Story Highlights

- About half of Americans (52%) say they invest in stocks

- Current figure down slightly from 2014 and 2015

- Middle-class adults, those younger than 35 less likely to invest

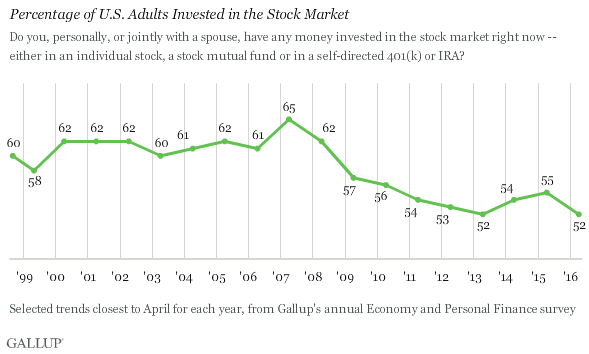

WASHINGTON, D.C. -- With the Dow Jones industrial average near its record high, slightly more than half of Americans (52%) say they currently have money in the stock market, matching the lowest ownership rate in Gallup's 19-year trend.

In 2007, nearly two in three American adults (65%) reported investing in the stock market, the high in Gallup's selected trend on this question for April of each year. But this percentage shrank each year from 2008 to 2013 as the effects of the Great Recession and big market losses took their toll on Americans' sense of , and financial means to invest -- as well as their general as a place to invest their money.

Though the Dow Jones industrial average has made great gains since bottoming out in 2009, Americans' stock ownership has yet to recover to the level reported prior to the recession.

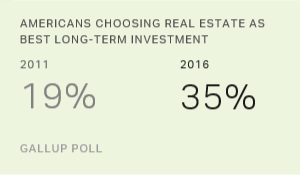

There were modest gains in the percentage of Americans with stock investments in 2014 and 2015, but reported ownership fell back this year, possibly because of the Dow's tumultuous performance over the past year. Americans' views of stocks as the also dipped this year.

Middle-Class Americans Most Likely to Leave Market

Although Americans in all income groups are less likely to have stock investments now than before the Great Recession, middle-class Americans have been the most likely to flee the market. Nearly three in four middle-class Americans, with annual household incomes ranging from $30,000 to $74,999, said they invested money in the stock market in 2007. Today, only half report having stock investments. This 22-percentage-point drop is more than double the changes seen in stock investing among higher and lower income groups.

| April 2007% | April 2016% | Change(pct. pts.) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| National adults | 65 | 52 | -13 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less than $30,000 | 28 | 23 | -5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $30,000 to $74,999 | 72 | 50 | -22 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $75,000 or more | 90 | 79 | -11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 18 to 34 | 52 | 38 | -14 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 35 to 54 | 73 | 62 | -11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 55+ | 65 | 56 | -9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 优蜜传媒Poll Social Series | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Adults younger than 35 are also less likely to invest since the recession. Slightly more than half (52%) said they invested money in the stock market in 2007. But nearly a decade later, fewer than four in 10 report investing in stocks. The 14-point dip for this group is the largest among all age groups; however, Americans aged 35 to 54 and those aged 55 and older each saw roughly double-digit decreases. Although many financial advisers say that young people should invest as much money as possible to maximize their long-term returns, the majority of 18- to 34-year-olds are not heeding that advice. Young adults are more likely to save their money or invest in real estate.

Bottom Line

While a slight majority of Americans report investing their money in the stock market, it's a far cry from pre-recession levels that spanned 58% to 65%. Confidence in the stock market and levels of financial literacy have clearly suffered in recent years, and investment rates lag significantly behind the overall rebound the market has made.

While Americans are likely still recovering from the fallout of the financial crisis, the market's behavior over the past year hasn't helped regain their confidence. The Dow's major drops in August and September of last year and again in January and February 2016 are now behind investors, but the unpredictability of its trajectory may have hampered the plans of potential investors to join them in the market. Fewer Americans -- particularly those in middle-income families -- are benefiting from the recent gains in stock values than would have been the case a decade ago.

Historical data are available in .

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted April 6-10, 2016, on the 优蜜传媒U.S. Daily tracking survey, with a random sample of 1,015 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is ±4 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 60% cellphone respondents and 40% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

View complete question responses and trends.

Learn more about how the works.