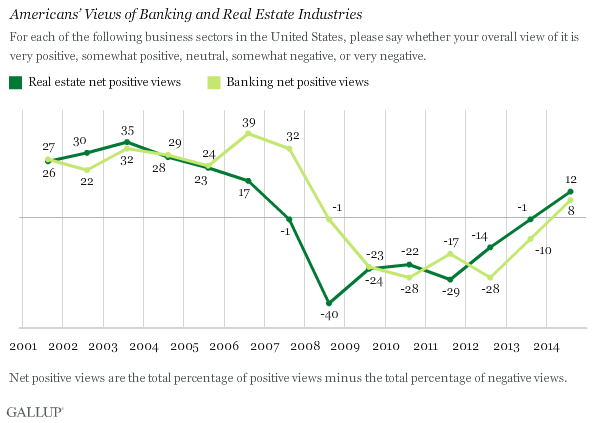

WASHINGTON, D.C. -- Americans' views of the banking industry are positive for the first time since 2007, at a net positive rating of 8. The public also has an improved view of the real estate industry (12), marking the first time Americans' image of this industry has been positive since 2006. Net positive views of banking increased 18 points from 2013, while opinions of real estate rose 11 points.

Each year since 2001, ���۴�ýhas asked Americans to rate 24 different business sectors and industries on a five-point scale ranging from "very positive" to "very negative." The net ratings are the difference between the positive and negative ratings for each industry, reflecting Americans' overall attitudes toward each industry. The most recent data were collected from Aug. 7-10 as part of Gallup's annual Work and Education poll.

The , up significantly from previous years. The images of both the banking and real estate industries remain below the overall average, continuing a pattern seen since 2007.

Americans' views of the banking and real estate industries worsened from 2003 to 2005. While views of banks then improved and reached a high of 39 in 2006, net positive views of real estate continued to deteriorate and fell into negative territory in 2007. Its image plummeted in 2008 to -40, the lowest ���۴�ýhas found for the real estate industry. In late 2006, real estate prices in the U.S. began falling rapidly, and continued to drop. Many homeowners saw their home values plummet, likely contributing to real estate's image taking a hard hit.

Views of the banking industry did not worsen until 2008 and did not plunge deeply into negative territory until 2009. Many banks suffered financially as a result of falling home prices as some were heavily involved in offering risky mortgage loans, and thus closed or faced significant hardship in 2008 and 2009. This may have been a key reason why Americans' image of the banking industry overall went downhill.

The large drops in the positive images of banking and real estate in 2008 and 2009 reflect both industries' close ties to the recession, which was precipitated in large part because of the mortgage-related housing bubble. U.S. government programs like TARP (Troubled Asset Relief Program) provided government money to banks, credit markets, and the automobile industry to stabilize these markets during the recession. At the time, , claiming it would waste tax payer dollars, which may have negatively affected views of the industries -- like the banking and real estate industries -- that benefited from the program. However, recent reports indicate that TARP did help stabilize the economy, with the government recovering much of its investment.

Americans viewed banks and the real estate industry negatively from 2008 through 2013. The real estate industry started to recuperate in 2012, and views of the banking industry grew more positive in 2013.

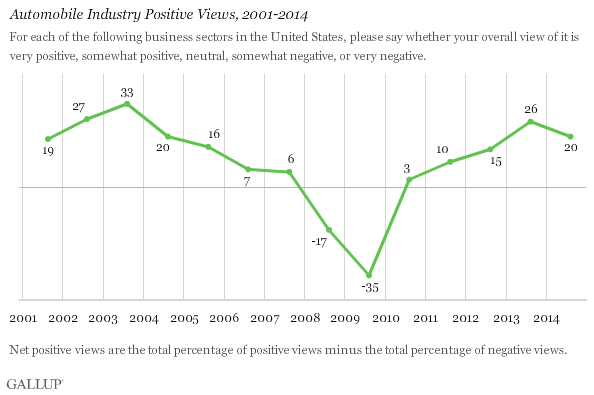

Views of Automobile Industry Also Deteriorated From 2008 Through 2009

Americans have a more positive view of the automobile industry than they do for either banking or real estate. The automobile industry this year has a net positive view of 20, down slightly from 26 last year, but still well above where it was during the recession. Prior to the recession, Americans viewed the automobile industry positively.

The recession hit the automobile industry hard, with three of America's largest companies requesting government bailouts to avoid bankruptcy. While Americans' views for , the -17 and -35 net positive views for the automobile industry in 2008 and 2009, respectively, were significantly below the industry's ratings before the bailouts. The is one of the largest and most rapid ���۴�ýhas found. Increasing car sales may have spurred part of this improvement. Many reports say auto sales returned to prerecession levels in 2013, and the bailouts have ended. This financial improvement in the automobile industry seems to coincide with the improvement in Americans' views of the industry.

Bottom Line

The positive images of , including three business sectors that the recession most directly affected: banking, real estate, and the automobile industry. The real estate and banking industry both have positive images for the first time since before the recession. Americans' views of the automobile industry reached positive territory in 2010 and have bounced back to prerecession levels. Although the images of banking and real estate remain below the average of 24 industries ���۴�ýhas tracked, their sharp recovery from their previous extreme low points suggests they are heading in the right direction.

Survey Methods

Results for this ���۴�ýpoll are based on telephone interviews conducted Aug. 7-10, 2014, with a random sample of 1,032 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

Each industry was rated by a randomly selected half sample of respondents. The sample sizes for each industry are approximately 500 national adultsor results based on the total sample of national adults. The margin of sampling error is ±5 percentage points at the 95% confidence level for each industry.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, and cellphone mostly). Demographic weighting targets are based on the most recent Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the most recent National Health Interview Survey. Population density targets are based on the most recent U.S. census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit .