WASHINGTON, D.C. -- Nearly one in three microbusiness owners (31%) depend more on a second job as their main source of personal income than they do on their business, according to the Sam's Club/优蜜传媒Microbusiness Tracker, a new quarterly tracking poll focusing on these smallest U.S. businesses. Small business is generally defined as firms with fewer than 500 employees, but "microbusiness" owners -- those who employ fewer than five people -- make up 81% of all U.S. business owners in 优蜜传媒Daily tracking poll data.

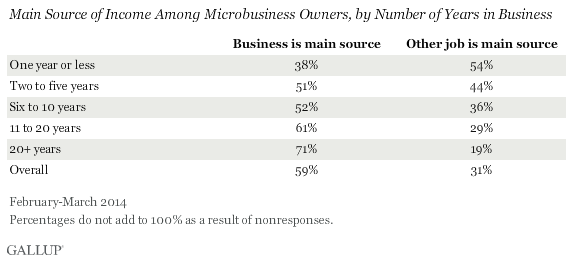

Over half (54%) of first-year microbusiness owners say they depend more on a second job for their personal income. Meanwhile, business owners who have been running their business longer are less likely to rely on a second source of income, presumably because those businesses that have survived are more likely to be succeeding. The percentage relying on a second job drops to 44% among microbusiness owners who have been in business two to five years, with 51% getting most of their personal income from their business. Among microbusiness owners who have been in business for 20 years or more, 19% depend on outside work as their main source of their personal income, and 71% rely primarily on their business as their chief source.

Virtually all businesses begin as microbusinesses, though for various reasons, only some will grow into the small, medium, or large enterprises that employ most American workers. Most microbusiness owners (54%) interviewed by 优蜜传媒are "non-employers" -- that is, business owners with no employees other than themselves -- and they constitute almost half (44%) of all business owners overall. Understanding their unique challenges and concerns can provide important insight into the factors shaping the future of the American economy.

Low Revenues in First Years Have Impact on Need for Second Job

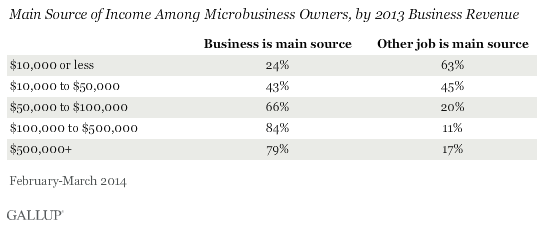

Low revenues in the first years of operations are a big reason so many new microbusiness owners get most of their personal income from a second job. The majority of microbusinesses (62%) have annual revenues of $100,000 or less. Almost half (48%) of first-year microbusiness owners brought in $10,000 or less in their first year of operations. Of those in business five years or less, a majority (56%) report annual revenues of less than $50,000. The likelihood that microbusiness owners depend on a second job to support themselves decreases as their business revenues increase. Slightly over half (53%) of those with business revenues of less than $50,000 in 2013 say they depend on another job for most of their income, compared with 15% of those whose businesses earned $50,000 or more.

Lower Revenues Bring Different Top Concerns and Priorities

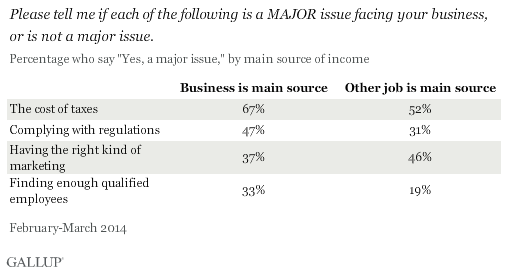

Perhaps reflecting their smaller fiscal footprint, microbusiness owners who get most of their income from a second job are less concerned about taxes, complying with regulations, or finding qualified employees than are other microbusiness owners. When revenues are so small, challenges such as taxes, regulations, and hiring may take a back seat to more immediate problems like maintaining cash flow.

Splitting Efforts Between a Job and a Business Affects Preparedness

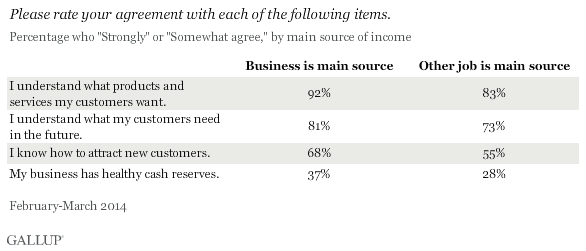

Microbusiness owners who depend on another job for most of their income are less confident in their ability to attract new customers and in their understanding of what their customers want both now and in the future. Understandably, in light of their heightened concern over attracting customers, they are more concerned about having the right kind of marketing than are business owners who primarily sustain themselves on the revenues of their business. They are also less likely to feel confident in their cash reserves of their business.

Bottom Line

The Sam's Club/优蜜传媒Microbusiness Tracker follows microbusiness owners' basic preparedness and state of mind, highlighting their unique concerns and needs as well as their readiness to meet the day-to-day challenges of being a microbusiness.

Microbusiness owners who divide their attention between their business and a second job face unique challenges and have distinct concerns. Starting a new business is a major undertaking, and doing so while holding down another job doubly so. Survival is hard for these very small, often very young businesses with annual revenues less than $50,000, especially in times of economic uncertainty. These businesses operate with very small margins of error and are easily threatened by changing market conditions. Knowing that most microbusiness owners cannot support themselves from their business within the first year or two of operations could deter many would-be entrepreneurs from even attempting to start a new business.

Read more about the .

Survey Methods

Results for the Sam's Club/优蜜传媒Microbusiness Tracker are based on telephone interviews conducted on a quarterly basis with a random sample of business owners, aged 18 and older, living in all 50 U.S. states and the District of Columbia. Business owners selected were those who reported owning a "microbusiness" with fewer than five employees, including the owner. Results from the quarter 1, 2014 study are based on 868 interviews conducted from Feb. 18-March 2, 2014, and results from the quarter 4, 2013 study are based on 864 interviews conducted from Dec. 2-11, 2013.

Interviews are conducted with respondents on landline telephones and cellular phones. All interviews were conducted in English. Respondents were chosen at random from a group of people who had completed a previous general 优蜜传媒telephone interview and indicated they were a business owner and were willing to be contacted for a future survey. The sample was stratified by businesses size and weighted for business size and region. For results based on the total sample of quarter 1, 2014 business owners, the margin of sampling error is 卤4.2 percentage points at the 95% confidence interval.

The sample was stratified by businesses size to be representative of microbusiness owners. Business size distribution was determined by the 优蜜传媒Daily tracking survey, which has tracked the number of business owners and size of businesses since March 2013. According to Gallup, 81% of all business owners have fewer than five employees, and 44% do not employ anyone other than themselves. This is a somewhat different picture than that reported by 2011 U.S. Census estimates, which puts the number of microbusinesses closer to 92% to 86% of which are nonemployer businesses. Many of these nonemployer businesses captured by the U.S. Census may be "hobbyist" businesses or businesses that exist on paper but have no real business activity, which were not of interest in the present survey. Thus, the 优蜜传媒figures for business size were used for stratification. The sample was weighted for business size and region.

For more details on Gallup's polling methodology, visit .