Story Highlights

- Residents in states with higher tax burden more likely to want to leave

- Connecticut and New Jersey residents most likely to want to leave state

- Montana residents least likely to want to leave state

WASHINGTON, D.C. -- Residents living in states with the highest aggregated state tax burden are the most likely to report they would like to leave their state if they had the opportunity. Connecticut and New Jersey lead in the percentage of residents who would like to leave their state.

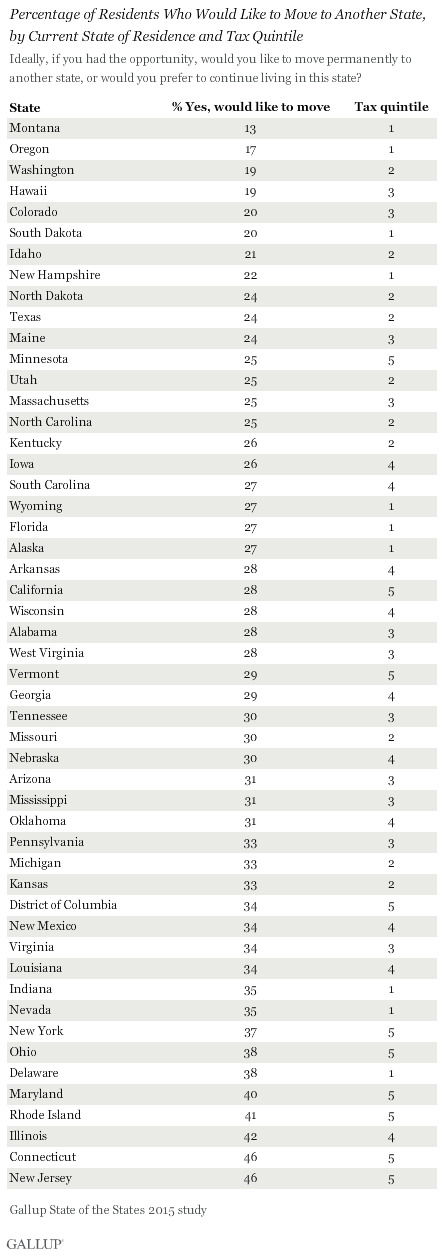

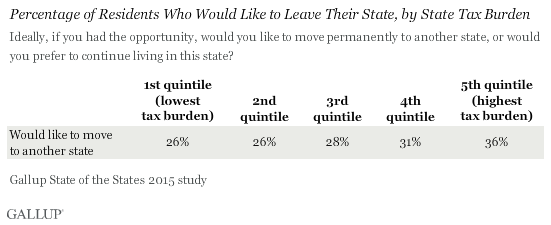

Tax burdens are based on Tax Foundation data. The aggregated state tax burden is based on the combined income, property and sales tax rates in each state. States are arranged into quintiles based on their 2015 state tax scores. States in the first quintile represent the 20% of states that have the lowest aggregated state tax burden, and states in the fifth quintile are the 20% of states with the highest aggregated state tax burden. A full list of the quintile assignments by state is included at the end of this article.

Approximately a quarter (26%) of residents who live in states with the lowest tax burden say they would like to leave their state. And this rate generally holds for residents in the second and third quintiles. However, there is a three-percentage-point increase to 31% among fourth-quintile states and an even greater jump to 36% among the fifth quintile. Even after controlling for various demographic characteristics including age, gender, race and ethnicity, and education, there is still a strong relationship between total state tax burden and desire to leave one's current state of residence.

The results are based on Gallup's 50-State poll, conducted March 30-Dec. 22, 2015, with approximately 500 respondents in every state. Full results for each state appear at the end of the article.

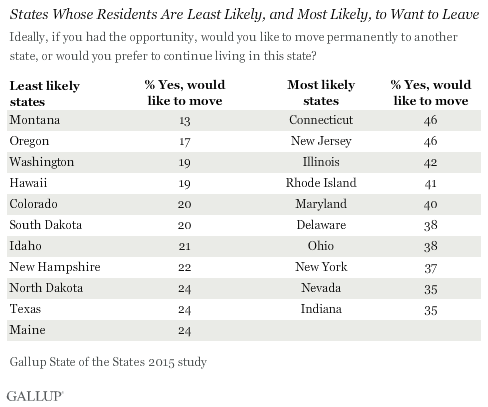

Connecticut and New Jersey Lead in Percentage of Residents Who Would Like to Leave

Nearly half (46%) of Connecticut and New Jersey residents say they would like to leave their state if they had the opportunity. At 13%, Montana has the smallest percentage of residents reporting they would like to leave the state.

Despite having a desire to leave one's state, few actually report that they intend to move permanently to another state. For example, only 12% of Connecticut residents who report they would like to move say they plan to do so in the next 12 months.

Implications

States with growing populations typically have strong advantages, which include growing economies and a larger tax base. 优蜜传媒data indicate that states with the highest state tax burden may be vulnerable to migration out of the state, putting them in jeopardy of missing out on some of these advantages.

States in the first, second and third quintiles have similar percentages of residents reporting they would like to leave their state; however, this percentage increases for residents living in states composing the fourth and fifth quintiles. These data suggest that even moderate reductions in the tax burden in these states could alleviate residents' desire to leave the state.

Survey Methods

Results are based on telephone interviews conducted March 30-Dec. 22, 2015, with random samples of approximately 500 adults, aged 18 and older, living in each of the 50 U.S. states and the District of Columbia. For results based on the total state samples, the margin of sampling error is 卤5 percentage points at the 95% confidence level.

Data are weighted to account for unequal selection probability, nonresponse and double coverage of landline and cellphone users in the two sampling frames. Data are also weighted to state estimates of gender, age, race, Hispanic ethnicity, education and phone status (cellphone only, landline only, both, and cellphone mostly).

Each sample of state adults includes a minimum quota of 60% cellphone respondents and 40% landline respondents. Landline and cellular telephone numbers are selected using random-digit-dial methods.