This article is part of an ongoing series exploring in-depth trends in Americans' consumer spending habits.

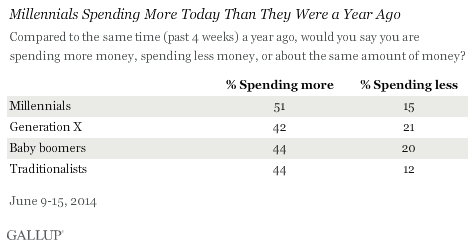

WASHINGTON, D.C. -- Forty-five percent of Americans say they are spending more today than they were a year ago, while 18% say they are spending less. Across several demographic categories, the percentage of people who say they are spending more is relatively stable. Among the groups most likely to say they have increased their spending is millennials. Members of Generation X are least likely to say they are spending more.

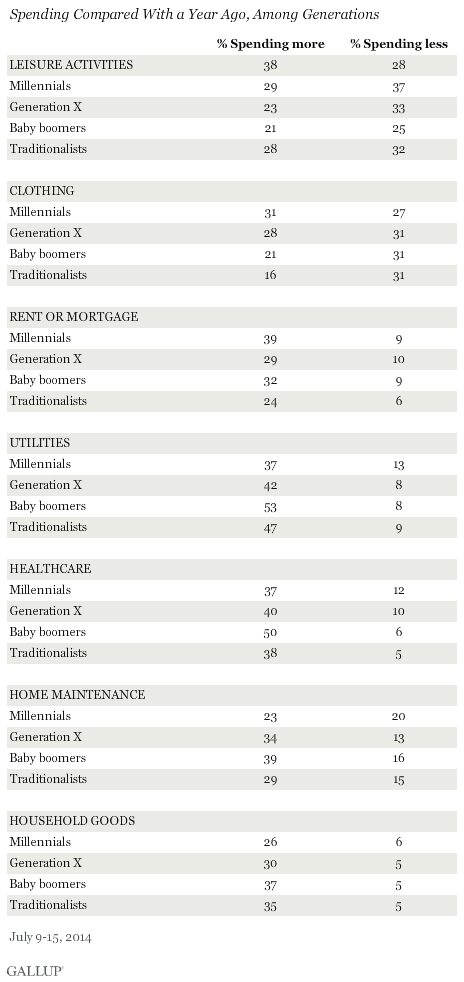

Among the generations, the youngest Americans (millennials) are more likely than the oldest Americans (Traditionalists) to report spending more this year than a year ago on rent or mortgage (39% for millennials vs. 24% for Traditionalists), leisure activities (38% vs. 21%), and clothing (31% vs. 16%). The other generational groups' spending reports fall midway between these two.

Despite a majority of baby boomers saying they are less willing to spend this year in general, they are spending significantly more than they did a year ago compared with millennials on household essentials such as utilities (53% for baby boomers vs. 37% for millennials), healthcare (50% vs. 37%), home maintenance (39% vs. 23%), and household goods (37% vs. 26%). Again, the other generational groups fall in between these two. Fewer millennials say they are spending more on these categories than any other generation.

Notably, millennials' increased spending on discretionary items on essential items at the expense of discretionary spending. This may be because younger people can generally spend more on discretionary items, if they have lower housing costs and are not providing for children.

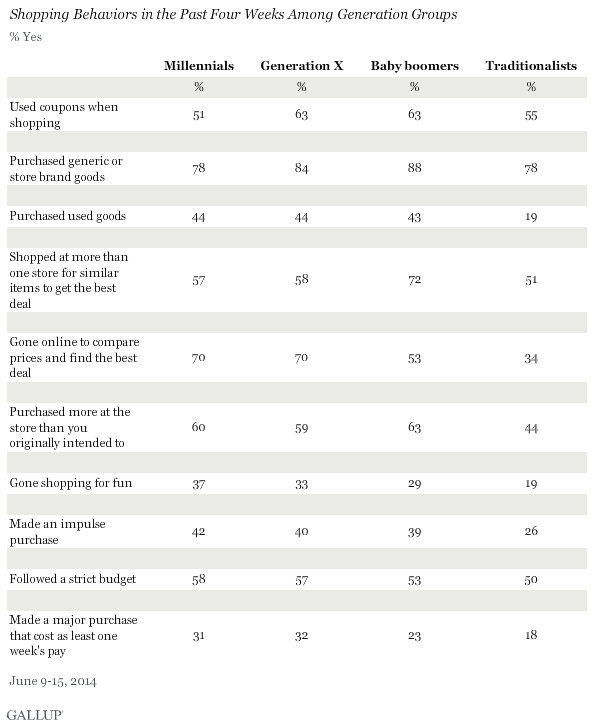

The generations also differ in the ways they try -- or fail -- to cut expenses. As one might expect, members of Gen X and millennials are both significantly more likely than the older generations to go online to compare prices (70% for members of Gen X and millennials). Baby boomers are significantly more likely than other generations to say they shop at more than one store for similar items to get the best deals (72%). Traditionalists are much less likely than any of the others to purchase more at the store than they intended to (44%), to go shopping for fun (19%), and to make an impulse purchase (26%).

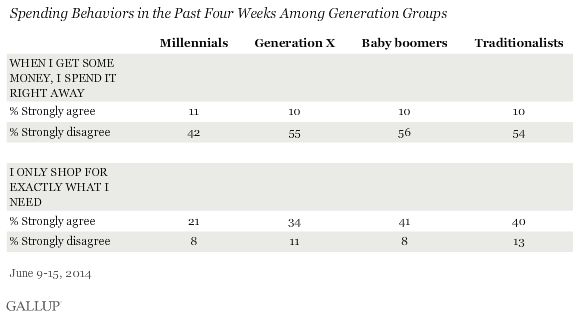

The data also suggest that millennials are more freewheeling and impulsive in their shopping behavior. Significantly fewer millennials strongly disagree with the statement, "When I get some money, I spend it right away" (42%) than any of the other generations. Moreover, fewer millennials strongly agree with the statement "I only shop for exactly what I need" (21%), compared with the other generations.

Implications

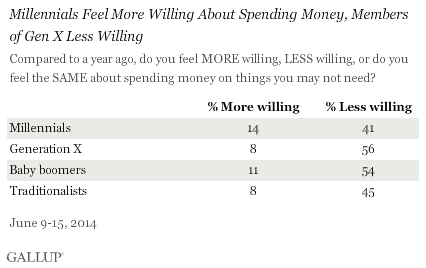

The general poll finding that Americans are , appears, in part, to be driven by baby boomers' spending. More than half of all members of Gen X and baby boomers are less willing to spend this year compared with last year, but baby boomers nonetheless find themselves spending more this year on essentials like utilities, home maintenance, household goods, and healthcare. This compares with generally low numbers of baby boomers saying they are spending more on discretionary items like leisure activities and clothing.

With baby boomers still commanding a substantial share of consumer spending, until they are more willing to spend on discretionary items, their increased spending will probably do little to aid an ailing economy. On the other hand, the generation that appears to be bucking that trend is millennials. They say they are spending more in some discretionary spending categories such as leisure activities and clothing. Millennials' share of the marketplace is also substantial; these younger consumers are beginning to do their part to help the economy improve.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted June 9-15, 2014, with a random sample of 1,029 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of national adults, the margin of sampling error is 卤4 percentage points at the 95% confidence level.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, and cellphone mostly). Demographic weighting targets are based on the most recent Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the most recent National Health Interview Survey. Population density targets are based on the most recent U.S. census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit .