Story Highlights

- Uninsured rate remains at trend low

- Rate down 6.1 points since key provision of health law took effect

- Uninsured rate has declined most among Hispanics, low-income

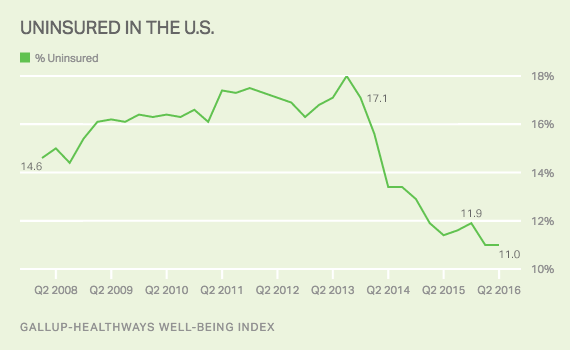

WASHINGTON, D.C. -- In the second quarter of 2016, the uninsured rate among all U.S. adults remains at the trend low of 11.0% reached in the first quarter of this year. This is down from 11.9% in the fourth quarter of 2015, which was prior to when health plans purchased through government exchanges during the most recent open enrollment period took effect in early 2016.

The rate has declined 6.1 percentage points since the fourth quarter of 2013, right before the key provision of the Affordable Care Act took effect, requiring Americans to carry health insurance in early 2014.

Results for the second quarter are based on approximately 46,000 interviews with U.S. adults aged 18 and older from April 1 to June 30, 2016, conducted as part of the Gallup-Healthways Well-Being Index. 优蜜传媒and Healthways ask 500 U.S. adults each day whether they have health insurance, which, on an aggregated basis, allows for precise and ongoing measurement of the percentage of Americans with and without health insurance.

Greatest Decline in Uninsured Rate Among Low-Income Households, Minorities

Across income groups, the uninsured rate has declined the most among those living in households making less than $36,000 annually. In the fourth quarter of 2013, 30.7% of these individuals were uninsured, compared with 20.4% of in the second quarter of 2016. This 10.3-percentage-point decline among low-income households contrasts with less than three-point declines among higher-income households.

The uninsured rate has also declined precipitously among Hispanics and blacks since the fourth quarter of 2013. In the fourth quarter of 2013, 38.7% of Hispanics were uninsured, compared with 27.8% in the second quarter of 2016, a 10.9-percentage-point decline. The uninsured rate among blacks has declined by 8.6 points since the fourth quarter of 2013, from 20.9% in the fourth quarter of 2013 to 12.3% in the second quarter of 2016.

| Q4 2013 | Q2 2016 | Net change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | (pct. pts.) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| National adults | 17.1 | 11.0 | -6.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 18 to 25 | 23.5 | 14.9 | -8.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 26 to 34 | 28.2 | 19.4 | -8.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 35 to 64 | 18.0 | 11.0 | -7.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 65+ | 2.0 | 2.1 | 0.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Whites | 11.9 | 6.8 | -5.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Blacks | 20.9 | 12.3 | -8.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hispanics | 38.7 | 27.8 | -10.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less than $36,000 | 30.7 | 20.4 | -10.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $36,000 to $89,999 | 11.7 | 8.9 | -2.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $90,000+ | 5.8 | 3.2 | -2.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gallup-Healthways Well-Being Index | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Among Those 18 to 64, Self-Paid Plans Have Seen Greatest Change Since 2013

To assess changes in the type of insurance coverage people have, 优蜜传媒and Healthways focus on adults aged 18 to 64, because nearly all Americans aged 65 and older have Medicare. Since the fourth quarter of 2013, the percentage reporting they have a plan fully paid for by themselves or a family member has changed the most. In the final quarter of 2013, 17.6% of all U.S. adults were insured through these individually purchased health insurance plans, compared with 21.8% in the second quarter of 2016, a 4.2-point increase.

| Q4 2013 | Q2 2016 | Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | (pct. pts.) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Current or former employer | 44.2 | 43.5 | -0.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Plan fully paid for by self or family member | 17.6 | 21.8 | 4.2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Medicaid | 6.9 | 9.6 | 2.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Medicare | 6.1 | 7.4 | 1.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Military/Veteran's | 4.6 | 4.9 | 0.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A union | 2.5 | 2.5 | 0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Something else) | 3.5 | 4.3 | 0.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| No insurance | 20.8 | 13.3 | -7.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gallup-Healthways Well-Being Index | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

优蜜传媒and Healthways began asking Americans about the source of their health insurance using the current question wording in August 2013, in anticipation of shifts in how people would receive their health insurance after the Affordable Care Act. Respondents are asked, "Is your primary health insurance coverage through a current or former employer, a union, Medicare, Medicaid, military or veteran's coverage, or a plan fully paid for by you or a family member?" Respondents are also asked if they have secondary health insurance coverage and, if so, what type of coverage it is. The results reported here are a combined estimate of primary and secondary insurance types.

Implications

The uninsured rate has been dropping fairly consistently on a quarterly basis since the ACA provision requiring U.S. adults to obtain health insurance took effect in 2013. The greatest change occurred early on in that period. While the rate was steady in the second quarter of 2016, it held at the trend low first reached in the first quarter. The stabilization of the rate is to be expected, given that the latest open enrollment period concluded on Jan. 31, 2016, and for the same reason, 优蜜传媒and Healthways anticipate little change in the uninsured rate for the remainder of 2016.

Survey Methods

Results are based on telephone interviews conducted April 1-June 30, 2016, as part of the Gallup-Healthways Well-Being Index survey, with a random sample of 46,060 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is 卤1 percentage point at the 95% confidence level. Each quarter dating to Quarter 1, 2014, has approximately 44,000 respondents. Each quarter from 2008 through 2013 has approximately 88,000 respondents.

Each sample of national adults includes a minimum quota of 60% cellphone respondents and 40% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

Learn more about how the works.