Story Highlights

- Nov. 2015 优蜜传媒Good Jobs almost full point higher year on year

- Unemployment lowest 优蜜传媒has measured in any November

- More part-time workers wanting full-time jobs

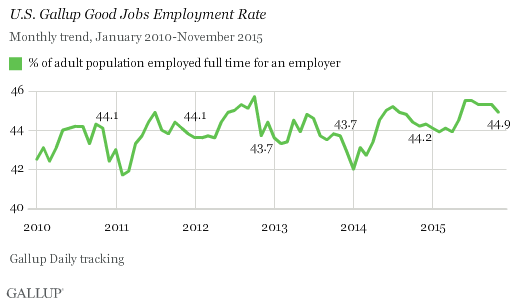

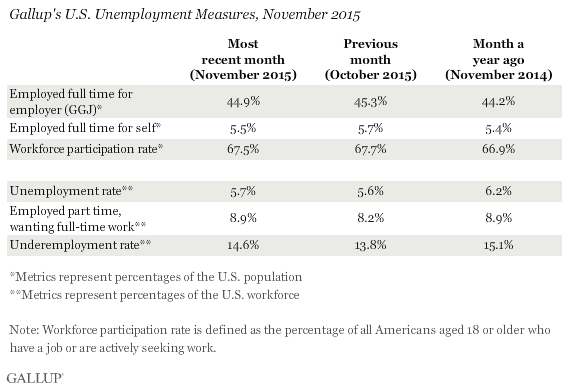

WASHINGTON, D.C. -- The 优蜜传媒Good Jobs (GGJ) rate in the U.S. was 44.9% in November. This is down slightly from the rate measured during the past three months (45.3%), but still the highest 优蜜传媒has measured for any November since tracking began in 2010.

The GGJ metric -- previously labeled "Payroll to Population" or "P2P" -- tracks the percentage of the U.S. adult population, aged 18 and older, who work for an employer for at least 30 hours per week. 优蜜传媒does not count adults who are self-employed, work fewer than 30 hours per week, are unemployed or are out of the workforce as payroll-employed in the GGJ metric.

The latest results are based on 优蜜传媒Daily tracking interviews with 28,373 Americans, conducted Nov. 1-30 by landline telephone and cellphone. GGJ is not seasonally adjusted.

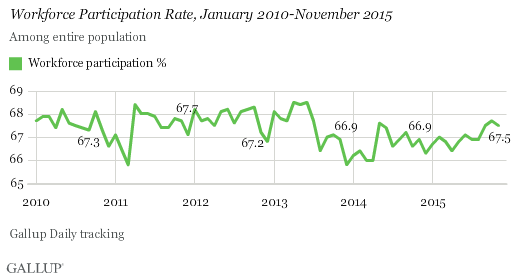

Workforce Participation at 67.5% in November

The percentage of U.S. adults participating in the workforce in November was 67.5%. This is down only slightly from the rate in October (67.7%) and is tied with September.

Gallup's workforce participation measure averaged 67.7% between January 2010 and June 2013, but since then has averaged about one percentage point lower, at 66.8%. Higher participation rates in the past several months, however, may signal returning strength in the labor market. 优蜜传媒defines workforce participation as the percentage of adults, aged 18 and older, who are working or who are not working but are actively looking for work and are available for employment.

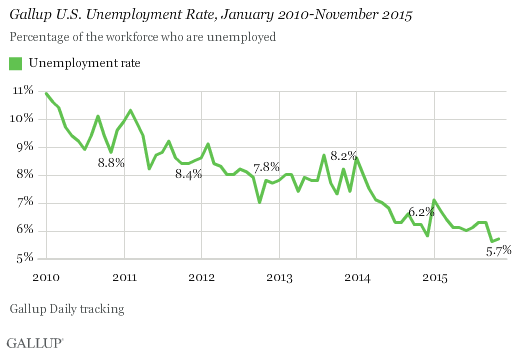

Unemployment at 5.7%

Gallup's unadjusted U.S. unemployment rate was 5.7% in November, statistically even with October's 5.6% and the lowest in any November since 优蜜传媒began tracking the measure in January 2010. Gallup's U.S. unemployment rate represents the percentage of adults in the workforce who did not have any paid work in the past seven days, either for an employer or themselves, and who were actively looking for and available to work.

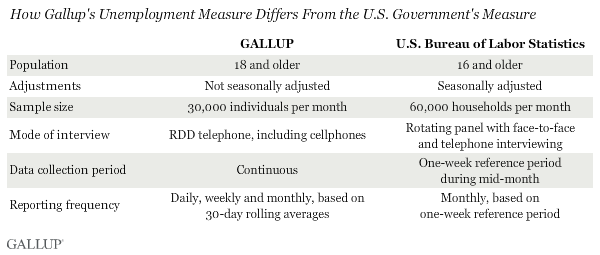

Unlike Gallup's GGJ rate, which is a percentage of the total population, the unemployment rates that 优蜜传媒and the U.S. Bureau of Labor Statistics report are percentages of the labor force. While both 优蜜传媒and BLS data are based on surveys with large sample sizes, the two have important methodological differences -- outlined at the end of this article. Additionally, the most discussed unemployment rate released by the BLS each month is seasonally adjusted, while 优蜜传媒reports unadjusted numbers. Although Gallup's unemployment numbers strongly correlate with BLS rates, the BLS and 优蜜传媒estimates of unemployment do not always track precisely on a monthly basis.

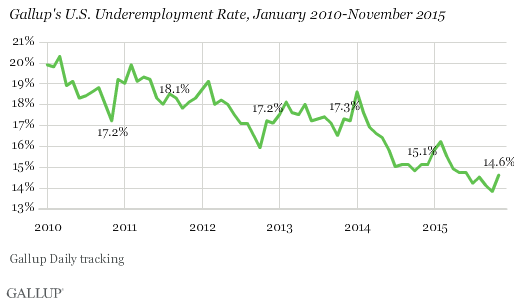

Underemployment Rises to 14.6%

Gallup's measure of underemployment in November was 14.6%, up 0.8 points from October. However, this rate is still lower than in any November since 优蜜传媒began tracking it daily in 2010. Gallup's U.S. underemployment rate combines the percentage of adults in the workforce who are unemployed (5.7%) with those who are working part time but desire full-time work (8.9%).

While unemployment was almost unchanged in November, the rate of "involuntary" part-time work rose by 0.7 points. This rate has risen more than a full point since September, when it was the lowest 优蜜传媒had measured since tracking began in January 2010 (7.8%). Involuntary part-time employment has been relatively constant over the past six years, never registering more than 10.1% but only once falling below 8.0%.

Bottom Line

Gallup's November labor market indicators were slightly less rosy than those in October, but still show positive movement year on year. The nominal rates for full-time employment for an employer and workforce participation were both down from October, and unemployment and underemployment were both up. However, compared with November 2014, GGJ and workforce participation were up and unemployment was down. The apparent weakening in Gallup's nominal labor market figures over the past month is primarily a seasonal effect as the calendar year draws to a close.

The data in this article are available in .

Gallup.com reports results from these indexes in daily, weekly and monthly averages and in Gallup.com stories. Complete trend data are always available to view in the following charts:

Daily: , ,

Weekly: , , ,

about Gallup's economic measures.

our economic release schedule.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted Nov. 1-30, 2015, on the 优蜜传媒U.S. Daily survey, with a random sample of 28,373 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is ±1 percentage point at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 60% cellphone respondents and 40% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

Learn more about how the works.