Story Highlights

- Americans with new exchange-obtained insurance are positive

- The newly insured are more satisfied with costs than others

- Most will renew their policies; few will drop insurance

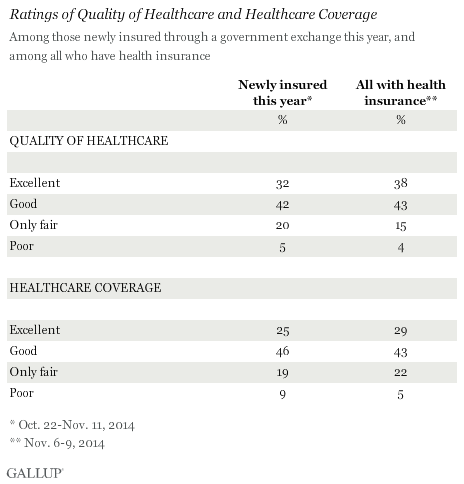

PRINCETON, N.J. -- Over seven in 10 Americans who bought new health insurance policies through the government exchanges earlier this year rate the quality of their healthcare and their healthcare coverage as "excellent" or "good." These positive evaluations are generally similar to the reviews that all insured Americans give to their health insurance.

Among those who bought new health insurance policies through the exchanges, the majority are about as satisfied with their coverage and healthcare as are other Americans -- suggesting that the end result of the exchange enrollment process is a generally positive one for those who take advantage of it. Americans who still lack health insurance will have the opportunity to buy coverage when the national insurance marketplace exchanges open again on Nov. 15.

These data reflecting newly insured Americans' attitudes toward their healthcare coverage are based on interviews conducted Oct. 22 through Nov. 12 on 优蜜传媒Daily tracking. 优蜜传媒asked all Americans with health insurance if their coverage was new for 2014, and if so, whether they had obtained their coverage through federal or state exchanges. About 4% of the adult population classify themselves as being newly insured this year through the exchanges. The comparison group of all Americans with insurance is from Gallup's annual healthcare survey, conducted this year Nov. 6-9.

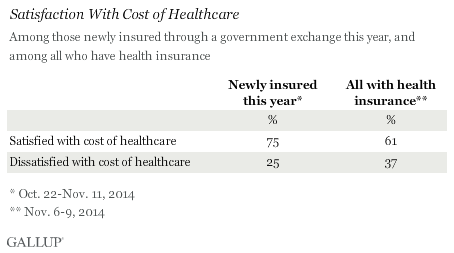

In addition to newly insured Americans rating their coverage and the quality of their healthcare positively, they are more satisfied than the average insured American with the cost of their health coverage. Three in four of the newly insured say they are satisfied with this aspect of their healthcare experience, compared with 61% among the general population of those with insurance. To some degree, this could reflect the fact that many who get insurance through the exchanges receive government subsidies to help reduce the overall cost of their health insurance.

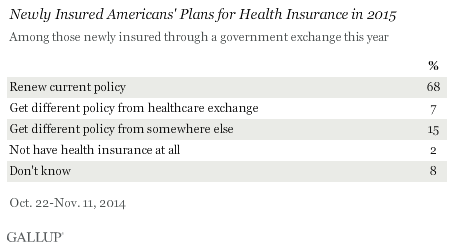

Newly insured Americans' positive attitudes toward their health coverage are manifested in their coverage intentions going forward. Among those who bought a new policy through a government exchange this year, 68% say they will renew their current policy, while 7% say they plan to get a different policy through a state or federal exchange. Meanwhile, 15% say they will get a different policy from another source, and 2% say they will drop their health insurance altogether.

Bottom Line

Americans who obtained new health insurance policies in 2014 using the government exchanges are roughly as positive about their healthcare coverage and the quality of healthcare they receive as the average insured American, and are more satisfied with the cost of their coverage. More than two-thirds of the newly insured who purchased coverage through federal or state exchanges intend to renew their exchange policies, while another 7% plan to look for a different policy through the exchanges.

As the healthcare exchanges reopen on Nov. 15, these data suggest that the currently uninsured will mostly be pleased with the outcome if they opt to use the exchanges to obtain insurance on this second go-around.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted Oct. 22-Nov. 12, 2014, on the 优蜜传媒U.S. Daily survey, with a random sample of 407 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia, who are newly insured in 2014 through a government health insurance exchange.

For results based on this sample, the margin of sampling error is 卤6 percentage points at the 95% confidence level.

Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

View complete question responses and trends.

Learn more about how the works.