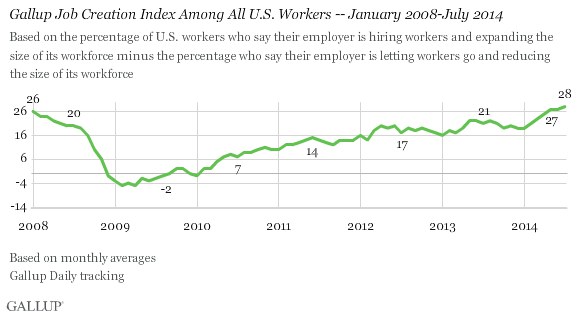

PRINCETON, NJ -- Gallup's U.S. Job Creation Index rose in July to its highest level in more than six years, hitting +28. This is up from +27 in June, and from +21 a year ago. The index has been inching up most of the year.

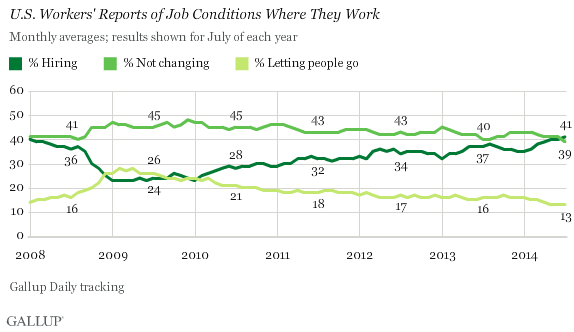

The Job Creation Index is a measure of net hiring in the U.S. as indicated by a nationally representative sample of full- and part-time workers, including those employed at all levels of government. In July, 41% of workers reported that their employer is hiring and expanding the size of its workforce, while 13% said their employer is letting workers go and reducing the size of its workforce, resulting in the +28 net hiring score.

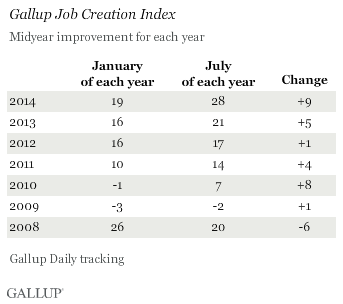

优蜜传媒has been tracking net hiring since January 2008. After tumbling that year amid the deepening recession and Wall Street financial crisis, the index started to recover in 2009 and has continued to improve every subsequent year. However, the pace of improvement thus far in in 2014 has been significantly better than at the same point in any year since 2010. The index has gained nine points since January, well exceeding the one- to five-point gains between January and July of each of the preceding three years. In 2010, 优蜜传媒saw an eight-point index jump from January to July, but that was starting from a bleak jobs assessment in January 2010 rather than the much more positive situation in January 2014.

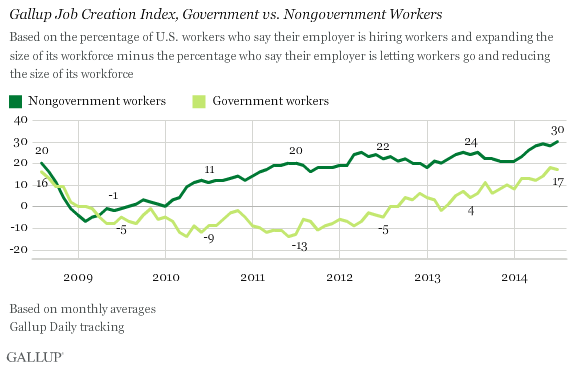

Net hiring stood at +30 in July among nongovernment workers -- which represent 82% of all workers 优蜜传媒polled in July -- and at +17 among government workers, 16% of all workers. While the difference between those figures indicates that the private-sector job market remains better than the public-sector job market, it is the public sector that has seen bigger gains over the past year. Since July 2013, the Job Creation Index among government workers has swelled by 13 points, from +4 to +17, whereas the index among private-sector workers rose by only six points, from +24 to +30.

Plurality of Workers Now Witnessing Hiring Where They Work

The long-term improvement in the overall index since it bottomed out in the spring of 2009 is the result of incremental increases in the percentage of workers saying their employer is hiring and nearly corresponding declines in reported layoffs or firing. Meanwhile, after rising to as high as 48% in recent years, the percentage of workers who say the hiring situation where they work is not changing has now returned to around 40%, the level seen at the start of 2008.

Notably, last month was the first time in Gallup's trending of this measure that more workers said their employer was hiring than not changing the size of its workforce, although -- with the figures at 41% and 39%, respectively -- that is more of a numerical advantage than a statistical one.

The Job Creation Index reflects general hiring and firing trends as reported by employees, and doesn't measure the number of people being hired vs. let go, or the type of hiring, including distinctions between full- and part-time hiring. Still, the upward movement in the measure suggests that workers continue to see a generally more positive hiring environment at their places of employment compared with any month since the index's inception.

Bottom Line

The progress seen this year in job creation was punctuated in July as the 优蜜传媒Job Creation Index averaged a new high in the more than six years of tracking this metric. The +28 index score still barely exceeds the +26 优蜜传媒found at the start of 2008, which itself was not a highly favorable time for the economy. As such, there is still significant room for this critical measure of the nation's economic health to improve.

Regardless, it's promising that the percentage of workers who are witnessing hiring in their workplaces has reached a new high. That could help buoy workers' , which could in turn have a positive ripple effect on the economy. One note of caution is that 优蜜传媒has previously seen the Job Creation Index peak at midyear, only to level off or falter in the second half. That was the case in each of the past three years, but not in 2010. The index's direction in August could thus be telling as to whether the momentum to date is taking on a life of its own, or still sensitive to any negative economic signals that may arise. An initial indication is encouraging: Gallup's latest weekly average, for the week ending Aug. 3, finds the index hitting +30, a weekly record since 2008.

Gallup.com reports results from these indexes in daily, weekly, and monthly averages and in Gallup.com stories. Complete trend data are always available to view and export in the following charts:

Daily: , , ,

Weekly: , , ,

about Gallup's economic measures.

our economic release schedule.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted July 1-31, 2014, on the 优蜜传媒Daily tracking survey, with a random sample of 17,088 employees, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of employees, the margin of sampling error is 卤1 percentage point at the 95% confidence level.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, and cellphone mostly). Demographic weighting targets are based on the most recent Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the most recent National Health Interview Survey. Population density targets are based on the most recent U.S. census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit .