investors who report having $10,000 or more in stocks, bonds, mutual funds, or a self-directed IRA or 401(k).

Reflecting the results of the 2016 presidential election, investor confidence zoomed 155 points in the post-election poll among investors who identify as Republican, from an index score of 0 in the third quarter to +155 in the fourth. Conversely, Democrats' confidence fell by nearly as much, from +174 to +25. At the same time, the index rose only slightly among those with $100,000 or more in investments, from +99 to +105, while it jumped from +55 to +87 among lower-asset investors.

The Wells Fargo/优蜜传媒Investor and Retirement Optimism Index has been conducted quarterly since 2011. The 优蜜传媒Index of Investor Optimism, which provides the historical trend, was conducted monthly from October 1996 through October 2009. The index has a theoretical range of +400 to -400, but in practice has ranged from +178 at its highest point in January 2000 to -64 at its lowest in February 2009.

Investors More Confident About Personal Than Economic Factors

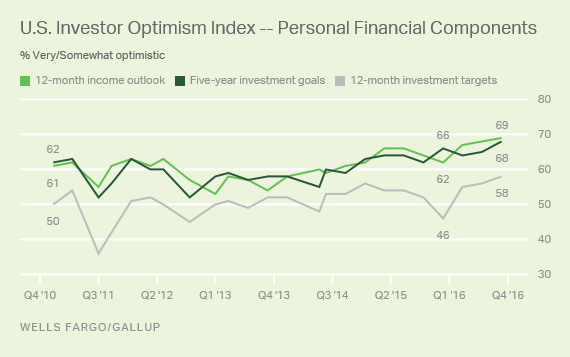

Of the seven elements that form the index, investors are the most confident this quarter about maintaining or increasing their income over the next 12 months -- 69% are optimistic about this while 15% are pessimistic, for a +54 net optimism score.

Investors are nearly as hopeful about reaching their five-year investment goals, with 68% optimistic. Slightly fewer are optimistic about achieving their 12-month investment targets (58%) and in their 12-month outlook for U.S. economic growth (57%) and stock market performance (54%).

Net optimism about the unemployment rate is just a notch below investors' outlook for the economy and stock market, while investors are split in their outlook for inflation.

| Optimistic | Pessimistic | Net optimism | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | (pct. pts.) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 12-month income outlook | 69 | 15 | +54 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Five-year investment goals | 68 | 20 | +48 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 12-month investment targets | 58 | 21 | +37 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Economic growth | 57 | 27 | +30 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock market performance | 54 | 24 | +30 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unemployment rate | 52 | 27 | +25 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Inflation | 37 | 36 | +1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Optimistic = % Very/Somewhat optimistic; Pessimistic = % Very/Somewhat pessimistic; % Neither not shown | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wells Fargo/Gallup, Nov. 16-20, 2016 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Optimism Typically Highest on Income, Five-Year Investing Outlook

The rank order of investors' confidence in the three personal financial components of the index has been fairly constant in recent years. Investors tend to be the most optimistic about the 12-month outlook for their income, as well as the outlook for reaching their five-year investment goals. They tend to be a bit less optimistic about achieving their 12-month investment targets. However, solid majorities are now optimistic on all three dimensions.

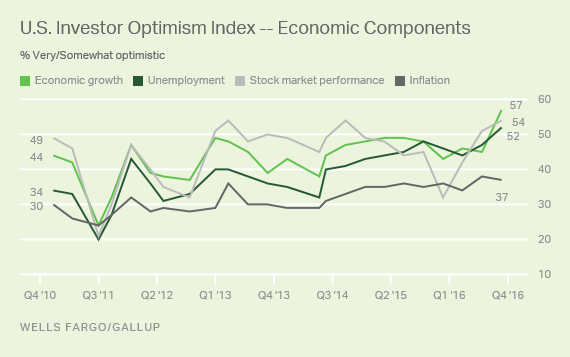

Investor optimism about the four economic factors included in the index have been more variable since 2011 but also stand at recent high points. This reflects a sharp increase in investor optimism about economic growth since last quarter -- from 45% to 57% -- as well as steady long-term gains in investor optimism about the U.S. unemployment rate.

Since early 2011, the percentage of investors expressing optimism about unemployment has risen 18 percentage points, compared with a 13-point increase in optimism about economic growth, a seven-point rise on inflation and a five-point rise on stock market performance.

Bottom Line

Investors' willingness to purchase equities in 2017, thus helping to maintain the bull market, will depend on many factors, not the least of which is their broad outlook on the investment climate as measured by the Wells Fargo/优蜜传媒Investor and Retirement Optimism Index. The index presents a fairly positive picture at the close of 2016 and is considerably improved over a year ago after three consecutive quarters of gains. While Republican exuberance about Donald Trump's victory may explain some of this, the fourth-quarter jump only added to long-term gains in confidence -- particularly in optimism about unemployment -- that should provide a good foundation to build on in 2017.

Survey Methods

Results for the Wells Fargo/优蜜传媒Investor and Retirement Optimism Index survey are based on questions asked Nov. 16-20, 2016, on the 优蜜传媒Daily tracking survey, of a random sample of 1,012 U.S. adults having investable assets of $10,000 or more.

For results based on the total sample of investors, the margin of sampling error is 卤4 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 60% cellphone respondents and 40% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

Learn more about how the works.