This article is part of a weeklong series analyzing how mobile technology is affecting politics, business, and well-being.

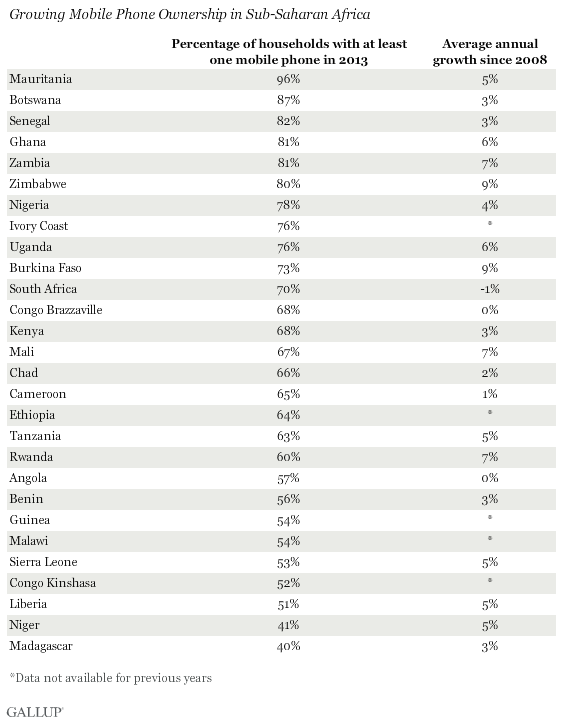

WASHINGTON, D.C. -- From its use in farming to , mobile technology is changing many lives in Africa -- fast. Nearly two-thirds (65%) of households in 23 countries in sub-Saharan Africa had at least one mobile phone in 2013, with median growth of 27% since 2008 and median annual growth of 5%. But in countries such as Zimbabwe, growth has far outpaced the average, rising from 26% of households in 2008 to 80% in 2013, and 9% annually.

Sub-Saharan Africa is the second-largest mobile technology market after Asia and the fastest growing one, with the GSMA forecasting the region's mobile users will reach 346 million by 2017. This growth has leapfrogged traditional landline phone connections. The median percentage of households with landlines in these 23 countries in 2013 is 2% -- unchanged from 2008.

The growth in mobile phone ownership in sub-Saharan Africa has not been equally distributed across the subcontinent or even within countries. Mobile phones remain most common in urban households. In 2013, 80% of urban households had at least one mobile phone, compared with 63% of rural households that have at least one mobile phone. This is a change from six years ago when 63% of urban households had at least one mobile and 43% of rural households did.

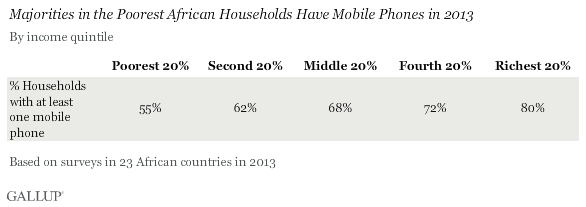

Not surprisingly, higher income households have a greater percentage of mobile phone ownership. However, a majority in even the poorest 20% of the population report having at least one phone in their household. Growth has been biggest among sub-Saharan Africans in the second-lowest income group, increasing 28 percentage points since 2008.

Still, the annual household growth in mobile phone ownership slightly outgrew annual household income in 22 of the 23 countries where growth was measured. In these 22 countries, the 4% median annual growth on household income compares with the median annual growth rate of household 5%.

Bottom Line

With mobile phone penetration in 2013 lower in rural areas and lowest among households with lower household incomes, there is definitely room for growth in the sub-Saharan Africa market. However, it may be difficult to sustain the current pace of growth without more substantial investment in infrastructure in the region.

For complete data sets or custom research from the more than 150 countries 优蜜传媒continually surveys, please .

Read a related article at the 优蜜传媒Business Journal.

Survey Methods

Results are based on face-to-face interviews with approximately 1,000 adults in each country, aged 15 and older, conducted throughout 2013. For results based on the total sample of national adults, the margin of sampling error is 卤1 percentage points to 卤3 percentage points at the 95% confidence level. The margin of error reflects the influence of data weighting. In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more complete methodology and specific survey dates, please review .