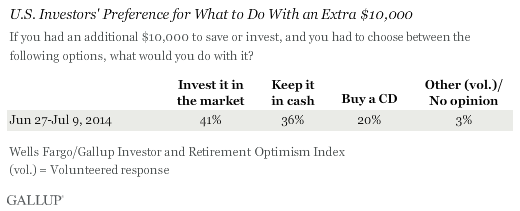

PRINCETON, NJ -- Amid a strong bull market that drove the S&P 500 up 30% in 2013 and has continued to produce gains, fewer than half of U.S. investors -- 41% -- say that if given an additional $10,000 to save or invest, they would put it in the stock market. Just over a third, 36%, would hold it in cash, while 20% say they would purchase a CD with it.

These findings are based on a Wells Fargo/优蜜传媒Investor and Retirement Optimism Index survey conducted in late June and early July. The survey is based on a nationally representative sample of U.S. investors with $10,000 or more in stocks, bonds, mutual funds, or in a self-directed IRA or 401(k).

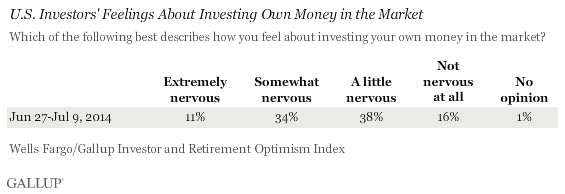

The cautiousness seen in investors' choices of where to put a spare $10,000 is mirrored in a separate question asking investors how they feel about investing their own money in the market. Nearly half describe themselves as extremely or somewhat nervous about doing this; another 38% are a little nervous, while just 16% are not nervous at all.

Every bull market, such as the one the country is now experiencing, has the bear's shadow hanging over it. And that shadow tends to grow bigger and darker with every additional month of market gains.

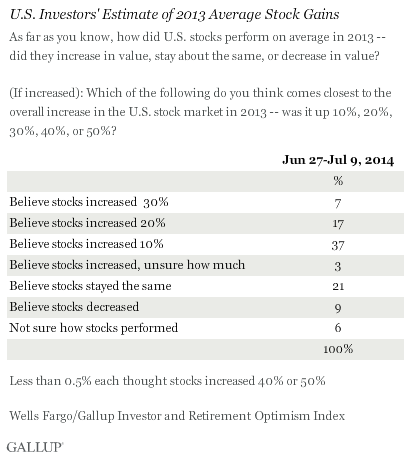

With that in mind, one might think investors' cautiousness about the market is warranted, given the market's strong gains since 2012. However, this assumes investors are aware that the market is up as sharply as it is. In fact, the survey shows that while the majority of investors (64%) do know that stocks increased on average in 2013, barely a quarter (24%) believe they increased by 20% or better, and only 7% are aware that the average increase was in the 30% range. The largest proportion -- 37% -- believe stocks increased by 10%, while another 21% think stocks were flat and 9% think they decreased.

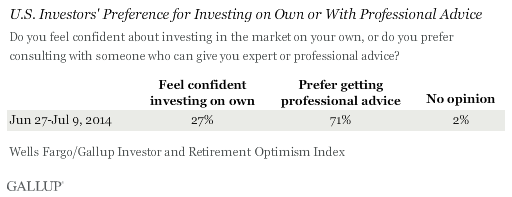

Accordingly, when asked directly how knowledgeable they are about investing in the market, only 11% of all investors call themselves highly knowledgeable. Three times as many say they are "not that knowledgeable," while the majority profess to be somewhat knowledgeable.

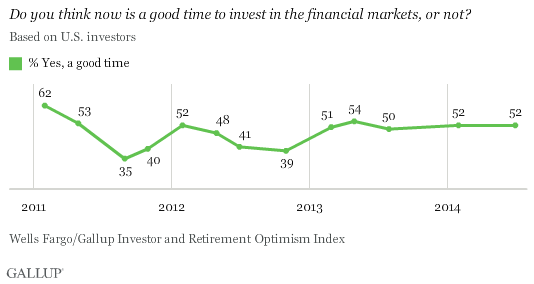

Additional evidence that investors are not swayed by recent market gains comes from the continued stability in the percentage saying now is a good time to invest. This improved noticeably at the start of 2013, but has since held steady at just over 50%.

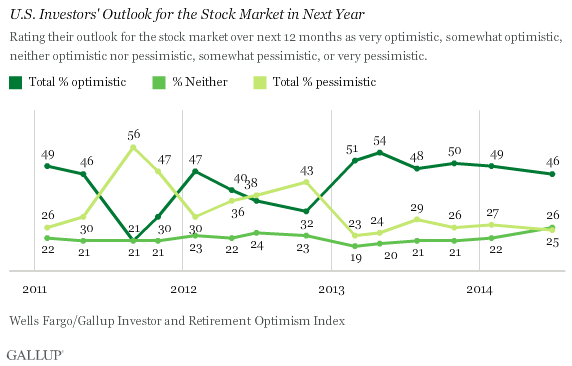

Further, while investors remain more optimistic than pessimistic about the outlook for the stock market in the coming year, the percentage optimistic has actually declined somewhat as the bull market has persisted.

All of this adds up to a situation in which the vast majority of U.S. adults who have $10,000 saved or invested -- 71% -- feel they require professional investing advice. Barely a quarter, 27%, say they feel confident about investing on their own.

Bottom Line

The extraordinary performance of the stock market over the past 18 months has not fully registered with most investors. Although the S&P 500 gained nearly 30% in 2013 -- the best performance for this bellwether index since the mid-'90s -- less than two-thirds of investors (64%) are aware that average stock values increased in 2013. And only 7% are cognizant that the market gained 30%.

This raises important questions about investors' ability to accurately assess market risk, and therefore to take advantage of the market to grow their wealth. It is exemplified by the finding that so many investors would opt to park an additional $10,000 in cash or CDs -- where they are virtually guaranteed no meaningful growth -- rather than invest it in stocks. Investing in stocks is certainly not appropriate for everyone, in every circumstance; but making wise financial decisions requires some basic market knowledge. The good news is that investors by and large recognize that their financial knowledge is limited, and believe they need professional advice.

Survey Methods

Results for this Wells Fargo 优蜜传媒Investor and Retirement Optimism Index poll are based on telephone interviews conducted June 27-July 9, 2014, on the 优蜜传媒Daily tracking survey, with a random sample of 1,036 investors, aged 18 and older, living in all 50 U.S. states and the District of Columbia. Investors are defined as adults with $10,000 or more invested in stocks, bonds, mutual funds, or in a self-directed IRA or 401(k).

Questions about the stock market were asked of a random half-sample of 508 U.S. investors. The margin of sampling error for these results is 卤3 percentage points at the 95% confidence level.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, and cellphone mostly). Demographic weighting targets are based on the most recent Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the most recent National Health Interview Survey. Population density targets are based on the most recent U.S. census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit .