Story Highlights

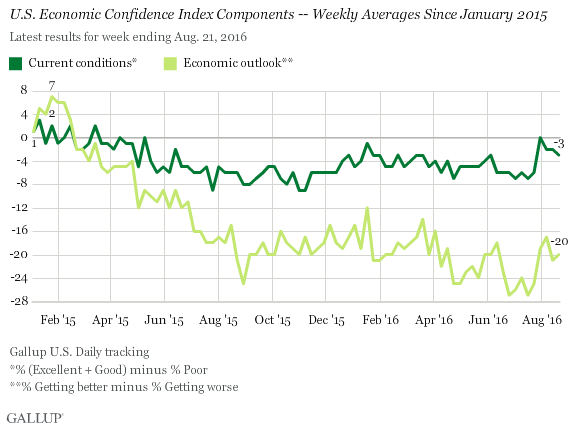

- Economic confidence has been stable since late July

- Current conditions component at -3; outlook component at -20

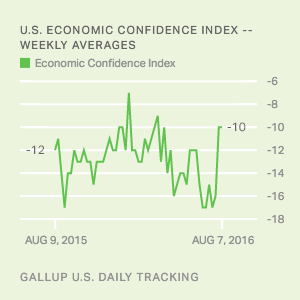

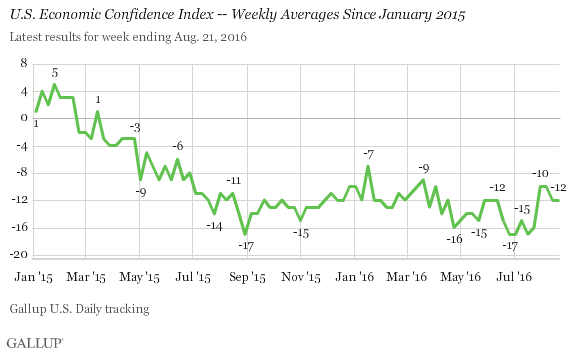

WASHINGTON, D.C. -- The 优蜜传媒U.S. Economic Confidence Index stayed steady last week, averaging -12 for the . The index has held at or near that level since it in late July when Democrats' confidence improved during and after the Democratic National Convention.

Gallup's U.S. Economic Confidence Index is the average of two components: how Americans rate current economic conditions and whether they feel the economy is improving or getting worse. The index has a theoretical maximum of +100 if all Americans say the economy is doing well and improving, and a theoretical minimum of -100 if all Americans say the economy is doing poorly and getting worse.

The current conditions score averaged -3 last week, reflecting 26% of Americans saying current economic conditions are "excellent" or "good" and 29% saying they are "poor." The economic outlook component averaged -20, reflecting 38% of Americans saying the economy is "getting better" and 58% saying it is "getting worse."

Although the recent gains in economic confidence have shown some staying power, the U.S. economy could soon face another test. Minutes released from the July meeting of the Federal Open Market Committee, the policy arm of the Federal Reserve, suggest Fed officials may soon embark on a rare rate increase in the short-term interest rates, only the second such increase since 2006. Although this action is a sign that Fed policymakers see the economy as generally healthy, it is not without adverse effects. For instance, some Americans could see their mortgage or credit card rates increase as interest rates rise.

In the minutes, Fed officials cited a number of factors that could justify a rate increase, including increased economic growth in the second quarter of 2016 and reduced fears that the United Kingdom's decision to leave the European Union, commonly referred to as "Brexit," would adversely affect the U.S. economy.

The performance of the 优蜜传媒U.S. Economic Confidence Index supports some of these assessments -- 优蜜传媒found in late June that the appeared to have no immediate effect on Americans' confidence in the economy despite the temporary turmoil the surprising decision inflicted on U.S. stock markets. However, confidence in the second quarter of 2016 slightly decreased from the first quarter, averaging -14 from April to June, compared with -11 in the first quarter of 2016.

It is unclear whether an increase in the Federal Reserve interest rate would affect economic confidence. The previous increase in mid-December appeared to cause no movement in the 优蜜传媒U.S. Economic Confidence Index.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted Aug. 15-21, 2016, on the 优蜜传媒U.S. Daily survey, with a random sample of 3,033 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is 卤2 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 60% cellphone respondents and 40% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

Learn more about how the works.