Story Highlights

- Spending intentions point to a nearly 4% increase in sales

- Smallest percentage since 2007 will spend less than last year

- October reading preliminary; November's results most telling

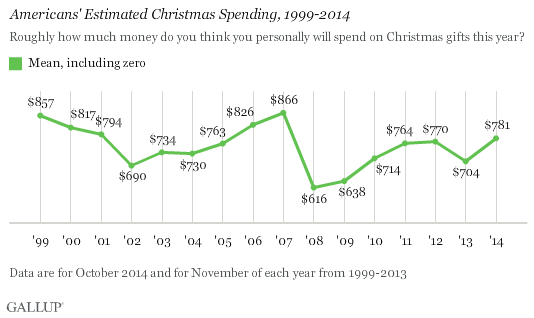

PRINCETON, N.J. -- Americans' initial estimates of the total amount they will spend on Christmas gifts this year point to an above-average holiday season for the nation's retailers. While Gallup's October spending forecast is a warm-up to its key measure in November, it finds Americans expecting to spend $781, on average, up from $704 last November.

The current figures are based on an Oct. 12-15 优蜜传媒poll of 1,017 U.S. adults, aged 18 and older.

These preliminary projections are positive, but it is important to note that Americans' estimates of the total amount they will spend on gifts can change as the holiday season progresses. Last year, Americans' average spending estimate fell by about $80 between October and November, and in 2008 and 2009, 优蜜传媒saw sharp declines in intended spending. By contrast, in 2011, the estimate rose by about $50 between October and November. In 2010, it stayed exactly the same.

Americans' Assessments of Their Spending Supports Optimism

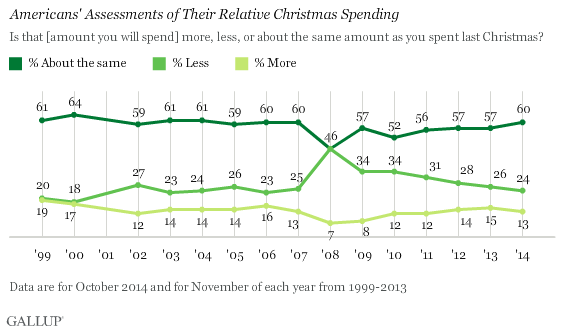

Underscoring this relatively upbeat preliminary forecast for retailers is that Americans' comparison of their projected holiday spending this year to what they spent last year is slightly more positive today than in November 2013. In fact, it is one of the most positive assessments Americans have given about their holiday spending since 2007 -- right before the U.S. sank into the last recession.

While most Americans, 60%, say they will spend the same amount on gifts this year as in 2013, the percentage saying they will spend less is now 24%, slightly below last November's 26%. By way of comparison, this figure reached 46% in November 2008 as U.S. consumers were reeling from the unfolding financial crisis, and remained above 30% in November readings from 2009 to 2011.

Few Americans ever concede they will spend more on gifts than they did the year prior, and that remains the case today, with 13% saying this -- about average for the past decade.

Gallup's November Christmas Forecasts Align With Hard Retail Data

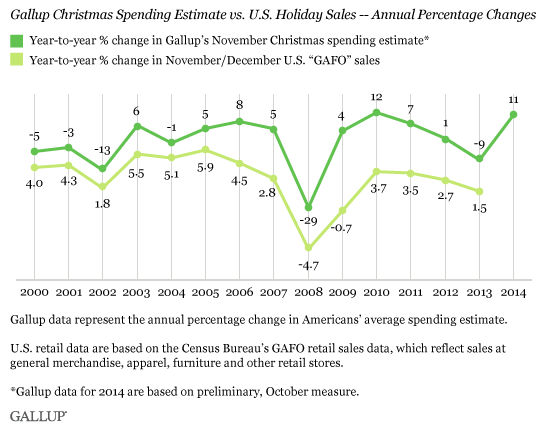

The relationship between Gallup's Christmas spending estimates and actual holiday retail sales is complex, and not always precise. Still, 优蜜传媒has been measuring U.S. Christmas spending intentions since 1999, and over that time, the November estimate has been particularly useful in forecasting changes in holiday sales. In years when consumers' projected holiday spending has been either flat or up slightly -- such as 优蜜传媒finds today -- actual retail sales tend to be fairly strong.

If Americans' Christmas spending intentions hold at the current level into November -- which hasn't always been the case -- Gallup's model suggests that 2014 holiday spending could grow by 3.8% or better over last year's level. That is above the average 2.8% increase in holiday GAFO sales since 2000. It is also similar to the 4.1% 2014 holiday spending growth estimate issued by the National Retail Federation earlier this month.

Bottom Line

U.S. consumers remain less extravagant in their Christmas shopping intentions than they were immediately prior to the recession, when expecting to spend $800 or more on average on gifts was the norm. But they are approaching that level today. If consumers' higher estimates persist into November, this points to a strong holiday shopping season. However, it is worth noting that the current estimate is nearly identical to what 优蜜传媒found in October 2013, and that estimate fell significantly in November, accurately foretelling that last year's increase in consumer spending would be rather anemic.

While no single aspect of the economy this year might be credited with boosting consumers' current Christmas budget, has been on an even keel for over a year now, with no major economic or political crisis throwing it too far off track, and this may be increasing Americans' willingness to splurge at this time of year. Similarly, while Americans' normal reports have not increased in the past year, they have been steady at a high level relative to where they were in the prior recession-tinged years.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted Oct. 12-15, 2014, with a random sample of 1,017 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of national adults, the margin of sampling error is 卤4 percentage points at the 95% confidence level.

Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

View survey methodology, complete question responses, and trends.

Learn more about how the works.