Story Highlights

- More than one in four have a great deal, quite a lot of confidence

- Level of confidence unchanged since 2013

- Liberals, conservatives share similarly low level of confidence

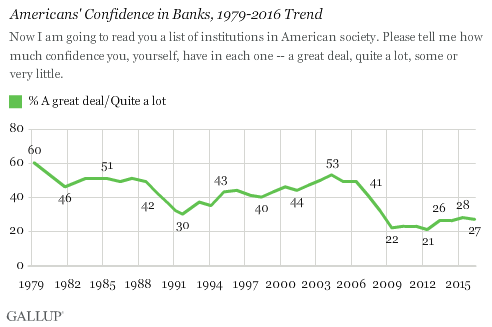

WASHINGTON, D.C. -- Americans' confidence in banks is unchanged from a year ago and remains below 30% for the eighth straight year after tumbling during the 2007-2009 recession. The 27% of U.S. adults who now say they have "a great deal" or "quite a lot" of confidence in the institution is slightly higher than the lows during the Great Recession and its aftermath. However, confidence in banks has been essentially at this level the past several years.

The current percentage of adults who say they have confidence in banks is just half of what it was in 2004 when 53% expressed confidence in the institution. The record high was 60% in 1979. In addition to those expressing high confidence in banks, nearly half of Americans say they have "some" confidence in them, while about a quarter (26%) have "very little" or no confidence.

About half of Americans expressed confidence in banks in most polls in the 1980s, but confidence suffered in the early 1990s , with confidence ranging from 30% to 37%. But by the late '90s, confidence improved, ranging from 40% to 44%. Confidence in banks gained in the early 2000s, reaching a majority level by 2004.

Like most institutions, confidence in banks began to fall in 2005 and 2006 as Americans' satisfaction with the way things were going suffered. By 2007, with housing prices starting to fall after peaking in 2006, banking confidence dipped to 41%. It then fell further to 32% in June 2008, after the recession began but before the October 2008 financial crisis. By June 2009, just 22% of Americans had confidence in banks, slightly worse than today.

Conservatives, Independents, Liberals Share Similarly Low Level of Confidence

Although railing against big banks has been the rallying cry of liberal Democrats such as Massachusetts Sen. Elizabeth Warren and presidential candidate Sen. Bernie Sanders, among the general population, conservatives and Republicans are no more likely than liberals and Democrats to have high confidence in banks.

About a quarter of Americans in each of the main political party and ideology groups say they have a great deal or quite a lot of confidence in banks. They differ in the percentages expressing low confidence, which is slightly higher for Democrats and liberals than for their Republican and conservative counterparts.

Confidence in banks differs a bit more among income groups. Adults whose households earn less than $30,000 annually (33%) are slightly more likely than those in the middle (24%) and higher (22%) income brackets to express high confidence in banks.

| A great deal/Quite a lot | Some | Very little/None (vol.) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Republicans | 26 | 55 | 17 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Independents | 24 | 44 | 32 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Democrats | 27 | 48 | 24 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Conservatives | 27 | 50 | 23 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Moderates | 25 | 50 | 24 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liberals | 25 | 44 | 30 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $75K+ | 22 | 56 | 21 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $30K-$74.9K | 24 | 52 | 24 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less than $30K | 33 | 36 | 29 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (vol.) = Volunteered response | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gallup, June 1-5, 2016 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Bottom Line

The fallout from the 2008 financial crisis continues to affect Americans' views of the banking industry. Despite some signs of economic recovery, remain negative, and Americans are not much more willing to express confidence in banks.

Low confidence in banks is not unprecedented, and Americans' views of the institution have recovered in the past from severe dips. However, past events such as the Savings and Loan Crisis paled in comparison to the wide-ranging effects of the 2008 financial crisis that led the economy to depths unseen since the Great Depression. Regaining Americans' trust in recent years, then, appears to be a heavier lift for the banking industry. And it is unclear when -- or if -- Americans' confidence in banks will be restored to what it was a decade ago.

Historical data are available in .

Survey Methods

Results for this ���۴�ýpoll are based on telephone interviews conducted June 1-5, 2016, on the ���۴�ýU.S. Daily survey, with a random sample of 1,027 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is ±4 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 60% cellphone respondents and 40% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

Learn more about how the works.