Story Highlights

- Investor Optimism Index at +48 in November, same as +46 in August

- Economic dimension of the index improved slightly

- Retirees' optimism swelled to roughly match nonretirees'

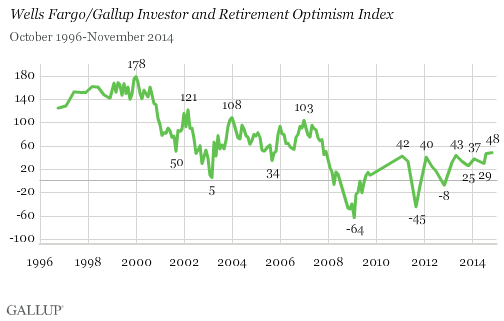

PRINCETON, N.J. -- Prior to the recent slide in the stock market, American investors' mood remained fairly upbeat this quarter, with the Wells Fargo/优蜜传媒Investor and Retirement Optimism Index coming in at +48 in mid-November, similar to the +46 reading in August. While still far from the +178 high point recorded in early 2000, the index is notably improved from +25 a year ago and at a seven-year high.

The fourth quarter Wells Fargo/优蜜传媒Investor and Retirement Optimism Index is based on a nationally representative telephone survey of 1,009 U.S. adults with $10,000 or more in investable assets, conducted Nov. 14-23, 2014. About two in five American households have at least $10,000 in savings and investments.

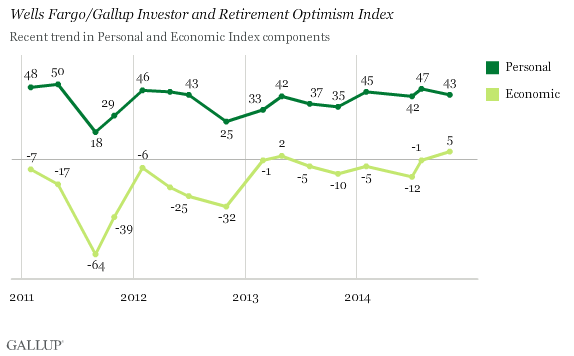

The index has two components: economic and personal. The economic dimension improved slightly this quarter, rising to +5 from -1. At the same time, the personal dimension was steady but positive at +43 versus +47 in August.

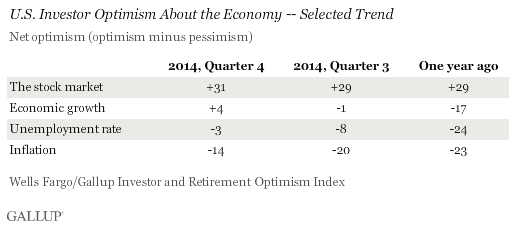

The economic dimension is based on investors' expectations about the performance of four aspects of the economy over the next year. Of these, investors' are most upbeat about the stock market, with a net optimism score of +31 (out of a possible +200), similar to +29 last quarter. 优蜜传媒also finds positive net optimism about economic growth, at +4 up from -1. Investors' ratings of unemployment (-3) and inflation (-14) are lower but slightly improved from August.

Compared with a year ago, investor optimism has shown some improvement on all dimensions except for the stock market, which is about as positive today as it was then.

Personal Financial Outlook Flat but Positive

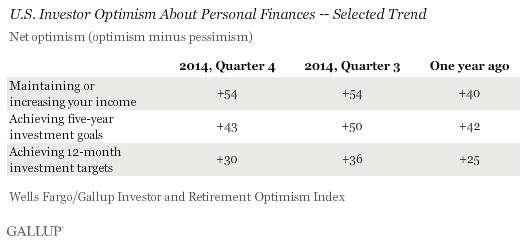

On the personal dimension, the fourth quarter survey finds investors quite optimistic about their ability to maintain or increase their income in the next 12 months (+54). That is similar to last quarter, but up 14 points from a year ago. At the same time, the +43 net optimism score for achieving five-year investment goals and +30 for achieving 12-month investment targets have shown less change in the past year.

Outlook Improves Among Retired Investors

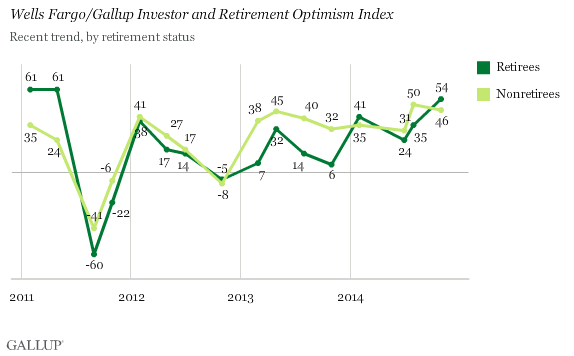

After trailing nonretirees' optimism last quarter, the level among retired investors rose 19 points in November to +54, edging past nonretired investors' optimism, which fell slightly this quarter to +46. This marks only the third time in three years that retirees' optimism has exceeded nonretirees'.

Retirees' increased optimism reflects major gains in their confidence on all four aspects of the economic dimension, with no improvement in their personal dimension ratings. While the reason for this is unclear, it could reflect retirees' greater exposure to the stock market given their higher average asset level and reliance on investments for current income. The performance of the stock market in the fourth quarter, bouncing back in November after plunging in October, may have encouraged retirees to feel better about the economy overall at the time of the survey.

Bottom Line

Investors have had some scares in 2014, with significant market declines in January, July, October and now December interrupting an otherwise encouraging market ride. Also, retirees who are reliant on interest income have had to endure another year of low rates, possibly hampering their overall outlook. At the same time, recent strength in the economy and labor market may be helping to offset concerns about low interest rates with some investors.

Whatever forces are at play, investors, overall, managed to remain fairly optimistic in the past quarter, at a level slightly better than a year ago and the highest the Wells Fargo/优蜜传媒Investor and Retirement Optimism Index has reached since 2007. Whether that continues into early 2015 will greatly depend on whether the latest market turbulence is as short-lived as the prior episodes this year, or if it proves to be the beginning of the end of the bull market.

Survey Methods

Results for the Wells Fargo/优蜜传媒Investor and Retirement Optimism Index survey are based on questions asked Nov. 14-23, 2014, on the 优蜜传媒Daily tracking survey, of a random sample of 1,009 U.S. adults having investable assets of $10,000 or more.

For results based on the entire sample of investors, the margin of sampling error is 卤3 percentage points at the 95% confidence level.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

Learn more about how the works.