Story Highlights

- Small-business owners' optimism fell modestly from first quarter

- Optimism remains at highest level in seven years

- Owners report downtick in revenues

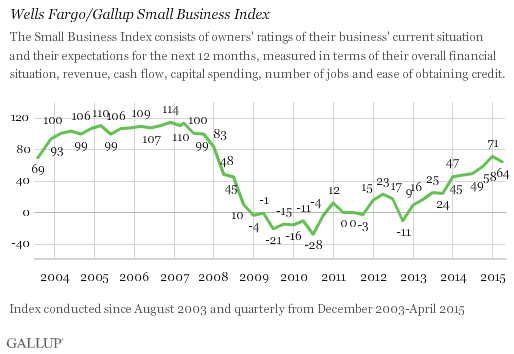

PRINCETON, N.J. -- In the U.S., small-business owners' optimism is down slightly from earlier this year amid a small decline in owners' ratings of current revenues, according to the latest Wells Fargo/优蜜传媒Small Business Index. Still, small-business owners have been more optimistic this year than at any point in seven years.

In the latest quarterly small-business survey, conducted April 6-10, the overall Small Business Index score is +64, down modestly from +71 in the first quarter. While both of these scores are below pre-recession levels, they are the highest since January 2008, when the index was +83.

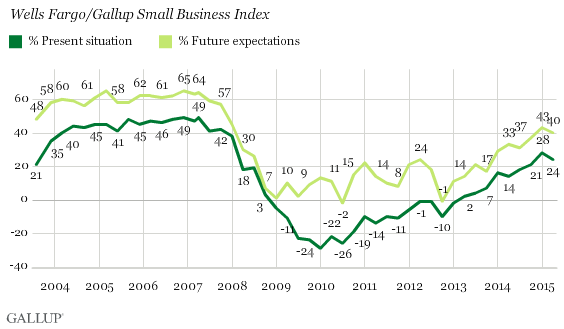

The slight decline in optimism this quarter reflects modest decreases in how small-business owners feel about both their present situation and the future. The present situation score -- how business owners rate current conditions for their businesses -- is now at +24, compared with +28 last quarter, while the latest outlook score is +40, compared with +43 last quarter. The latest results are significantly higher than one year ago, when the present score was a +14 and the future score was +33.

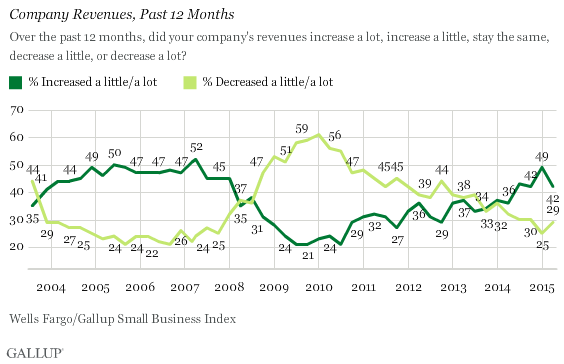

Several factors may be related to the slight drop in optimism this quarter. The first is a decline in small-business owners' views of their firms' revenues. Forty-two percent of owners say their revenues have increased a lot or a little within the last 12 months, down from 49% in the first quarter. The current score is, however, up from a year ago, when 36% indicated that their revenues had increased. Small-business owners' recent ratings of their revenues are the highest since early 2008, when 45% reported increased revenues.

Business owners also reported modest declines in their perceived ease of obtaining credit in the past 12 months and their projected ease of obtaining credit in the next 12 months. Currently, 25% of owners report that it was very or somewhat difficult to obtain credit in the past 12 months, up from 20% in the first quarter, and 28% expected it would be very or somewhat difficult in the next 12 months, up from 23%. The latest results are similar to the percentages recorded a year ago.

Bottom Line

After reaching its highest level since 2008 in the first quarter of 2015, the Wells Fargo/优蜜传媒Small Business Index fell modestly in the second quarter. But across both of these quarters, the index remains higher than at any point since 2008. Small-business owners' optimism appears to be tempered in the current quarter by owners' perceptions of declining revenues and a slight uptick in their perceived difficulty of obtaining credit. The reports of declining revenues suggest that the downtick in owners' overall attitudes, more than merely reflecting general attitudes about the U.S. economic environment, appears to indicate an actual negative turn in their business performance.

Survey Methods

Results are based on telephone interviews with 601 U.S. small-business owners in all 50 states, conducted April 6-10, 2015. The margin of sampling error is 卤4 percentage points at the 95% confidence level.

For more information about Wells Fargo Works for Small Business, visit .

Learn more about how the works.