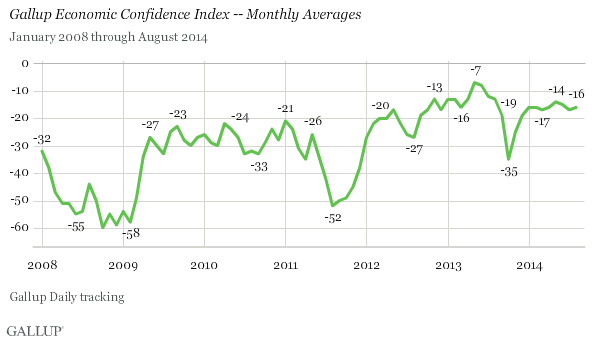

WASHINGTON, D.C. -- Gallup's U.S. Economic Confidence Index was steady at -16 in August. This score falls within the -14 to -17 range that the monthly averages have been in throughout 2014, including -17 in July.

The three-point range in monthly economic confidence this year does not appear to be the norm, given the wide month-to-month variations in previous years. In 2013, for example, the index rose to as high as -7 in May before falling to -35 in October -- down 16 points from the previous month -- during the partial government shutdown.

Weekly economic confidence was -17 for the week of Aug. 25-31, 2014, consistent with . Weekly averages have been almost as stable as the monthly averages, with only that was larger than five points.

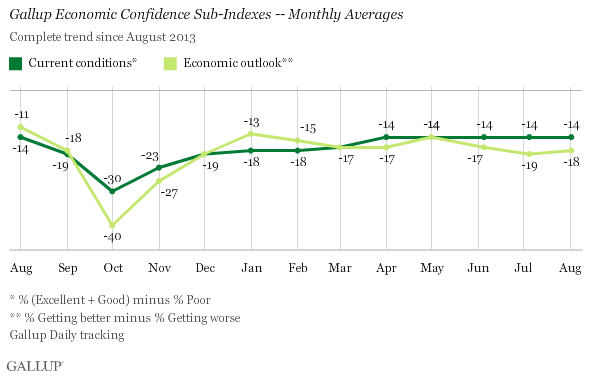

Gallup's Economic Confidence Index is the average of two components: how Americans view current economic conditions and their perception of whether the economy is getting better or worse. In August, 20% said the economy is "excellent" or "good," while 34% said it is poor. This resulted in a current conditions index score of -14, the same current conditions score found for five consecutive months.

Economic outlook has varied a bit more over the past six months, ranging from -14 to -19, although still a much narrower range than in previous years. In August, 38% of Americans said the economy is getting better, while 56% said the economy is getting worse. This resulted in an economic outlook score of -18, similar to the -19 in July.

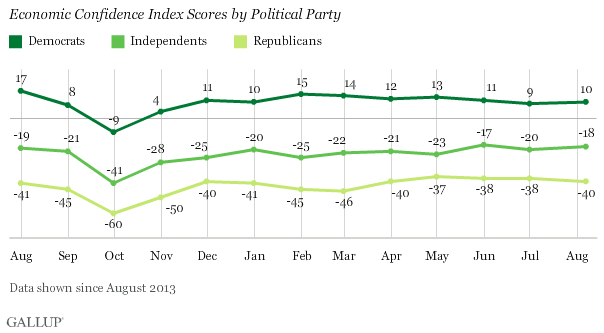

Democrats Continue to Have More Economic Confidence

As the midterm election approaches, Democrats continue to have much higher economic confidence (+10) than Republicans (-40), with independents in between (-18).

Since February 2009, when partisan views about the economy flipped after the , Democrats have been more positive about the economy than Republicans and independents. This is consistent with the historical pattern in which partisans whose party occupies the White House are much more positive about the economy than the other party.

Further, in contrast to independents' and Republicans' net-negative view of the economy, Democrats' economic confidence score has been at least slightly positive . The only exception to that occurred in October 2013 when it dipped to -9, as confidence dropped for all parties during the government shutdown.

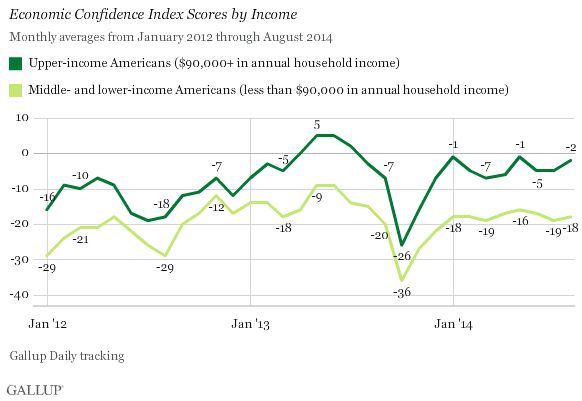

Upper-Income Americans Continue to Be More Confident

Americans with an annual household income of $90,000 or more continue to have more economic confidence than those who reside in households with less annual income. Upper-income Americans had an index score of -2 in August, up slightly from -5 the past two months. Lower- and middle-income Americans, on the other hand, averaged -18, similar to -19 in July.

Americans in upper-income households have consistently viewed the economy more positively than those in lower-income households since 优蜜传媒began tracking the measure in 2008. However, Americans in households with different incomes tend to gain and lose confidence at the same time, typically in response to news about the economy or major political events. Upper-income Americans had positive economic confidence in May through July 2013 and have approached that point twice in 2014. By contrast, since 2008, the highest score that lower-income Americans reached was -9 in May and June 2013, after which it fell to -36 -- and it has yet to exceed -16 this year.

Implications

Despite strong stock market gains, as well as more robust consumer and increased , Americans' economic confidence continues to be flat. While Democrats and upper-income Americans are the most positive about the economy, other Americans lag behind. In recent months, Americans have been a bit more negative about the direction of the economy than they have been about current economic conditions. However, economic confidence as a whole has remained consistent.

Gallup.com reports results from these indexes in daily, weekly, and monthly averages and in Gallup.com stories. Complete trend data are always available to view and export in the following charts:

Daily: , ,

Weekly: , , ,

about Gallup's economic measures.

our economic release schedule.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted Aug. 1-31, 2014, on the 优蜜传媒Daily tracking survey, with a random sample of 15,170 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of national adults, the margin of sampling error is 卤1 percentage point at the 95% confidence level.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, and cellphone mostly). Demographic weighting targets are based on the most recent Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the most recent National Health Interview Survey. Population density targets are based on the most recent U.S. census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit .