Story Highlights

- 40% positive about finances now and in retirement

- 30% negative about finances now and in retirement

- Outlook has improved since bottoming out in 2012

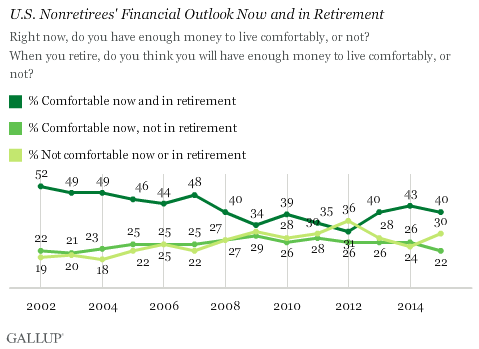

PRINCETON, N.J. -- Four in 10 U.S. nonretirees report they have enough money to live comfortably now and expect they will have enough to live comfortably when they retire. This percentage is improved from 31% in 2012, but it is still below pre-recession levels. Meanwhile, a still-elevated 30% of nonretirees say they are not living comfortably now and do not expect to be in retirement.

Additionally, there are two smaller groups who predict that their financial situation will change between now and retirement. The larger of these -- representing 22% of all U.S. nonretirees -- report having enough to live comfortably now but do not expect to do so after they retire. The percentage in this group peaked at 29% in 2009.

The smaller group, those who say they are not living comfortably now but expect to be in retirement, has ranged between 6% and 10% of nonretirees since 2002 and is currently at 8%.

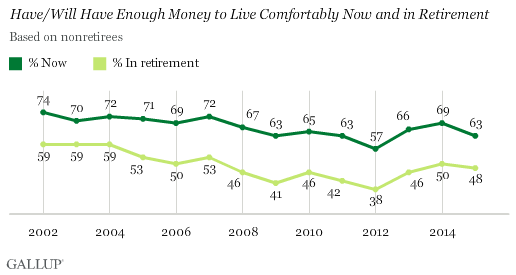

These results are based on data from Gallup's annual Economy and Personal Finance poll, conducted April 9-12. That poll asks all Americans whether they have enough money to live comfortably right now. Currently, 66% of all Americans, including 63% of nonretirees, say they do. Both figures are up but are still not back to where they were before the economic downturn.

Separately, nonretirees are asked if they think they will have enough to live comfortably when they retire. Forty-eight percent of all nonretirees currently think they will, which is again improved from the immediate post-recession years but .

Over time, nonretirees have been consistently more positive about their current financial situation than about their situation after they retire, perhaps because of the uncertainty about the future and what .

Financial Outlook Similar by Age of Nonretirees

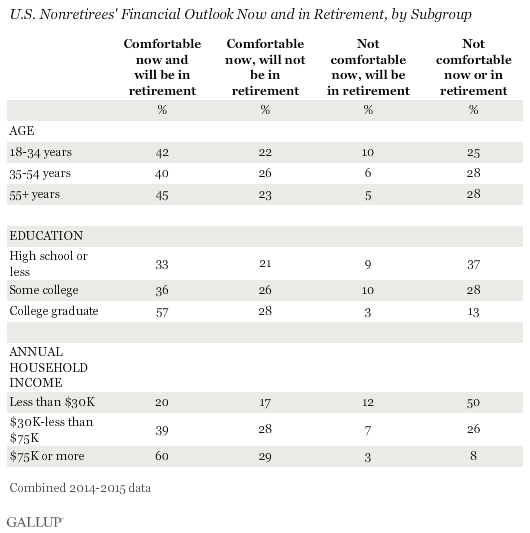

Perceptions of current and future finances are similar among those nearing retirement and those who are farther away from it. Between 40% and 45% of nonretirees in all age groups are positive about their ability to live comfortably both now and in retirement, while between 25% and 28% are pessimistic on both questions. Those figures are based on combined data from the 2014 and 2015 surveys.

The major differences in nonretirees' financial outlook are by socioeconomic status, that is, their education and household income level. Roughly six in 10 college graduates and those with higher annual incomes expect their current comfortable financial situation to continue in retirement. Meanwhile, the plurality of those with a high school education or less, and half of those whose annual household income is less than $30,000, say they are not living comfortably now and do not expect that to change when they retire.

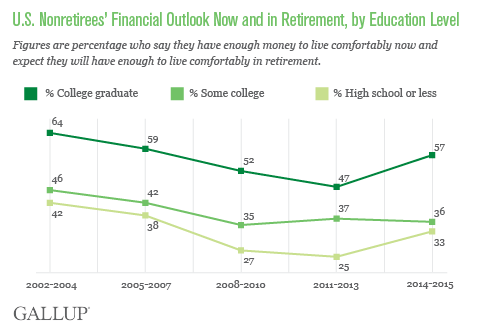

College graduates' assessments are nearly back to where they were before the recession. From 2005 to 2007, an average of 59% of nonretired college graduates said they had enough money to live comfortably now and believed they would in retirement. Over the past two years, the average is 57%. But those with some college education, or a high school diploma or less, still trail where they were before the recession, by six percentage points and five percentage points, respectively.

Implications

Americans' financial security was clearly shaken during the 2007-2009 recession and the ensuing years of high unemployment and sluggish economic growth. Now that the economy has picked up steam, Americans are much more upbeat about their current and future financial situation. However, when asked whether they have enough money to live comfortably now, and if they expect to be comfortable financially in their retirement years, U.S. nonretirees are still not as positive as they were before the recession. Further, it appears those of a lower socioeconomic status are further from a full recovery than those of a higher socioeconomic status, whose financial assessments are nearly as positive now as they were before the recession.

Given the prominence of 401(k) and other stock investment plans as an expected , and that stock values have more than made up the value they lost during the recession, one would think that Americans should be as positive about their current and "golden years" finances as they were a decade ago. However, recent Wells Fargo/优蜜传媒Retirement surveys have found that U.S. investors themselves are a bit as a place to grow one's savings. Also, investors widely favor that provide lower returns in their retirement accounts over riskier investments with greater growth potential. To these points, the percentage of Americans who is still well below where it was before the recession.

Nonretirees who are somewhat averse to investing in stocks and who are increasingly likely to see as a major source of retirement income may not believe their retirement nest egg will be large enough to afford them a comfortable lifestyle after they stop working.

The data in this article are available in .

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted April 9-12, 2015 with a random sample of 652 nonretirees, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of nonretirees, the margin of sampling error is ±5 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

View complete question responses and trends.

Learn more about how works.